Comparing Texas Health Insurance Carriers

We already went through how to pick the best Texas Exchange plan or Medicare plan.

There's even a deep dive on comparing the different Obamacare metallic plans (bronze, silver, gold, and platinum) or subsidy.

Then, it turns to a question of carrier.

This is as important as picking the right plan since many of the plans are standardized now:

- The Exchange plans can differ by +/- 2% at given plan level (say Gold for example)

- The Texas medicare supplements are completely the same (G plan as example)

- The Advantage plans vary but have to meet certain minimum requirements

What can really differ is the network of doctors and this is a function of the carrier you pick!

Let's compare the Texas carriers by market since each market is different.

First, our credentials:

We'll cover these topics:

- Quick intro to the health carrier landscape in Texas

- The Texas exchange carrier comparison

- The Medicare supplement carrier comparison

- Medicare Advantage carrier comparison

- Medicare Part D carrier comparison

- Texas small business carrier comparison

- How to quote the different Texas health carriers

Let's get started!

Quick intro to the health carrier landscape in Texas

The Texas health carrier landscape is composed of one huge established player, some nationwide players, and a slew of small regional competitors.

- Of course BCBS is the king to dethrone and that's not likely with their marketshare and mindshare.

- The big nationwide players are United Health, Aetna, Cigna, Ambetter, and Humana depending on the market.

- Smaller regional players are Oscar, KelseyCare, and others.

This really does vary depending on which market we're looking and we'll get specific below.

Why does the carrier even matter?

The Advantage market is a good indicator with its Star Rating administered by Medicare.

The ratings can really vary by carrier and even plan! That's in one market!

Same goes for the others but we don't get the benefit of a Star Rating and good luck finding reliable reviews online.

This isn't your favorite restaurant! You're not going to find positive reviews at the main sites for health insurance carriers.

If they do their job right (pay the claim) then... "they better have!!".

And if they don't, those reviews will show online. It's all pretty much negative. Health insurance carrier's aren't getting birthday cards from any members even though we see $250K+ bills paid all the time with clients.

