Texas Medicare Supplements - Everything You Need to Know

Give us 10 minutes and you're going to be in such a better place when comparing and choosing supplements (Medigap plans).

We'll go through the basics but then we'll turn to the strategy of picking the best supplement out there!

Here's our credentials:

This is what we'll cover:

- Why even get a Medicare Supplement in Texas

- Medicare supplements versus Texas Advantage plans

- What do Medigap plans cover

- How to compare the different Medigap plans

- How to compare the Texas Medigap carriers

- What about Part D prescription coverage

- How to quote and enroll in Texas Medicare supplements

Let's get started!

Why even get a Medicare Supplement in Texas

This is a common question.

"I'm healthy! Why not just go with Part A and B with Medicare"?

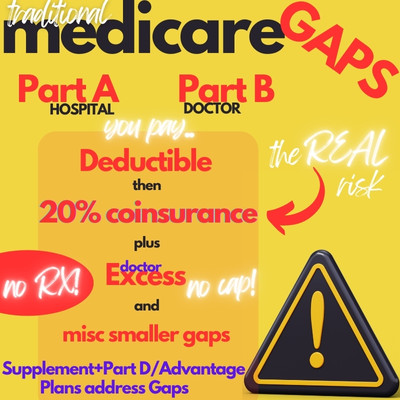

There's one big issue there... the 20% coinsurance!

We can calculate our exposure with the deductibles but the coinsurance at 20% after deductible can go forever!

A family member just had a clot to the heart out of nowhere. She's healthy, eats well, etc. but there's been a lot of that over the last few years.

The total bill? $500K! Anything facility-based (think hospital) will be 10's if not 100's of $1000's quickly, and we're seeing these pop up across our clients.

The different Medigap plans will have different bells and whistles as we'll discuss below, but one thing they all have in common...

All Medigap plans cap or cover the 20% coinsurance!

It's really the reason you're buying a Medigap plan at all. If we only have traditional Medicare (Part A and B), we have a huge exposure for the big "What if".

So...there are two ways to cap this and deciding on which one is really the first decision.

Medicare supplements versus Texas Advantage plans

We have a big article on Texas Medigap plans versus Advantage plans.

Let's boil it down.

How do you feel about HMO versus PPO?

In a nutshell, that's the bulk of it.

Medigap (supplements) are like PPOs in that you can see any provider that takes Medicare. Anywhere in the US!

You refer yourself out and decisions are made between you and your doctor.

The trade-off is cost since Medicare supplements have a monthly premium that can run $150+ depending on age, plan, and area.

You can run your Texas supplement quote here.

Then there are Advantage plans. The HMO kid on the block, which makes up about 40% of the Texas market (and growing).

There are PPO versions of the HMO, but both have more structured networks that you need to use. Care decisions are more "managed" with the carrier having oversight.

You're essentially exchanging the anchor coverage from Medicare to a private carrier!

The trade-off is that they can be zero or low-cost monthly. Watch out for the backend if you have bigger bills with the out-of-pocket max.

Learn how to compare Texas Advantage plans here for more info.

You can quote the Texas Advantage plans here.

Let's assume you're more a PPO type of Texan, and Medigap matches your needs more.

What do Medigap plans cover

Supplements are also called Medigap plans because they fill in the major holes of traditional Medicare.

Some of these "gaps" really stand out!

Medicare has two key parts:

- Part A - hospital and facility costs

- Part B - doctor and other costs

Medicare works like an 80/20 plan where you pay 20% of the charges after you meet the deductible for that category.

The Part A and B deductibles go up each year, and this is separate from the amount you pay monthly to keep Part B active with Social Security.

Medicare loves all its lettered terms!

The deductibles are easy enough to handle since they're fixed amounts. It's that 20% after the deductible is met that we're really trying to address.

