How to Compare Texas Medicare Advantage Plans

With over 25+ years experience, we're going to peel back the curtains on Advantage plans on how to really compare them.

Enough with the sales pitches and marketing gimmicks. Watch out for anyone who's just a little too excited about a specific plan.

Probably not in your interest.

First, our credentials:

Advantage plans are increasing in popularity with almost half the Medicare marketplace and we expect that to continue to 70% by decade end.

Why?

Just this...

We've already seen it with the Texas On-Exchange marketplace's move to HMO across the board.

Any model that keeps a lid on costs will win and that's...Advantage plans (HMO).

So...how do we actually compare these options?

Let's cover the big ticket items here:

- Understanding the basics of Texas Advantage plans

- The Star Rating

- Avoid complaint #1 and 2 with Texas Advantage plans

- The Triple Threat selection process for TX Advantage plans

- Don't forget the backend! Out-of-Pocket maxes

- Networks drive the decision

- Special situations with Advantage plans (SNP plans)

- Quoting and enrolling on your terms

Let's get started!

Understanding the basics of Texas Advantage plans

First, a lay of the land.

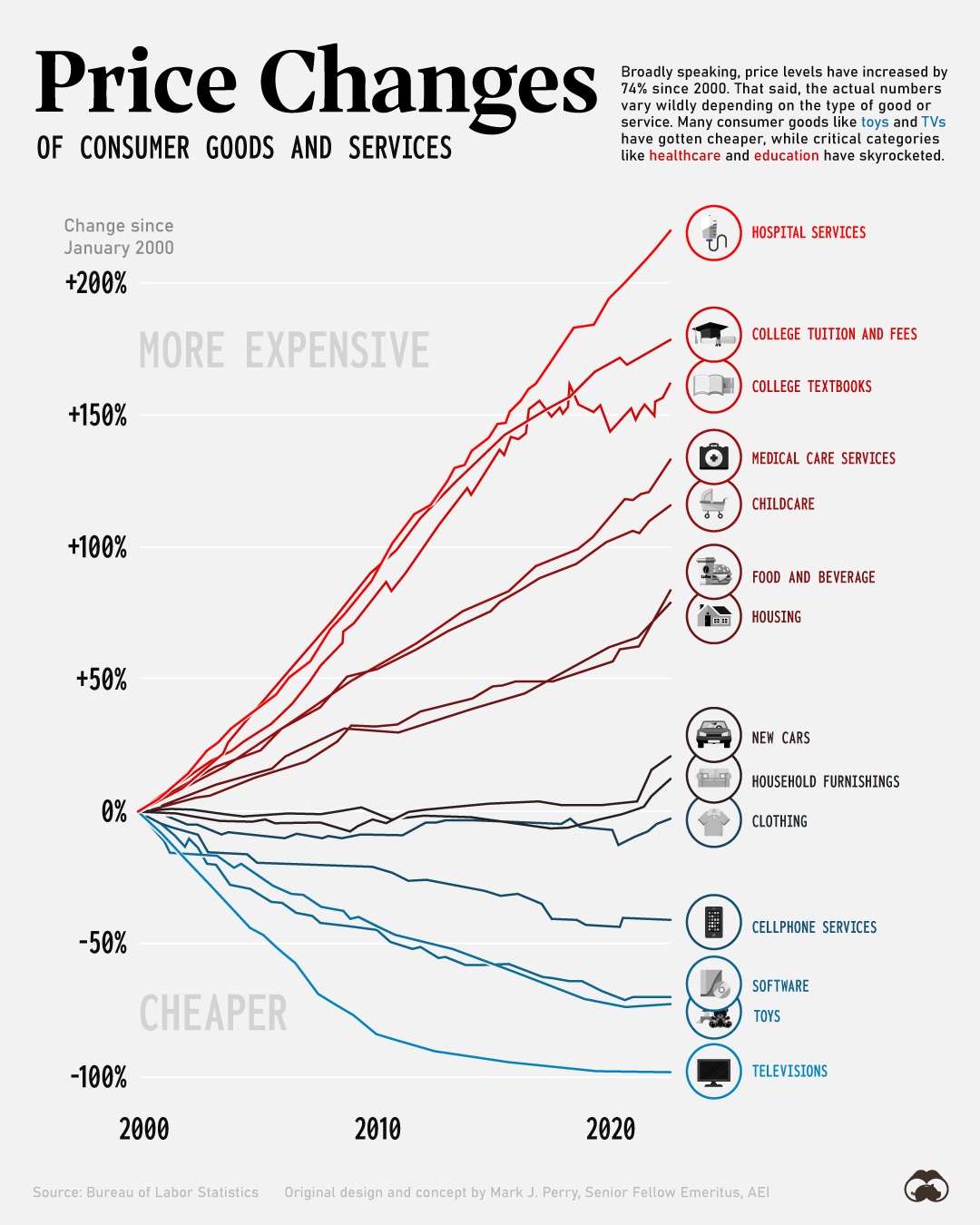

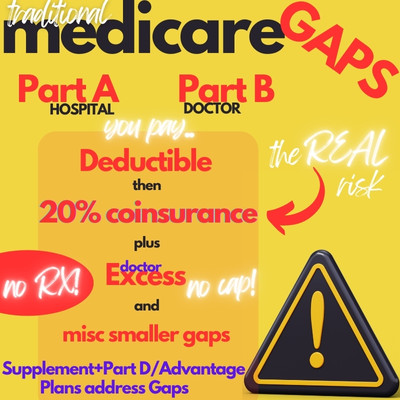

Traditional Medicare is broken into 2 main sections:

- Part A - Hospital; usually free if you paid into it during your life through payroll taxes

- Part B - Doctors; requires a monthly premium that goes up each year based on prior income

The issue with Medicare by itself is that after the deductibles you have to pay up front, you're then on the hook for 20% coinsurance.

