Your Comprehensive Guide to Choosing the Right Medicare Plan in Texas

Instant quotes for Medicare plans are available almost everywhere. But what comes next?

You need a reliable expert (not the eccentric uncle) in the field to cut through the clutter and provide clarity!

It's crucial to understand what really matters when evaluating your options.

There's a proven method to sift through the numerous choices and find the best value, especially with all the aggressive marketing from carriers and brokers out there.

Trust us, we're not here to offer you a set of free steak knives!

Our goal is to genuinely help you, and if you check our Google reviews, you'll see that we stand by our word.

Key factors to consider when selecting a plan:

- Decision #1 - Medicare Advantage vs. Medicare Supplement

- Decision #2 - Doctors and Medications

- Decision #3 - Cost vs. Benefits

- Decision #4 - Customer Reviews

Let's dive in! We have important choices to make!

Decision #1 - Medicare Advantage vs. Medicare Supplement

We have a comprehensive guide comparing Advantage and Supplement plans.

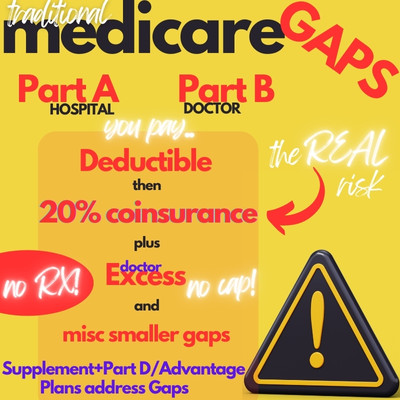

This is the first critical decision for anyone looking to cover the gaps in Medicare.

Relying solely on Medicare can leave you vulnerable to significant risks, such as the 20% coinsurance with no maximum limit.

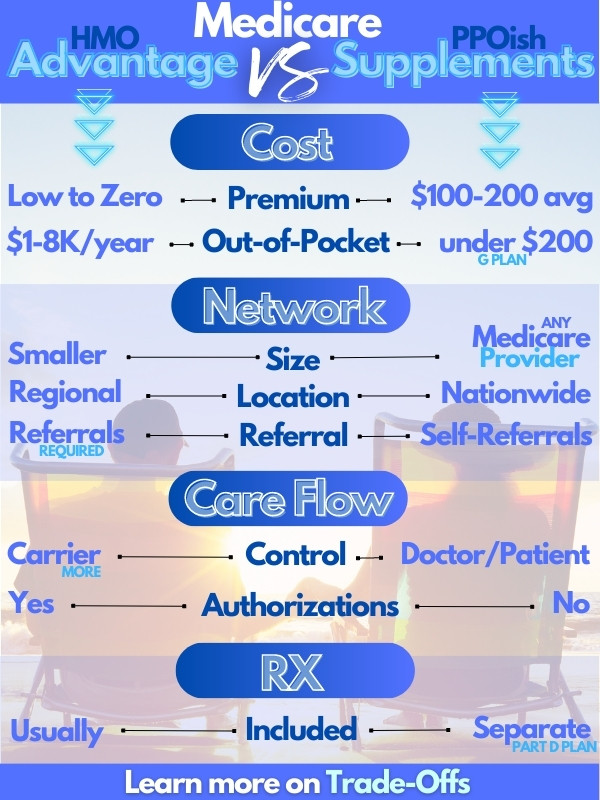

So, what's the trade-off between Medicare Advantage plans and Supplements?

Essentially, it's a trade-off between network control and costs.

Alright, but what does this mean in practical terms?

Some of you might already be familiar with these trade-offs if you've had HMO plans before Medicare.

Let's break it down.

HMOs operate on fixed budgets. Insurance companies receive a fixed payment from Medicare per member and then pay providers a set amount per patient.

This creates a cost constraint on cost and care. This can be both good and bad.

The downside is that sometimes less expensive treatments might be tried (or even required) before other options are considered.

Additionally, there is a limited network of doctors and hospitals that you must use to receive benefits, typically within about 45 miles of your location.

