A Texan's Guide to Medicare Supplements versus Advantage Plans

This is really the first decision to make when you're approaching the whole Medicare question and it's...complicated!

We'll get into a simplified explanation of how they differ in practical terms as the world of Medicare is generally pretty confusing to new (and old) members!

At its heart, this is really a question of Medicare decision control/flexibility versus cost.

That cost piece is tricky though if you don't have all the facts as you may end up paying in the end even with a cheaper plan.

We'll walk through this little snag but first, our credentials:

This is what we'll cover:

- What does core Medicare cover (and not cover)?

- How Medicare supplements work in Texas

- How Advantage plans work in Texas

- How to really compare Advantage versus Medigap (supplements)?

- How to quote and enroll in either Advantage or Medigap plans

Let's get started! First, why do we need either at all?

What does core Medicare cover (and not cover)?

We get people every day who say upon turning 65...

"I'm healthy. Never see a doctor. Why not just have Medicare by itself?"

This is the absolute worst bet you can make age 65 and older. The house wins in this case.

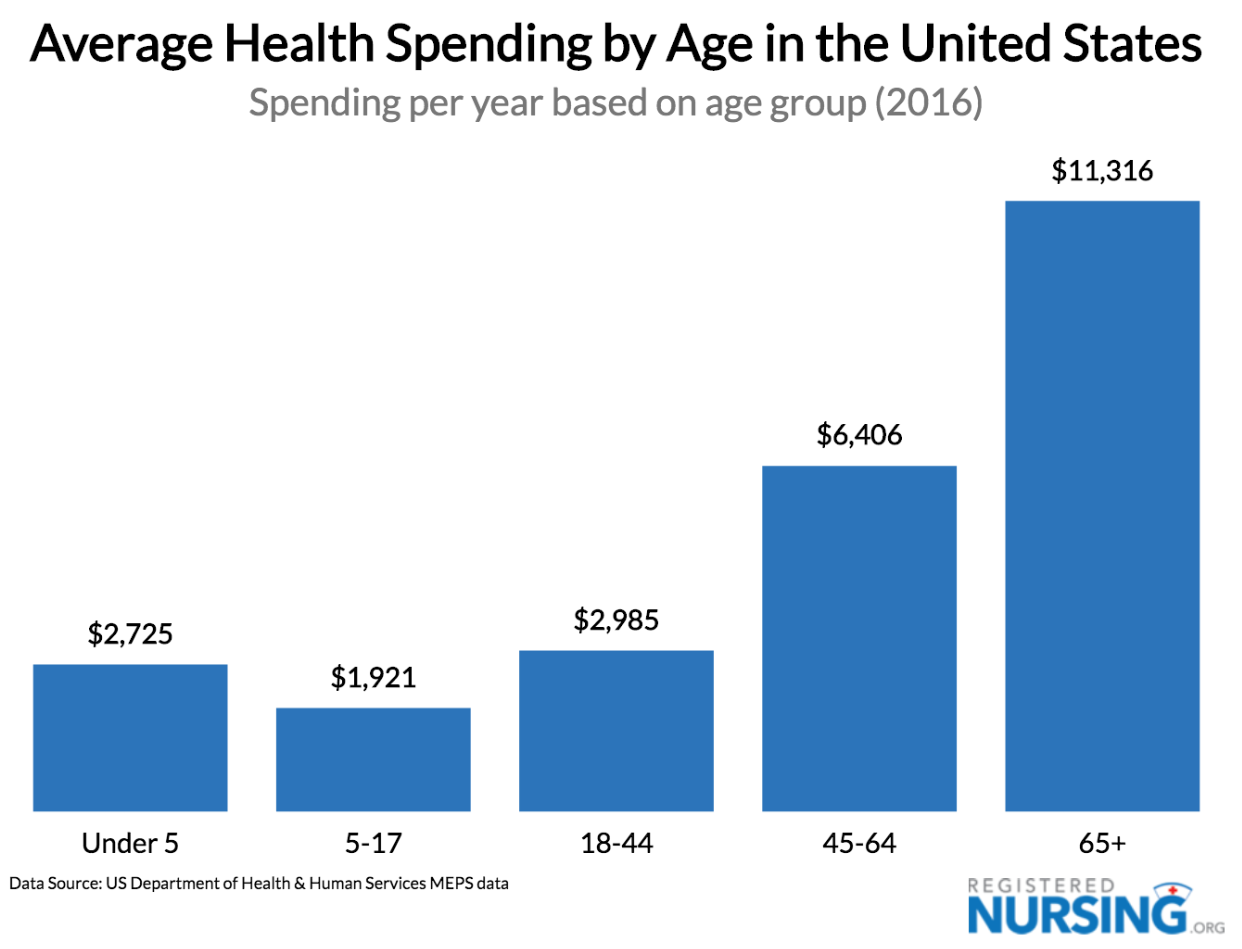

Medical expenses roughly double with each decade and go through the roof at age 65 and older.

Add on to that all the nasty surprises around cancer and out-of-the-blue heart issues (we're seeing it with clients) since 2020 and it's really not advisable.

Especially if there may be ways to cap our exposure for very low cost.

So...let's address the "holes" in Medicare first.

Medicare works like an 80/20 plan with deductibles built in. Two of them:

- Part A - hospital and facility costs - over $1600 annually

- Part B - doctor expenses - $240+ annually

After you meet either deductible, you then start paying 20% of the bills.

That's the real issue with just having Medicare. That 20% can continue forever.

A family member had a heart clot (completely healthy) which cost $500K!

You would be on the hook for $100K in this case with just Medicare. Not worth it.

