Can Individuals and Families get a PPO in Texas?

We've been talking about this for almost a decade now.

The slow, steady move towards HMOs after the ACA law was a sure thing!

Across different states, it's been the same and Texas is no different with the vast majority of plans available on or off-exchange (both technically Obamacare) being HMO's.

With a sprinkling of EPOs (like a PPO but with no benefit out of network) and one POS (from BCBS) which is like an HMO with benefits.

What about a true PPO? More importantly, what about nationwide access that used to come with PPOs?

There's one way and we'll describe it below.

First, our credentials:

This is what we'll cover:

- Why the loss of PPOs in Texas?

- Quick intro to the Texas individual family health networks

- The small business method to get a PPO plan for individuals

- How to compare the small business and on-exchange options

- What's required to set up the small business PPO plan

- How to quote and enroll in small business Texas PPO

Keep in mind that the carriers may change their rules so check in with us first!

Let's get started!

Why the loss of PPOs in Texas?

First, this is happening across the US!

Question is why?

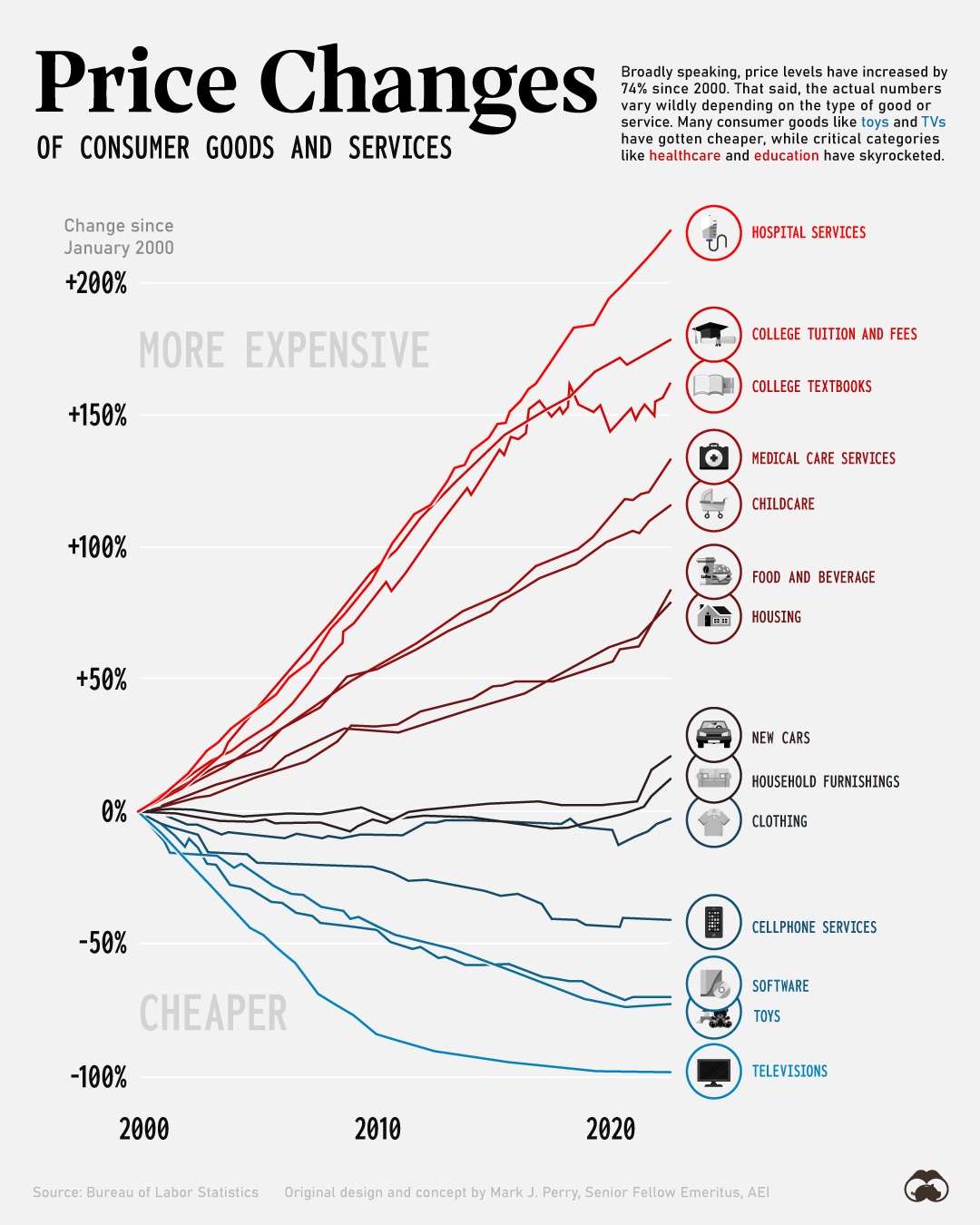

It's all about cost! The cost of healthcare has spiraled since 2014 with the ACA law and that just continues. If anything, it's speeding up:

Anything that bends this cost curve will win the market and Texas, we have a winner.

By definition, HMO's will put pressure on costs more than PPOs.

Here's why.

With HMOs, there's a financial incentive for the providers (doctors/hospitals) to keep costs down. They share in the outcome.

Essentially, HMOs are like a mini Single Payer plan.

- There's a fixed budget to spend on health care for a group of people

- The carriers give the providers a budget to stay within

- The doctors/medical groups then use that budget accordingly for the insured