There's no cap for this 20%!

A $100K bill (very easy these days unfortunately) means you're on the hook for $20K.

If you've got that laying around.

There are two ways to "cap" this exposure:

- Medicare supplements: work like PPO plans but you pay more monthly; starting over $100 generally

- Advantage plans: low or no cost monthly with different benefits and a cap on that 20%!

So, it's really a trade off between paying now (G medicare supplement) or paying as things come up with a cap (advantage plans).

Now, most Advantage plans are HMO so there are trade-offs that you take on versus a supplement.

Generally speaking:

- With HMO's, care is more "managed"; you have less control and flexibility

- You have to stick within a network based on where you live

That's just a function of the HMO model and why it's able to contain costs.

We're happy to walk through your situation at help@texasplans.com or pick a time to chat here.

You can quote both here:

Now, let's get into the nitty gritty of comparing Texas Advantage plans.

The Star Rating

When you run your quote, you really need to start here.

The scale is from 1 (worse) to 5 (best) and the Star Rating reflects how actual members feel about their plan.

It's a Yelp review of Advantage plans!

It's administered by Medicare so we know it's impartial.

Our recommendation??

Aim for 4 stars or better!

- 3 star is pretty average - members are not too jazzed about their plan's day-to-day

- 4 star is good; people are generally happy with their plan

- 5 star is fantastic; as excited as you can get about health insurance

This goes a long way to avoiding bad plans and the Star Rating will be shown for every plan!

We skip right over 3 stars and lower. You should too!

A big part of picking the best Texas Advantage plans is by avoiding bad ones. Let's go there.

Avoid complaint #1 and 2 with Texas Advantage plans

The two biggest complaints from members of Advantage plans?

- Can't see my doctors with the plan

- The plan doesn't cover my medications

How do we address these?

In the free quote tool here, make sure to enter the following under "Preferences":

- Doctors and hospitals

- Medications and dosages (exactly as they're listed on the bottle)

- Preferred pharmacy

The system will automatically reflect this information and even show you how to save money on the medications if there are alternatives (for example with generics).

Sort by "Total Estimated Cost" so the quote ranking will reflect your out-of-pocket medication share.

This plus the Star Rating is half way there!

Let's get into the weeds of the actual plan benefits.

The Triple Threat selection process for TX Advantage plans

This is probably the most confusing piece. So many different options!

We recommend using our Triple Threat option:

So...

- Star Rating (we're well versed on this now)

- Deductible and premium: aim for zero or lowest available

- Out-of-Pocket max: what's your exposure in case of big bills

This really eliminates many of the least attractive plans off the bat. Star Rating alone will cut ½ of them out of the picture.

Deductible and Premium tend to be similar in a given area and this can really differ from area to area.

The out-of-pocket max requires its own section!