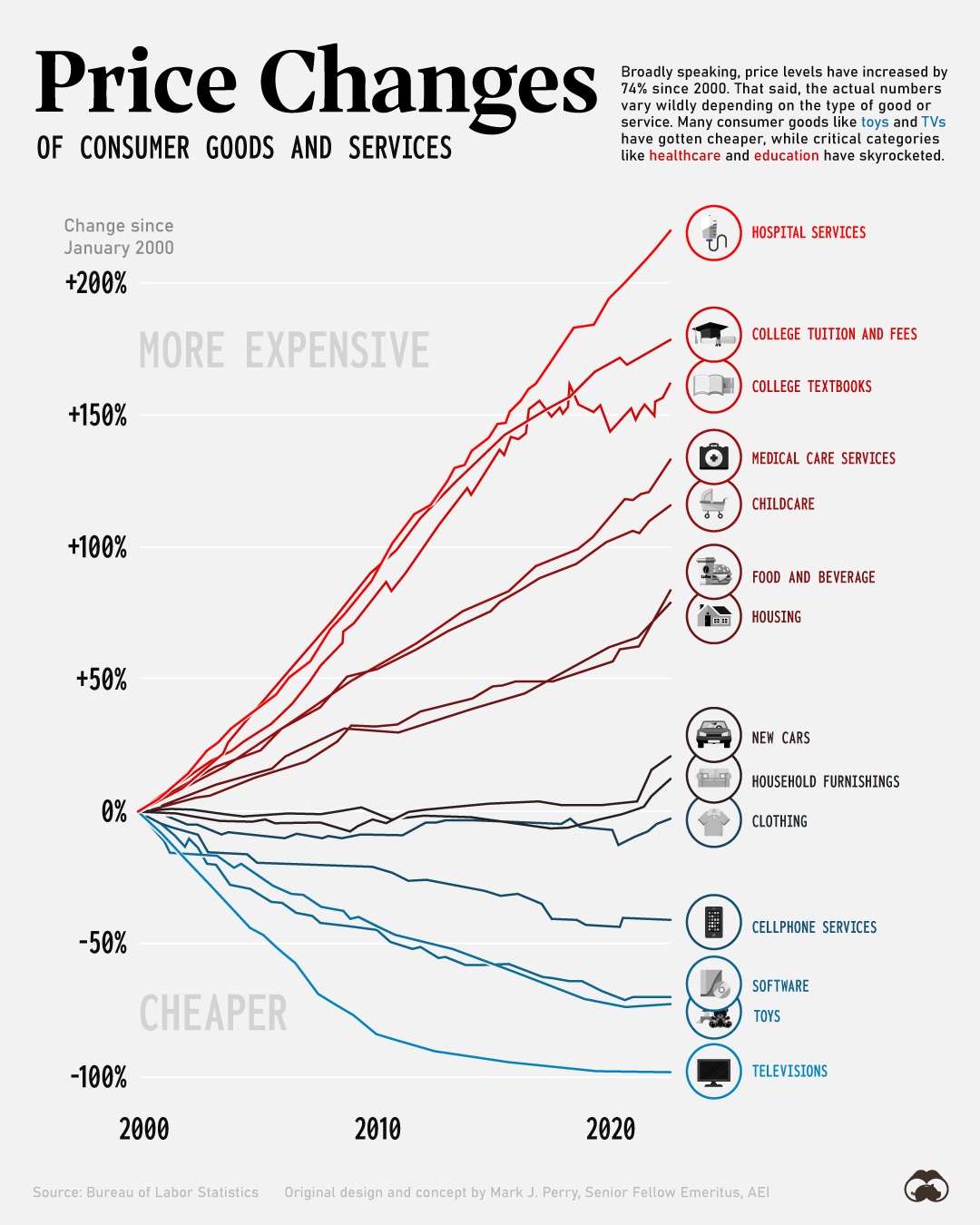

So...we need to dig a little deeper but before we go there, understand the real importance of a carrier.

It's all about the network! What doctors and hospitals are you able to see with a given carrier and this partially comes down to size in today's world.

The healthcare delivery market has become more and more consolidated. Big networks of hospitals (think Scott and White) and medical groups...especially in more populous areas which seems to be where Texas is heading.

Hey, I grew up in Fort Worth and it was small back then! Arlington was basically Six Flags and the water park.

Why does size matter with carriers? They can negotiate better with these larger medical entities and that means better rates for you.

Especially true with the HMO model which really requires size to actually function correctly.

So...carriers need to hit a certain size to really compete and that will show below.

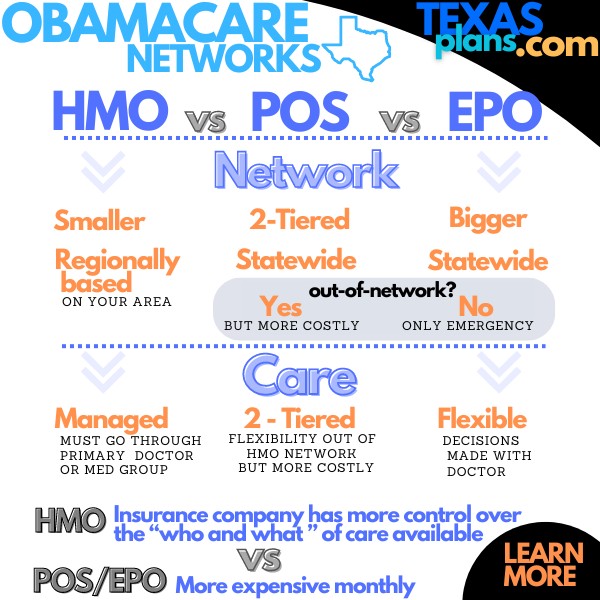

There's a general movement towards HMO across Texas and the US since 2014.

The Texas exchange plans have basically gone HMO with EPO being a close second and POS being a arm-twist HMO.

The Advantage plans keep growing marketshare and they're the HMO wing of the Medicare party.

HMOs are better able to contain cost and that's going to win longer term.

This favors bigger carriers that can negotiate with the consolidating healthcare delivery system.

Watch...you'll start to see healthcare go full circle where doctor medical groups start to work for hospitals.

Like it was in the 50's!

Okay...so, that's the general lay of the Texas carrier landscape. Let's get specific now.

The Texas exchange carrier comparison

BCBS really dominates here. Roughly 50% of the market for individuals and families.

The closest competitor is Oscar and that can change over a few years.