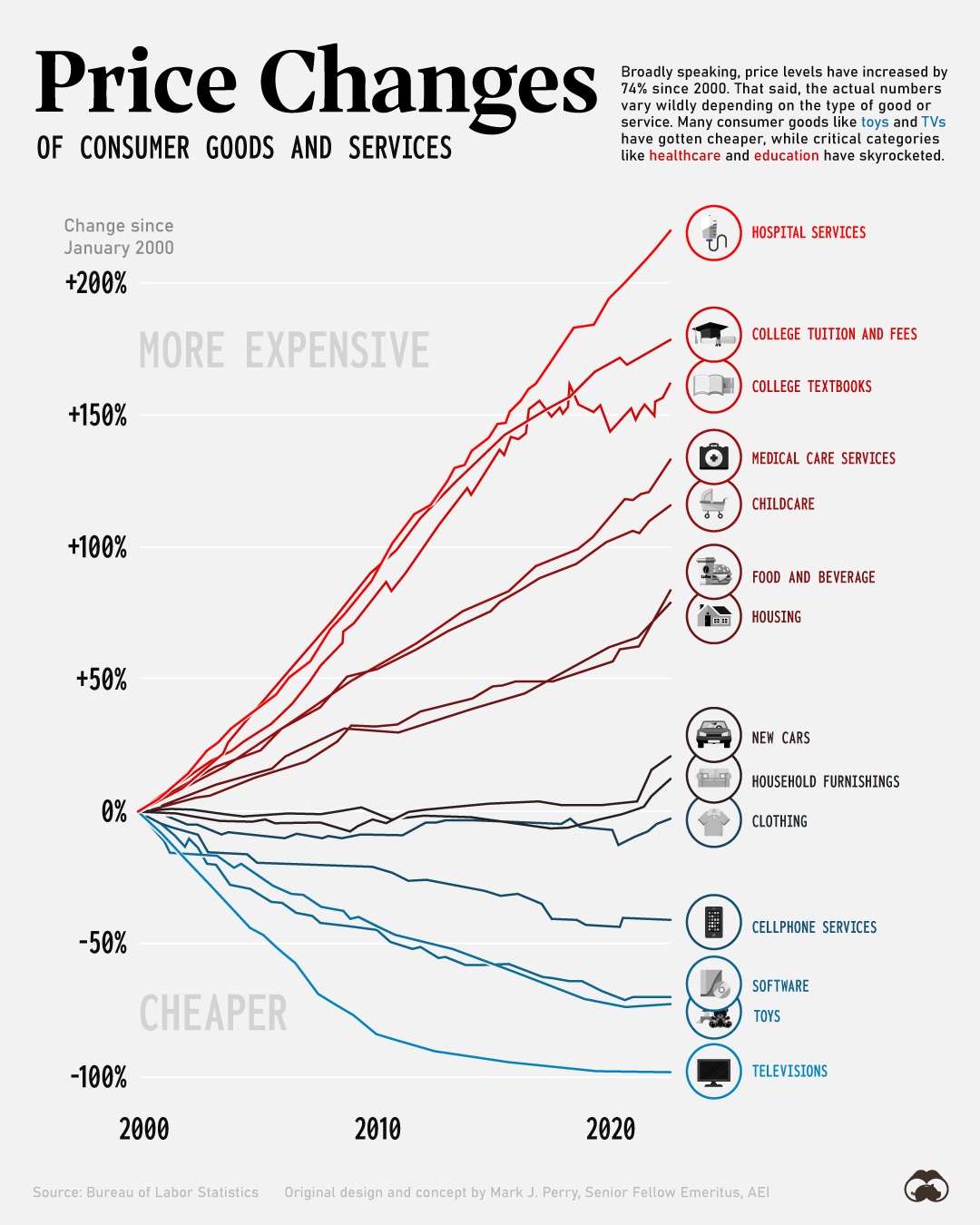

Especially with health care costs expected to explode higher generally.

So...how can we cover these core "gaps" in Medicare?

There are two ways on the market:

- Medicare supplements - work like PPOs

- Advantage plans - usually structured like HMOs

Let's understand what this really means.