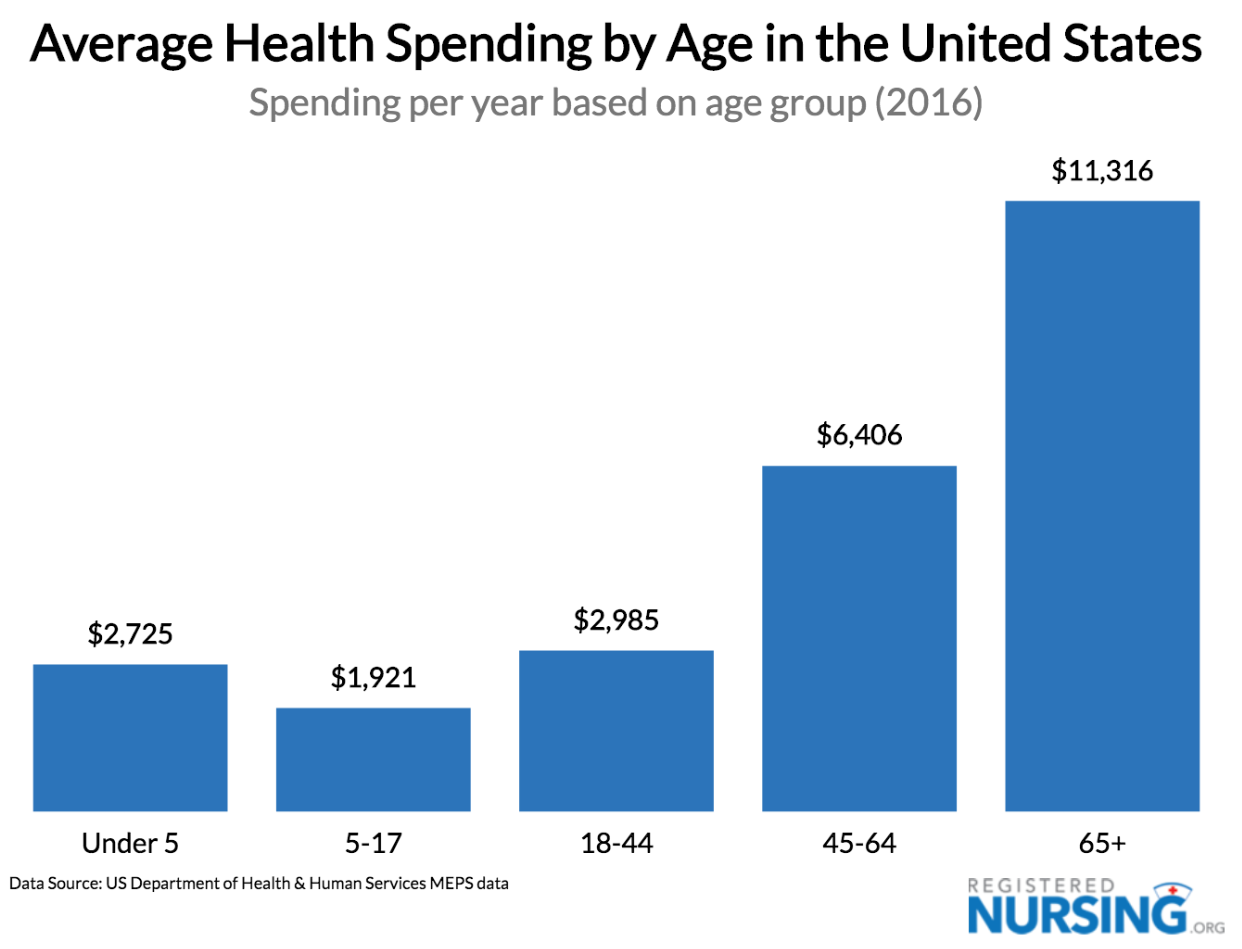

Don't forget the backend! Out-of-Pocket maxes

Pushy salespeople will sell you on gym memberships and free steak knives (okay...I date myself) and totally gloss over this piece but it's probably the most important.

This number reflects your exposure in case we have really bad bills in a calendar year.

If the Max is $1000, we can expect to pay the copays and coinsurance, etc until we hit $1000.

Okay..that changes things quite a bit. If some plan has really rich copays but adds serious money to the backend, it's not so great.

Sucker's bet.

Here's why:

This is the wrong time to take this bet and in this case, the carrier is the house! The house always wins.

It also changes the comparison with supplements. $1000 is the equivalent of around $80/month in premium if we have bigger bills.

The G plan is probably around $150/month (depending on age) with just the Part B deductible ($240 currently) exposure.

Subtract 80 from $150 and now that G plan feels like $70 roughly if we have bigger bills.

Hmmmm. That changes things and we're happy to walk through your specific comparison.

Some plans might look like they have massive Out-of-Pockets ($8K+) but they might be Texas medi medi plans. For people eligible for medicaid.

Medicaid will help with this backend so that's less of an issue. You can select "Show Special Need Plans" up top to see these plans.

Then there's network!

Networks drive the decision

Since one of the big trade-offs with Advantage plans (versus supplements) is what doctors we can see, network becomes really important.

This is one reason why United Healthcare® gobbles up almost half the market! That and Star Rating!

It also speaks to why some regional, smaller players can have 5 Star plans such as KelseyCare!

This would be unheard of in the Obamacare market for example where big rules.

Again, the best approach is put your doctors and hospitals in the quote preference. You can email us at help@texasplans.com and we can check what plans work with your doctors as well!

Zero cost for our assistance.

Let's look at special versions of Texas Advantage plans.

Special situations with Advantage plans (SNP plans) and Giveback plans in Texas

There are specific versions of Advantage plans available in certain areas based on:

- Eligible for Medicaid - so-called Dual Eligible or DNSPs

- Chronic Illness eligible - called CSNPs

- Medicare Part B Giveback plans - will pay towards your Part B premium

These plans may not be available in your area. When you run the quote, just select "show Special Need Plans".

For the Giveback plan (not a Special Need Plan), you'll see "Part B Giveback" on the left if available in your area.

We can run these quotes for you at help@texasplans.com or...you can run them right now!

Quoting and enrolling on your terms

We believe in giving you this control with our free and secure online Advantage quoting tool here:

Make sure to do the following for the best quote:

- Enter your doctors/hospitals under Preferences

- Enter your medications and dosages

- Enter your preferred pharmacy

Then, sort by "Total Estimated Cost".

Most Advantage plans include Part D for medication.

We're happy to go through any of these options with you! There's zero cost for our assistance and we work with the biggest Texas Advantage plans.

If you need more help, email us at help@texasplans.com or pick a time to chat here.