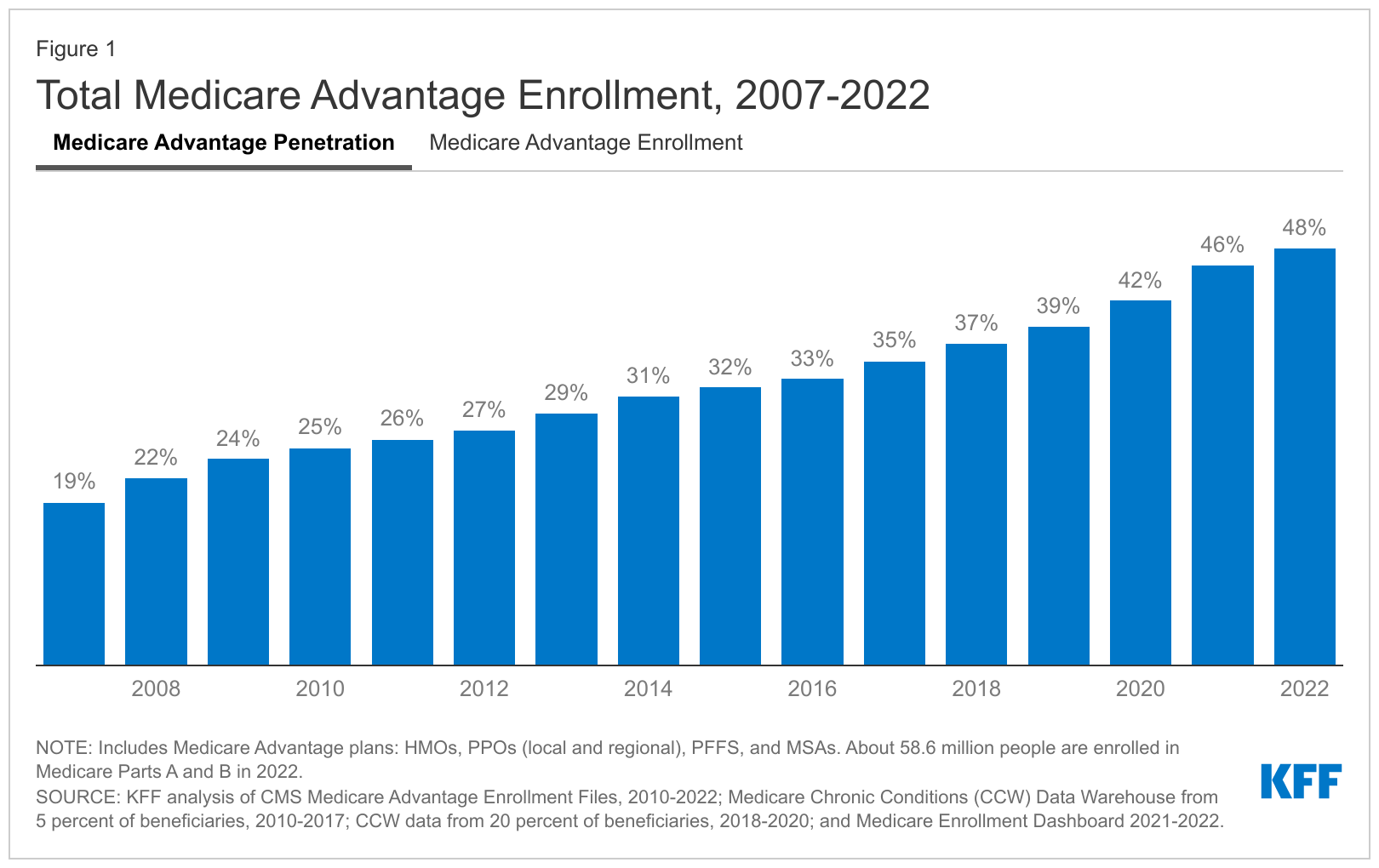

The upside is...this cost control is reflected in the monthly premiums! Given the rapid rise in medical costs, it's not surprising that the Advantage plan market continues to grow.

In Texas, the enrollment in Advantage plans surged from 40% to 50% between 2019 and 2021!

For more details, read our full review, but let's get to the key points.

Can you afford around $300 per month ($130 for a G supplement plan; $160 for Medicare Part B, and $20 for Part D) at age 65, with costs likely increasing as you age?

For many, this is a crucial consideration. Advantage Plans can be low or no cost (learn more about the trade-offs and how to navigate them).

Here's the deal:

- If $300+ per month is not affordable - Advantage plans are the default choice

- If you can afford $300+ and want more control over your healthcare providers - Supplements (typically G plan) are the way to go

We're here to help you navigate your options at no cost to you.

Get quotes for Medicare Supplements, Advantage plans, and Part D from top carriers, tailored to your doctor and medication needs:

Next, let's tackle the network question.

Decision #2 - Doctors and Medications

If you choose a supplement plan, any doctor that accepts Medicare will be covered, so this is less of an issue.

If you opt for an Advantage plan, this decision becomes crucial based on how important your current doctors are to you.

In the past, this process was a nightmare! Different carriers, different networks, different medical groups.

Now, it's much simpler!

With our Quoting System, you can input your doctors and medications, and the system will automatically show you the options by cost that include those doctors!

This feature is incredibly useful and will be available to you every open enrollment to ensure you're always getting the best deal.

And it's free for you! Request your personalized quote here.

What about medications? This is another critical factor that varies significantly between individuals.

If you go with a supplement plan, you will need a separate Part D plan, which can be from a different carrier.

You can get a Part D quote here instantly.