Ambetter, United, and Aetna CVS are all trying to grow but it's a tough market with BCBS presence.

Remember that the Texas exchange plans are standardized so a Gold plan with one carrier can't differ by more than 2 up or down from a Gold plan with another.

It then comes down to pricing and network, both of which are driven by the carrier's ability to keep costs down and grow membership (the size issue from above).

That favors BCBS longer term and we're seeing it.

When you run your quote, you'll notice the rates can be comparable at a given plan level (for example, the very popular silver).

This then puts more focus on networks and doctors you can see. It's really tough for a Texas doctor or hospital NOT to contract with BCBS!

Oscar will occasionally price better in certain areas which is why they're a distant #2. United and Scott and White are being pretty aggressive.

Once you've established what level you want (see how to compare Texas exchange metallic plans), check your doctors through the quote (you can enter your doctors RIGHT INTO THE QUOTE!!), and price compare.

We're happy to help with this process at no cost to you at help@texasplans.com or pick a time to chat here.

In most cases, BCBS is the lead dancer. Some regional players might work if you can definitely stay within their medical system.

Reach out with questions!

One note...the markets are definitely in flux!

- BCBS used to offer the cheapest silver plan in over 150 counties and it dropped to 54 in 2023.

- Baylor Scott and White grew significantly where they have a footprint.

- United was very aggressive with pricing to grow market share so include them in the mix

Okay.

We have some head to head comparisons:

-

BCBS of Tx versus United

probably the big battle going forward

- BCBS of Texas versus Oscar really an HMO versus EPO battle

-

BCBS of Texas versus Ambetter

same with the EPO network angle

- BCBS of Texas versus Scott and White

Were happy to help with any questions!

Let's turn to Medicare now starting with the supplements.