If they spend too much, they can actually lose money themselves!

If they're able to save, they make more.

This doesn't mean care is lacking but there is definitely a cost constraint built into the system.

PPOs are based on utility. There's no incentive financially for a doctor to try a cheaper course of treatment or delay treatment.

For example, maybe try anti-inflammatories before Physical Therapy (more expensive).

Some people hate HMOs and love PPOs as a result!

So...what's available on the individual/family market in Texas.

Quick intro to the Texas individual family health networks

First, the networks are identical on or off-exchange.

Some people think that the networks are broader off-exchange and only limited if they get "Obamacare" on-exchange.

It's all the same thing! Same networks. Same benefits. Same pricing.

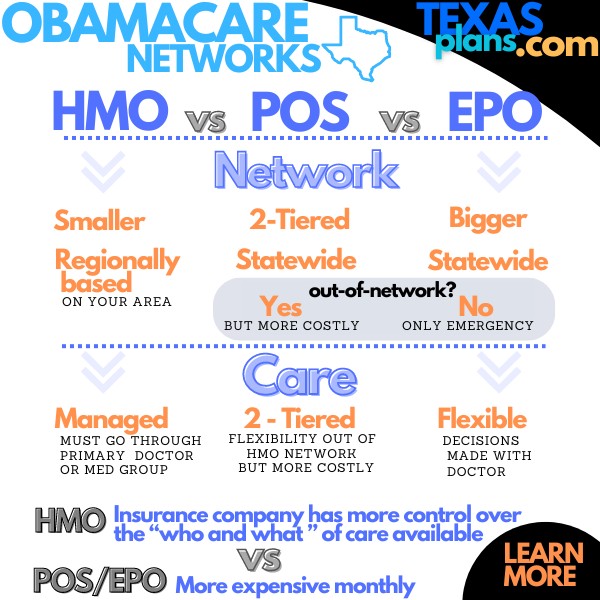

As we mentioned, there are three basic flavors available out there:

- HMO - limited network based on where you live; care is more managed

- EPO - similar to the PPO but with no benefits out-of-network other than true emergency

- POS - HMO network with some added flexibility outside core network but at higher cost

The POS is not a true PPO as people are used to from employer plans.

PPOs have a big network in which you get highly discounted care when you stay within it.

You can go out of the network but with less reimbursement. Quite a bit less these days...even for employer plans.

PPOs are also much less managed in terms of access to care. Most decisions are made between you and your doctor.

Referrals to specialists are generally not required and authorizations are much fewer than with HMOs.

We have a big review on Texas Obamacare networks but there's one more piece that many people miss from PPOs.

How to get Blue Card nationwide access in Texas

The big draw with PPOs was you had access with some carriers to nationwide carriers.