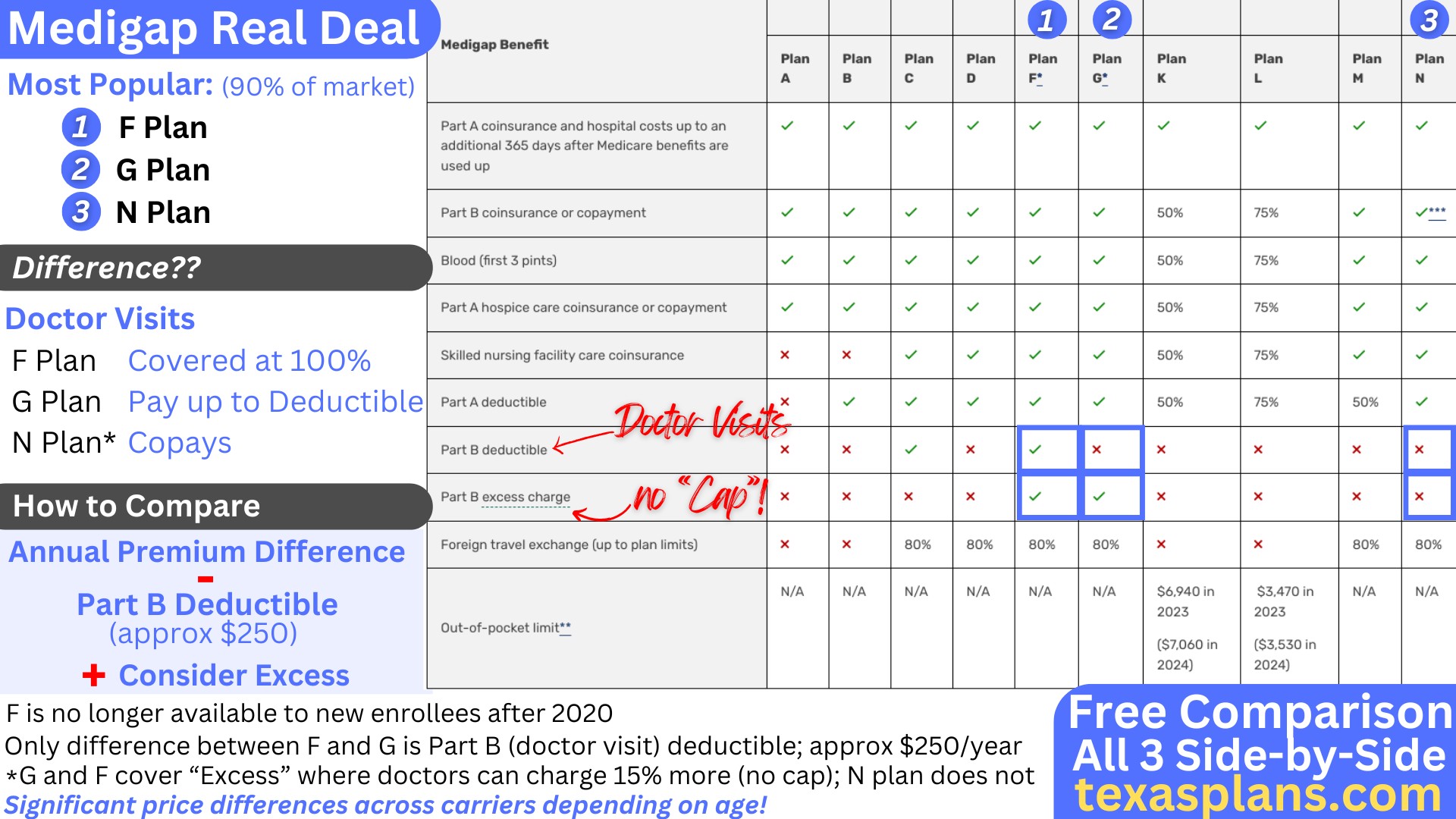

All the Medigap plans will cover or cap that exposure. Some plans will fully pay the A deductible, while the Part B deductible is either not covered or office visits are handled with copays.