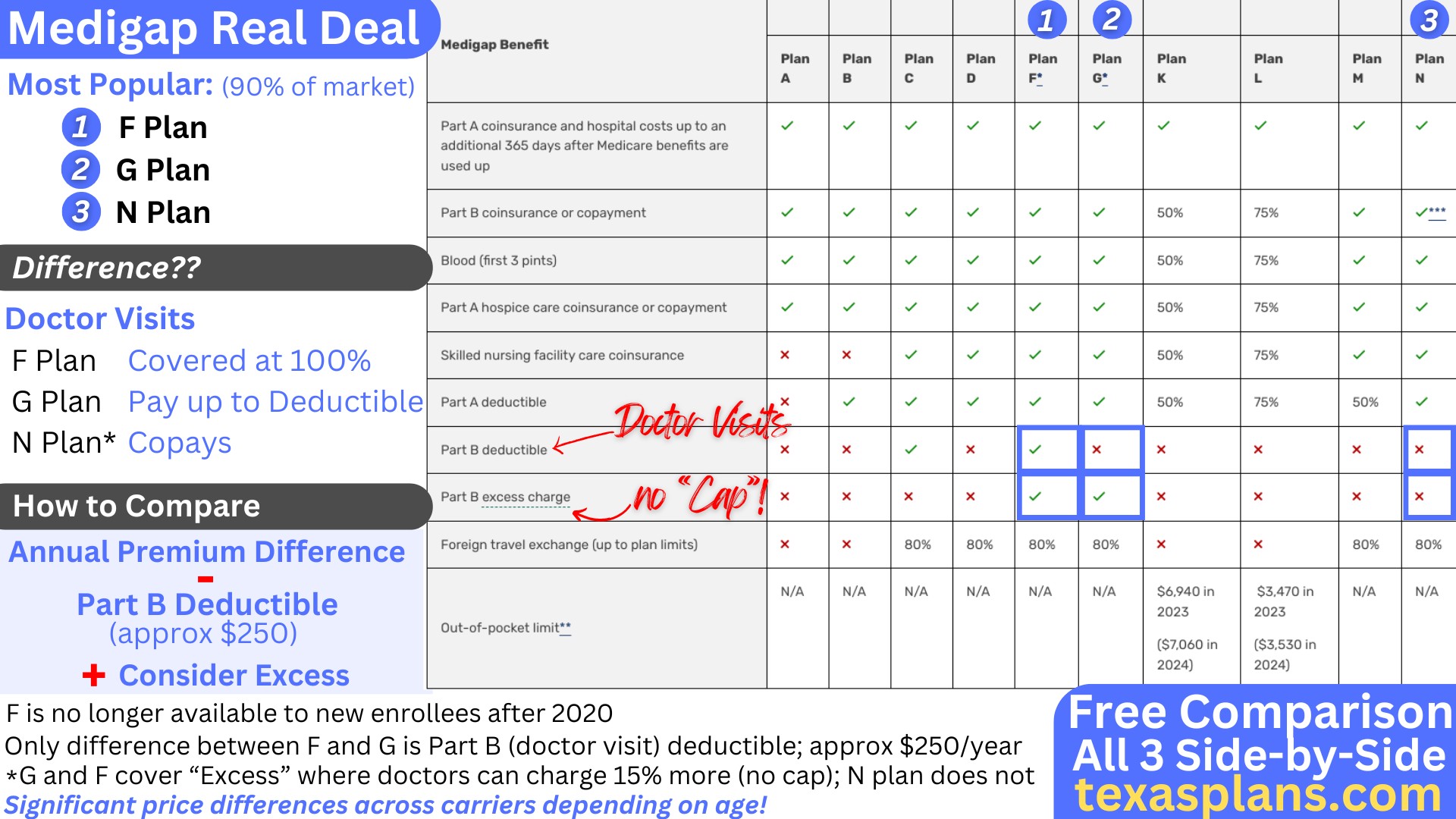

The Medicare supplement carrier comparison

There are over 50 carriers offering Medicare supplements in Texas but we can focus on a few that really do dominate.

The networks and benefits are standardized at the Federal level so it's a function of pricing and pricing stability (how it increases as you age).

The dominant carriers to focus on:

- BCBS of Texas

- United Healthcare®

- Humana

- Cigna

United Healthcare eats up about 25% of the market which is expected with their marketing prowess at its back.

This is interesting considering that Humana and Cigna can be cheaper by quite a bit for the exact same plan!

Humana basically started a new "book of business" with their Achieve products which can be the cheapest G plan on the market.

Even more surprising is that quite a few Texas seniors are still on the old F plan (stopped in 2020 for new enrollees) even though they're paying quote a bit more versus the G plan.

Almost identical plans except for the Part B deductible ($240/year currently).

We calculate that's about $500/year that potentially millions of seniors are burning each year.

Run your quote and reach out if you're still on the F, I, or J plan.

So...run your quote below:

Focus on Humana Achieve, United Healthcare® (email us if you need separate quote), Cigna, and BCBS.

The G plan is by far the most popular medigap plan with 80% of the market.

The N plan is second for new enrollees but at 6% of the market versus 40% for the G plan and roughly 45% for the F plan (not available to new enrollees).

Here'a quick lay of the medigap landscape:

Happy to walk through any questions you have. Medigap plans are pretty easy to compare.

Not so much for Texas Advantage plans.

Medicare Advantage carrier comparison

Just a head's up...the Advantage plan share of the Texas marketplace is over 50% now!

And growing. Expect this to continue for the same reason as the Exchange market with HMO's better able to keep a lid on costs.

Comparing Advantage plans gets more complicated but we have a secret weapon.

The Star Rating!

It's administered by Medicare and it let's us know how actual members see their carrier and plan.

It's from 1 to 5 stars with 5 stars being the best.

- 3 is pretty mehhh

- 4 stars is good

- 5 stars is fantastic

We basically skip over any plan that's 3 stars or below and you probably want to as well!

You'll see the star rating next to each plan.

This is a big part of our Triple Threat we use to compare Texas advantage plans.

So...who are the dominant Texas Advantage plan carriers?

This is similar but different from the medigap or Exchange market:

- United Healthcare

- BCBS

- Humana

- Aetna

- Cigna

You also have some regional players which are coming on strong.

Scott and White, Devoted, or KelceyCare are good examples of this flight to small and well run.