How Medicare Supplements Work in Texas

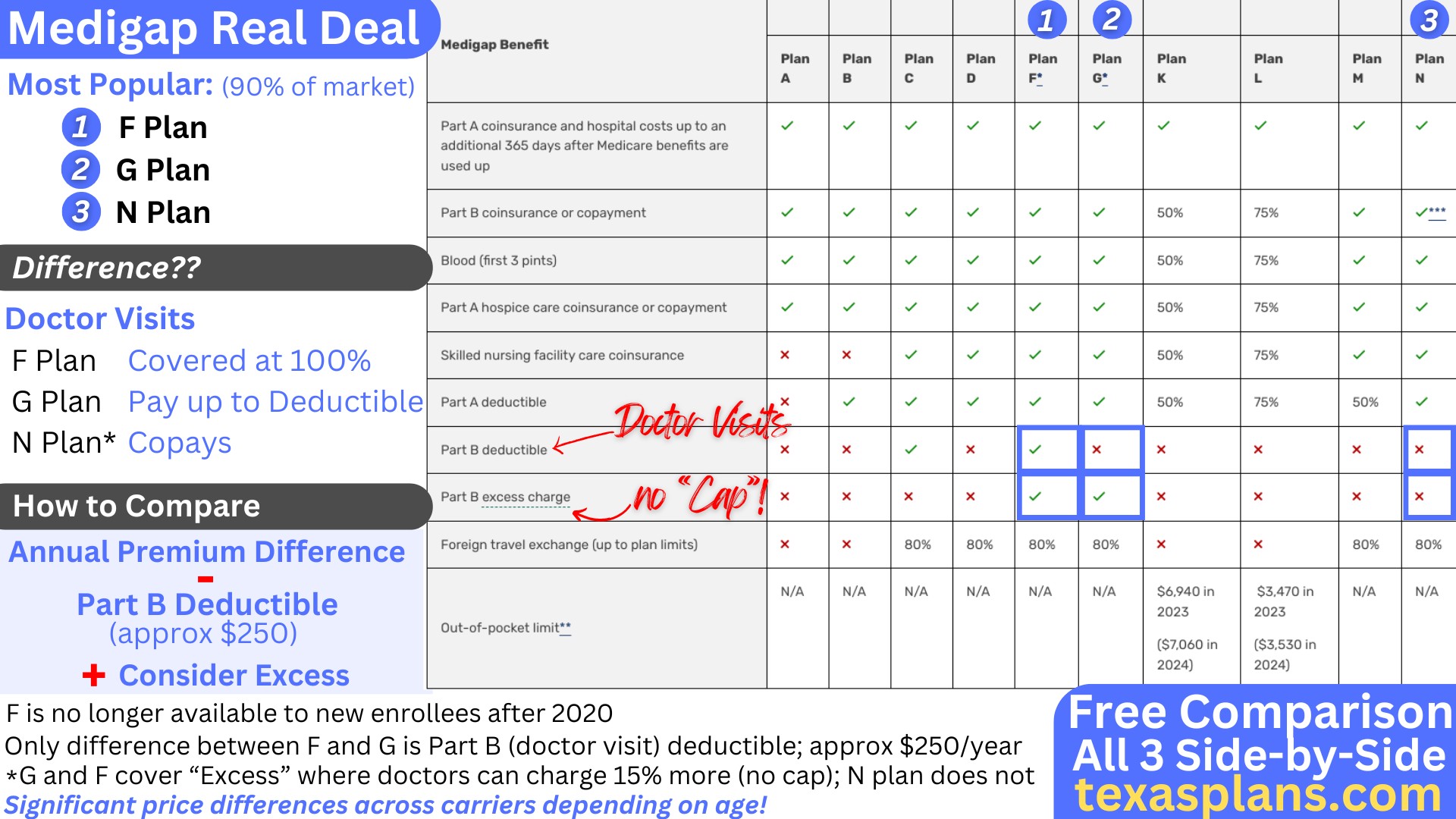

Supplements or "Medigap" came first with a range of plans that are designed to cover the main holes of Medicare.

You'll see the key items we listed above plus some smaller ones.

The main thing is that they all cover or cap the 20% coinsurance. That's our primary concern as we mentioned above.

The most popular plan by far is the G plan which is currently the richest for new enrollees.

The only real exposure it has is the Part B (doctor) deductible of over $240 annually.

The real pull of supplements is how access to care is handled:

- You can see any doctor or hospital that takes Medicare. Anywhere in the US!

- You can refer yourself out and just make appointments with doctors. No referrals needed.

- Decisions on course or care are made with your doctors as long as Medicare covers it.

So this is really for people who are used to PPOs where they have more choice, flexibility, and control.

All the major Texas carriers offer Medigap plans and you can quote them here.

One note. Medicare nor Medigap plans cover prescriptions so you'll want a separate Part D plan.

You can quote those separately here (PDP tab):

Make sure to enter your medications, dosages, and pharmacy. Sort by "Total Estimated Cost" to see the best total value.

We're happy to walk through any questions you have.

The most popular carriers for Medigap plans in Texas are:

- BCBS of Texas

- United Healthcare

- Humana

- Cigna

You can quote them all above side by side, and we're happy to run the numbers for you with just a zip code and date of birth.

That's the rough sketch of Medigap, but reach out with questions, especially around how and when to enroll. Let's check out the new kid on the block.

How Advantage Plans Work in Texas

Advantage plans are generally structured more like HMOs for Medicare.

You still need Part A and B effective with Medicare, but essentially, the private carrier takes over the responsibility of coverage from Medicare.

Advantage plans usually cover medication (called a MAPD with PD short for Prescription Drug).

Generally, Advantage plans offer:

- Low or no monthly cost

- Deductibles and out-of-pocket maxes that cap your total exposure

- Richer benefits when sick or hurt

- Additional benefits such as dental, vision, hearing aids, Part B rebates, etc.