Remember, there's a 1% per month penalty that continues to grow if you don't enroll in a Part D plan when you're first eligible.

Because of this, at least enroll in a basic plan right away, and you can change plans at the end of each year.

With Advantage plans, Part D (medication coverage) is usually included in the plan.

Just like with doctors, you can input your medication information, and the system will automatically show which plans include your doctors AND your medications.

As insurance experts, we geek out on this stuff. In the past, this process could take hours!

Now, it's instant and free for you here!

Technology is amazing.

Once we have the suite of plans available, you can easily compare costs and benefits side-by-side. This ensures you're getting the most value from your Medicare coverage, tailored specifically to your healthcare needs.

On to the next decision!

Decision #3 - Cost vs. Benefits

Cost is always a major factor, but it's important to weigh it against the benefits each plan offers.

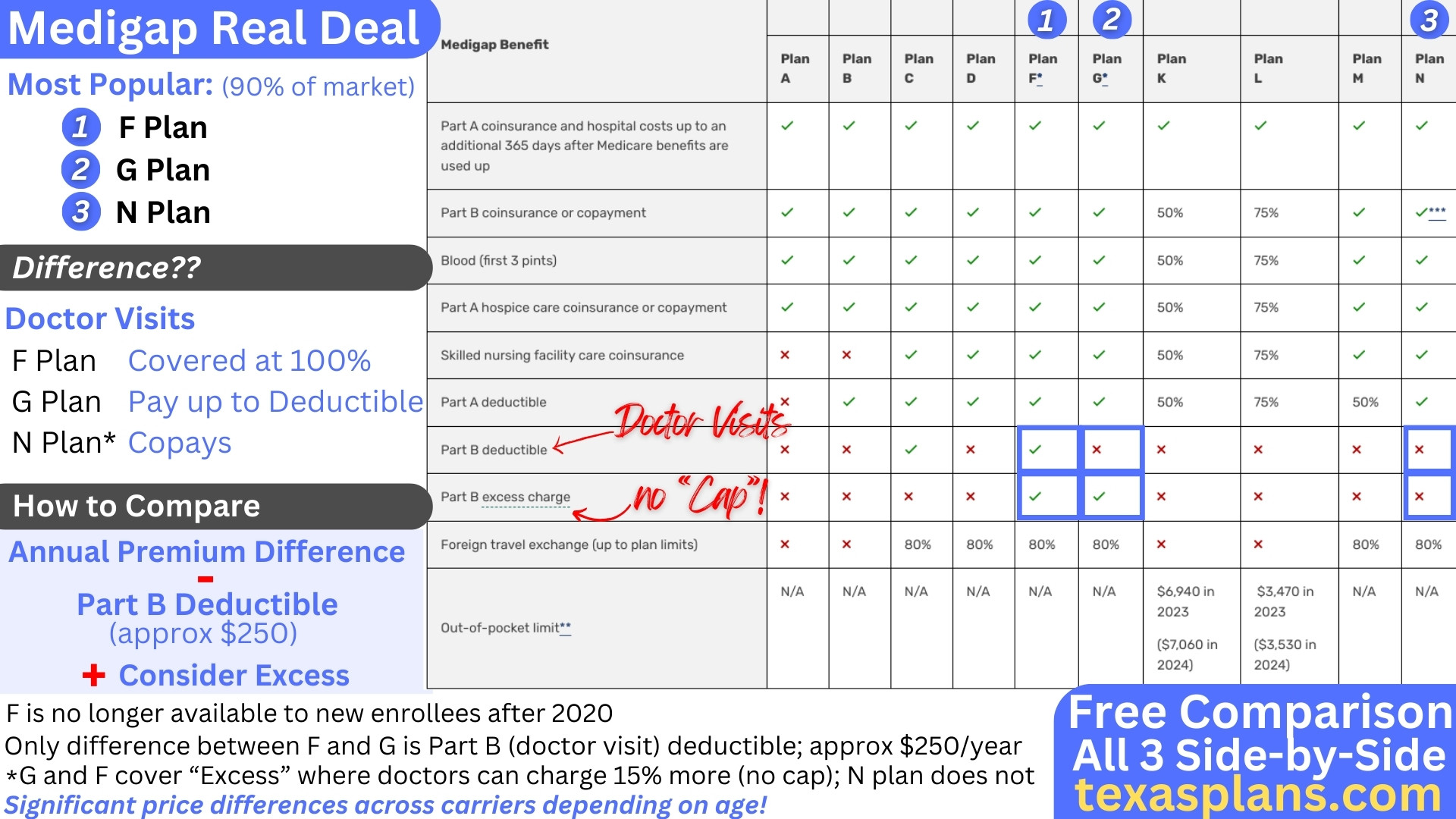

Medicare Supplement plans (Medigap) generally have higher monthly premiums but offer more comprehensive coverage with fewer out-of-pocket expenses. These plans can be particularly beneficial if you have frequent doctor visits or need specialized care.