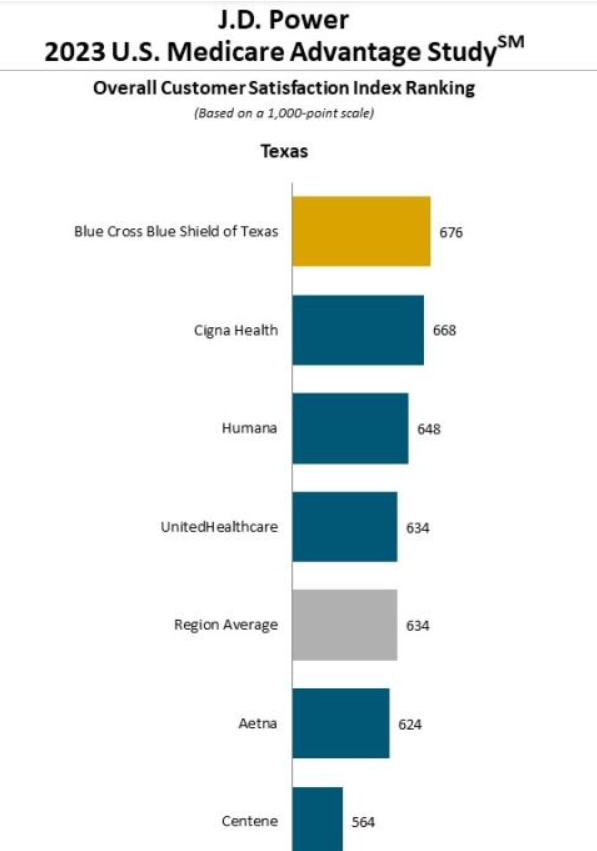

JD Powers did a survey of satisfaction with the following results:

https://www.jdpower.com/business/press-releases/2023-us-medicare-advantage-study

Again, really look at the Star Rating since plans offered by the same carrier can really differ in actual client satisfaction!

It should reflect in their Star Rating when you run your quote here.

What about Part D for people who pick a medicare supplement?

Texas Medicare Part D carrier comparison

Even though Part D operates similarly to Medicare Advantage in Texas, the carrier mix is completely different.

The dominant players:

- Wellcare (Centene)

- AetnaCVS (SilverScripts)

- BCBS

- United Healthcare

Wellcare blew away the market with a very inexpensive offering that does a remarkable job of covering many meds.

It was almost too popular with an onslaught of new enrollees jamming things up a bit. We'll see if they can keep the strong Star Rating for following years (and the price!!).

Aetna made an early attempt to go after the Part D market aggressively after being acquired by CVS (which is interesting as to where the money/power is in today's RX market).

Of course, BCBS and United Healthcare will show strongly as some people just go with what they know from the medigap side of things.

So...how do we really compare Part D options?

Run your quote here (PDP tab):

Under preferences on the "Prescription Drug Plan" tab, enter:

- Your medications/dosages

- Your preferred pharmacy

Sort by "total estimated cost" up top so the quote will take into account your medication costs.

This is a fantastic view now of Star Ratings by plan, your expected total cost, and whether your medications and pharmacy are in-network.

With Part D, we're more picking by plan than by carrier. We can change end of each year anyway!

It's very common to have one carrier for medigap or Advantage and another one for Part D.

Don't think they have to be the same as you'll probably be overpaying or under-delivering if you just pick the same one for both.

That's just the way the market is these days.

You shouldn't need a separate Part D with an Advantage plan, only medicare supplements.

Reach out with any questions at help@texasplans.com or pick a time to chat here.

What about small business?

Texas small business carrier comparison

Again, a totally different market but we see similarities driven by the same push for size to negotiate with consolidating medical networks.

The Small Group market (1-100 employees) also has standardized plans (Bronze, Silver, Gold, and Platinum) with the same benchmarks of +/- 2%.

This means that the plans at a given level (say Silver) will be pretty comparable over-all in core benefits.

Then, it's network and pricing! Again.

The following dominate the small business marketplace:

- BCBS - extensive network coverage

- United Healthcare - large nationwide networks and aggressive pricing in certain areas

Cigna, Aetna, and Humana all vie for remaining share but like the other markets, regional players are aggressively growing with limited networks (think HMO).

Scott and White is a perfect example of this.

It really does vary by area so it make sense to run a quote specific to your company.

Speaking of which...

How to quote the different Texas health carriers

We make this fast, easy, and free to you here:

The quote is just the start though. Here are additional guides:

Don't go this alone. There's zero cost for our assistance and judging by the reviews, we don't push or sell.

We answer questions and if you want to work with us, great!

Refreshing, right?