There are lots of different options out there on the market since Advantage plans are not as structured as Medigap plans.

They must meet or beat core Medicare with a cap on exposure. Beyond that, lots of differences.

How do we actually compare all these options then?

Use our Triple Threat selection technique:

Star Rating is a fantastic look at how actual customers feel about their plans.

- 5 Star is fantastic

- 4 Star is solid

- 3 Star is meh

Then there's the out-of-pocket max. If you have really big bills, what's your total annual exposure?

That's the max! Try for under $1000 as we'll explain below. One note...medi-medi plans (both Medicare and Medicaid) may have large maxes since Medicaid is going to help with the backend.

Finally, there's the actual premium. This can be zero depending on the area!

So...what are we giving up?

Advantage plans are going to be more "managed".

This usually involves the trappings of HMOs:

- Must stay within a region

- Usually have a primary care doctor and/or medical group

- No benefits out of the network other than true emergency

- Carrier has decisions in the medical course of care (referrals, pre-authorizations, etc.)

If you're used to HMOs, this won't feel that different, especially if you live in a more populous area where there are lots of doctors (and members).

HMOs thrive in these situations.

You can quote the Advantage plans directly here:

Make sure to enter your doctors, medications/dosages, and pharmacy and sort by "Total Estimated Cost".

All the big carriers also offer Advantage plans including:

- BCBS of Texas

- United Healthcare

- Humana

- Cigna

- KelseyCare

- Alignment

- Scan

- Scott and White

So it's a trade-off...monthly cost versus control over care.

Let's now get to the headline comparison!

How to Really Compare Advantage versus Medigap (Supplements)?

First, if you have a strong preference for PPOs (you know who you are), then Medigap is probably going to be the better fit.

Separately, if you can't afford the monthly Medigap cost, Advantage plans will probably be the default option.

In between, there's lots of wiggle room.

How do we really compare them?

It partially depends on the area! If you have lots of zero monthly premium plans with low out-of-pocket maxes on the Advantage side, that makes it more level.

IF, however, the maxes are a few thousand, that makes supplements look better.

Here's why.

Let's say we have a $3000 max-out-of-pocket. This means in a bad year, we could see $3000 out-of-pocket in medical bills; that's not so great.

A Medigap plan might run $150/month or $1800 annually. Part D might be another $35 or $500 annually.

That's $2300, and we almost have nothing (besides the Part B deductible of $240+) out of pocket in a bad year.

So in a bad year, we're paying more out-of-pocket in total, and we're losing all the flexibility and control that Medigap plans offer.

Now, if it's a fairly tame year...let's say $500 in medical costs, the Advantage plan looks much more affordable (versus the $2300 in costs above).

That's one reason Advantage plan enrollment has taken off in Texas!

Check out our How to pick the best Medicare plan which goes through this process in detail.

One note, there can be special Advantage plans if you have Medicaid or chronic health issues.

If this all sounds too confusing, have us do the heavy lifting at zero cost to you!:

You saw the reviews above!

So...the tally sheet really depends on our area. It's very personal, so let's go there now.

How to Quote and Enroll in Either Advantage or Medigap Plans

We make this fast, free, and easy here:

The Part D options are also on the Advantage plan link since they have the same general rules.

Remember, for Advantage and/or Part D (if you're getting Medigap), enter:

- Doctors

- Medications/dosages

- Pharmacy

- Sort by "Total Estimated Cost" up top.

We can generally apply for Medigap plans any time of the year depending on health after our initial eligibility window.

Advantage plans and Part D have very specific rules on when we can apply including:

- Initial enrollment period - 7 months, 3 before and 3 after the month become eligible

- Annual enrollment period - Oct 15 - Dec 7th of each year for Jan effective date

- Special enrollment period - moves, losses of coverage, etc. (check with us)

We're happy to help and enrollment is pretty simple for either Medigap/Part D or Advantage plans.

This is all complicated, so let us know how we can help. We're happy to walk through the ins and outs of both options in Texas.