There are lots of "additional benefit categories", but the deductible and coinsurance are the main reasons to get Medigap.

If we had to highlight the other charges, it would probably lead with:

- Excess charges (more on that below)

- Travel Medical

- Short-term care

The excess is a new term to most people on Medicare, but it's really important, and only one plan covers it.

Essentially, doctors can charge up to 15% more than what Medicare allows and still be considered "Medicare" doctors.

This is becoming a bigger deal since Medicare keeps putting pressure on doctor reimbursement to keep Medicare solvent, and that pressure will only increase over the next decade.

The issue we have with excess is that there's no cap!

A $10K bill with a doctor might mean $1,500 out of pocket for you.

The issue we see all the time is where a member checked their doctor, but the anesthesiologist is an "excess" doctor during an operation.

There's only one Medigap plan that covers Excess (G plan) on the market for new enrollees (the old F plan covers it).

This brings us to the next section!

How to compare the different Medigap plans

Here's the Texas Medigap lay of the land:

We can weed out a bunch of these plans right away.

First, here are the most popular plans:

- G plan - most comprehensive, covers excess - probably 80% of new enrollment

- N plan - 2nd up with probably 10% of the new market

- Mix of high deductible and other plans

Really, the market is all about the G plan these days, and it's the only plan that covers excess!

Excess is a hidden risk that most people new to Medicare don't know about!

So...what's the difference between the G plan and N plan?

It all comes down to how they treat the Part B (doctor visits) deductible.

With the G plan, you have to pay for doctor visits till you meet the Part B deductible (currently $240/year).

With the N plan, you'll pay copays for office visits (higher for specialists) indefinitely.

So...how do we compare the two most popular plans?

- Outside of preventative, how many office visits do you have?

- What is the premium difference between the two?

- Is the premium savings with the N plan enough to offset the excess risk?

In most situations, the office visit difference is a wash. So it's really premium difference annually versus excess risk.

We don't like that excess is uncapped. That's why the G plan is the dominant option.

You can run your quotes here.

Of course, we're happy to help with any questions:

How to compare the Texas Medigap carriers

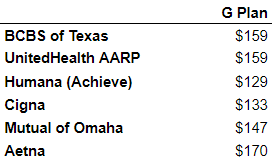

The benefits and networks are identical once we narrow down the plan choice (G plan, for example).

So what's left to compare?

Pricing! The carriers will have very different pricing for the very same G plan for a given person.

The dominant Texas Medicare Supplement carriers are:

- BCBS of Texas

- United Healthcare®

- Humana

It's hard to beat them in terms of pricing and customer service since all other aspects are the same.

Here's a sample quote for a 65-year-old in Travis across the carriers:

Keep in mind that every area will be different with a different carrier mix in terms of affordability.

What about Part D prescription coverage

Traditional Medicare or Supplements don't cover medication with the new plans.

It makes sense to get a separate Part D plan specifically for this cost and risk.

A few notes on that front:

- The Part D carriers may or may not be the same as the one you pick for the supplement.

- There's a penalty for not enrolling in Part D when eligible that increases every month by 1%.

At least get a placeholder plan (cheapest) to avoid the penalty, knowing that we can change plans at the end of each year (Open Enrollment) worst case.

You can quote the Part D plans here (PDP tab).

Make sure to enter your medications, dosages, and favorite pharmacy, then sort by "Total Estimated Cost" to find the best value.

How to quote and enroll in Texas Medicare supplements

We make this free, fast, and easy here:

A few notes:

- As we mentioned above, the benefits are standardized for a given plan (G plan, for example).

- We have a simplified online Medigap application available here.

With the simplified app, we can process it directly with the carrier to make sure nothing will slow down the process, and there's zero cost for our assistance!

Of course, this is all confusing to many Texans, so don't go it alone!

You're probably bombarded with calls and mail around the Medicare transition.

Just check out our reviews! We're happy to help with any questions, and there's zero cost for our assistance.

Hopefully, this helps lessen the cloud around Texas Medigap plans.