The G plan is by far the most popular.

It covers all the major holes of Medicare except for the Part B (doctor) deductible which is roughly $240/year (increases a bit each year).

The G plan is now the richest medicare supplement option since the F plan is no longer available.

More importantly, the G plan covers Medicare excess which is the 15% more that doctors are allowed to charge ABOVE what Medicare allows.

There's no cap on this 15%! If a surgery is $20K, you could be on the hook for $3000 extra. It's really important to cover this as there's pressure on reimbursement to doctors and more and more will charge the additional 15%

So then...it's easy! Just run the quote here and price out the G plan across the carriers. A high deductible version of the G will bring costs down but still keep cap on back-end.

The benefits are standardized so a G plan will have the same benefits AND networks from carrier to carrier.

Medicare Advantage plans, on the other hand, often have lower monthly premiums but come with more out-of-pocket costs and network restrictions. They might include extra benefits like vision, dental, or wellness programs, but you'll need to use doctors within their network.

This gets more complicated since the plans are not standardized like supplements.

Focus on our Triple Threat selection system.

Let's explain a bit.

First, the Star Rating allows you to see how actual members rate the individual plans and carriers.

- 3 stars is pretty average

- 3.5 stars is better

- Aim for 4 stars or better!

Next, we look at out-of-pocket max to see what your exposure is in case of big bills.

This is generally pretty comparable within a given area but it really helps to compare Advantage plans against the G plan Medicare Supplement.

In competitive areas (think more populous areas), the max's can be pretty low. We're happy to help you compare this at help@texasplans.com

We basically compare monthly premium versus this out-of-pocket max but that's just a basic level analysis.

When you run your quote, make sure to enter your doctors, medications, and preferred pharmacy.

Now, here is where Advantage plans get...confusing.

There can be many add-on, bells, and whistles!

- Plans that work with medicaid better

- Plans that work with particular chronic illnesses

- Part B giveback plans which will help absorb your monthly Part B premium

- Flex cards with money for groceries and other bills

Focus on the Triple Threat, enter your specific info (doctors and medication), and then sort by "Total Estimated Cost"

Of course, we're happy to help with this whole process and there's ZERO cost for our assistance!

Use our quote tool to compare the costs and benefits of different plans to see what works best for you.

Just remember...this is no time to penny-wise and pound-foolish:

Finally, what about how happy (if that's possible with health insurance) other people are with a given plan?

Decision #4 - Customer Reviews

Customer reviews can provide insight into the service quality and reliability of different Medicare plans. Look for feedback on:

- Ease of claims processing

- Customer service quality

- Network satisfaction (for Advantage plans)

- Overall satisfaction with coverage

For Medigap plans, cost and carrier stability are key. Major carriers in Texas include:

- Blue Cross Blue Shield of Texas

- Humana

- Cigna

These carriers have long-standing reputations and are generally well-regarded, but running a personalized quote will help you compare the specific costs and benefits for your needs.

For Part D plans (added to a supplement), star ratings and reviews are crucial due to the many similar options. Our quote tool will provide these ratings to help you make an informed decision.

For Medicare Advantage plans, star ratings are particularly important because they reflect customer satisfaction with plan administration and access to care. Aim for plans with 4+ stars.

Use our quote tool to see personalized ratings and reviews for different plans.

Final Thoughts

The big decision is really between Advantage plans and Medicare Supplements. Two very different ways go about filling the holes of Medicare.

It's really a trade-off between control and choice versus cost now (supplement) and potential cost when sick or hurt (Advantage).

We kept this guide at a high-level strategy for selecting a plan. If you're feeling overwhelmed by Medicare, reach out to us with ANY questions.

Here's a quick recap on how to choose the best Medicare plan:

- Decide between Advantage and Supplements. These are fundamentally different. Consider control and access vs. cost. Be realistic about whether you can afford $300-400 per month as this cost will recur annually!

- Enter your doctors and medications into our personalized quote tool to see the best plan options for you.

- Quote different plans within your preference (Advantage vs. Supplement); focus on the G plan for supplements and on lower out-of-pocket maximums (OOP) for Advantage plans, aiming for $1,000 or less.

- Wrap it all up with confirmation from Star Ratings! This is especially important for Part D and Advantage plans where there are many choices.

- Reach out to us with any questions! As certified Medicare agents, there's NO cost for our assistance, and it's best to work with someone who has your interests at heart (hopefully, this guide reflects that, but you can also check our Google Reviews for reassurance).

Our assistance is free, and no question is too small.

Call 800-320-6269 or email us at help@texasplans.com

Take care!

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact www.medicare.gov or 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week to get information on all of your options.