For example, BCBS PPO plans generally had the Blue Card network which allowed you to see BCBS PPO providers in other States, even in a non-emergency.

This can also be a big deal if you live by the State line and medical providers just happen to be in the other State.

With an HMO or EPO, you likely will not have access to these providers.

There may also be a specialist who's the top for a more serious issue you have and they're in Arizona or California.

Not happening with an HMO or EPO.

This is just one more feather in the PPO's cap that people want, especially coming from employer plans.

So...is there any wiggle room?

The small business method to get a PPO plan for individuals

Here's an avenue to consider.

PPOs are still available for Texas small business plans.

After the ACA law, the rules changed in terms of eligibility but here are the hurdles:

- Need a small business LLC or S/C Corp for the family

- Payroll is not required!

- We can enroll down to 1 person

- Don't need to enroll partners with eligible waiver (Medicare, medicaid, other group coverage, or even on-exchange plan)

These days, it's mostly LLCs where we're able to get this through and certain carriers are much easier to deal with. Reach out to us at help@texasplans.com or complete the small business health quote here.

These are the full-bore PPOs of yesteryear!

- Bigger networks across the State

- Self-referral and more flexibility

- Access to providers out-of-State

The small business networks are completely different from individual/family markets and PPO access is a big part of that.

Alright, so how do we compare these plans and what's available on the Texas exchange?

How to compare the small business and on-exchange options

First, there can be big subsidies available on-exchange depending on income. Run your individual family quote here and enter your income (AGI on the 1040 tax form; following April):

This subsidy is not available on the small business market for the owners so if you're eligible, that's a big determining factor.

Let's assume we don't qualify for a subsidy. Then what?

First, the benefits are pretty standardized for individual/family versus small business.

Meaning, a silver plan will be pretty comparable to another silver plan, +/- 2%.

This is true across both on-exchange or small business plans now.

The pricing is actually comparable although PPOs will be more expensive.

Here's what we usually hear:

"I don't care about the cost...I want a PPO".

Seriously. Interestingly, the PPO with small business is probably not that different from the POS available through BCBS.

We can run the quotes for both for you. Just need dates of birth, zip code, and best estimate for this year's income (to make sure we're not losing a subsidy).

Email us at help@texasplans.com and let us know you want a PPO so we quote both markets for you.

We'll do all the heavy lifting and there's zero cost for our assistance!

We can then compare cost difference which is really the big deciding factor between small business PPOs and on-exchange POS or EPOs (outside of the network of course).

Let's say we want to go that direction. What's needed?

What's required to set up the small business PPO plan

As we mentioned above, a partnership structure is ideal.

LLC's are what we usually see that works to set up a small business, even with just the spouses.

S and C corps may work with the owners as officers. Payroll is not needed but doesn't hurt.

If we set up a small business, there are certain waivers for either owners or employees:

- Medicare

- Medicaid

- Other employer coverage

- On or off-exchange coverage

Those are the big waivers. This means they don't need to enroll in order to hit participation requirements.

Usually, it's just a family business in Texas that's enrolling and we can do that with the LLC at a minimum.

Sole proprietorship won't work unless we also have payroll which isn't typical.

Again, LLC seems to be the best fit.

We only need one person enrolling as long as the other partners have an eligible waiver.

Let us know what you're dealing with and we'll try to provide some guidance at help@texasplans.com .

Keep in mind that the carriers can change their requirements so it may be a question of applying and see their response. The past doesn't guarantee the future in this situation.

So...what are the rates like?

How to quote and enroll in small business Texas PPO

This is pretty easy. Request your quote here:

Make sure to note that you're a small family business and the structure so we know which carriers to look at.

If we can't qualify, the EPO is probably the best bet out there on cost/network comparison.

We've been on EPOs and PPOs in the past and they feel pretty comparable except for the out-of-State access.

PPOs have ramped down out-of-network benefits over the past year so you can expect to pay quite a bit more when using this feature.

Happy to help with any questions!

help@texasplans.com Call 800-320-6269 or pick a time to chat here