Texas Health Exchange Networks Explained

After the subsidy (learn more here) and actual plan design, the networks are key to which plan to go with.

It really separates the different carriers (Texas health exchange carrier comparison).

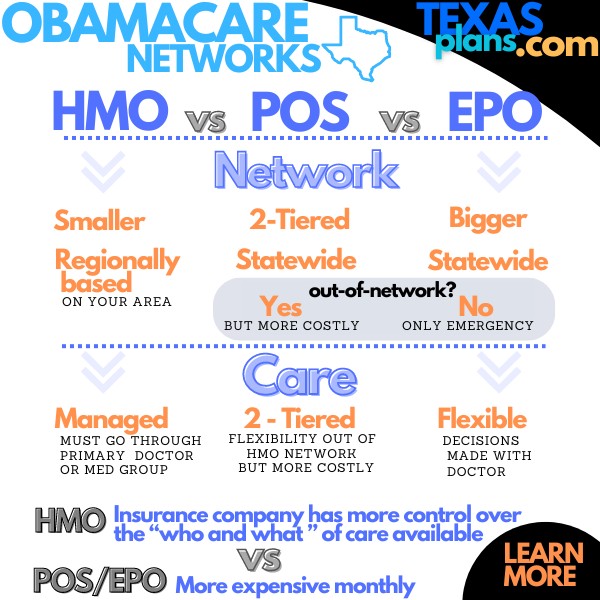

This can be really confusing to most people with the various letters HMO, EPO, POS, etc.

Let's break this down in practical terms so you can make a better decision when you run your quote here.

First, our credentials:

This is what we'll cover:

- Top level intro to Texas health exchange doctor networks

- The HMO model in Texas

- The EPO model in Texas

- The POS model in Texas

- Why pricing may matter more than network

- Regional networks come on strong

- Quoting Texas health exchange plans with online doctor finders

Let's get started!

Top level intro to Texas health exchange doctor networks

Things have changed quite a bit in the first 10 years of the Texas health exchange (Obamacare).

We've gone from PPO's to EPO's to HMO's over that time and expect this to continue.

Why?

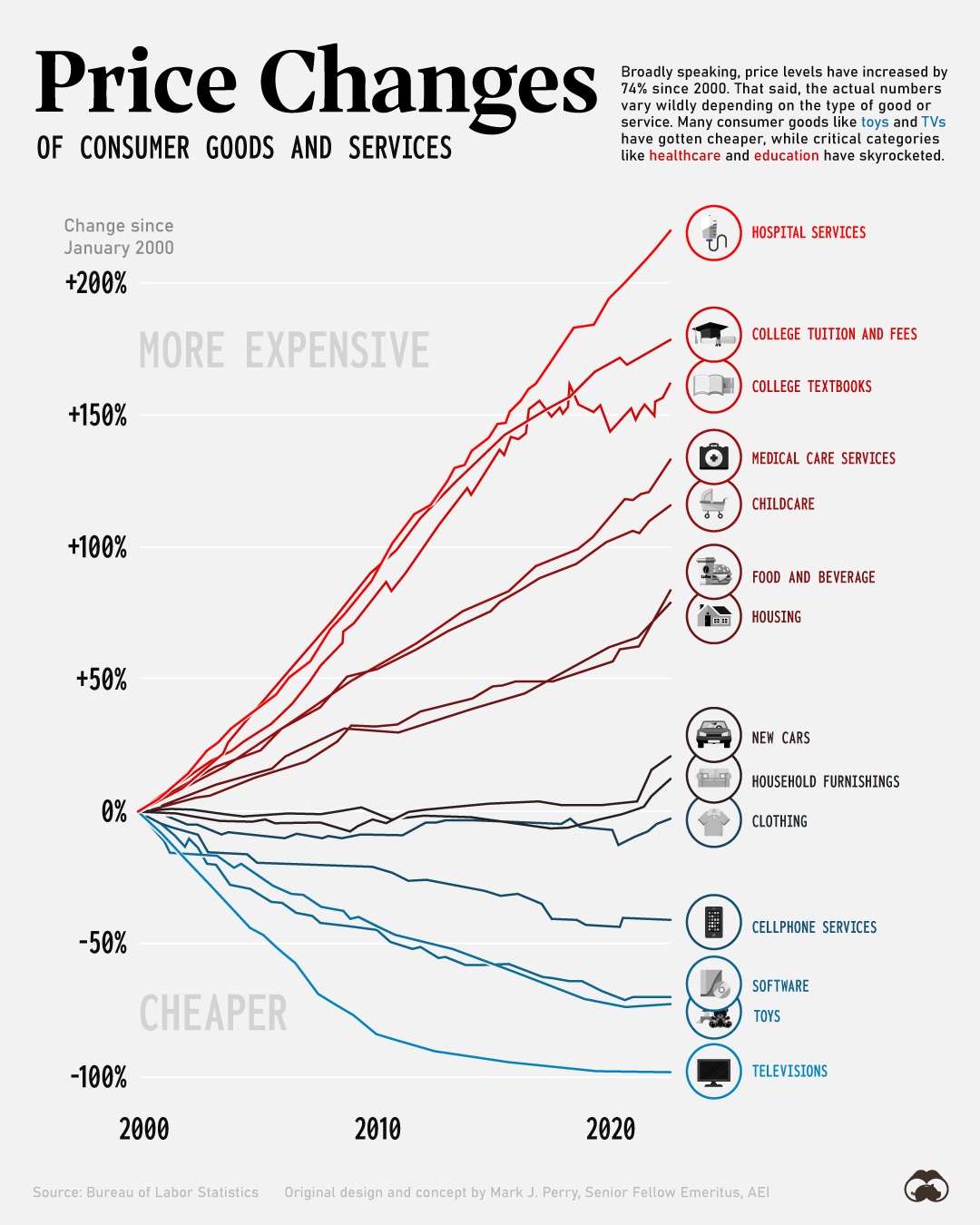

Cost! Any model that contains cost better will win because it's been ridiculously lately:

This is reflected right in the cost of each plan as we'll see below.

The dominant carrier BCBS of Texas currently offers HMOs and POS's. Oscar (runner up) offers EPO's The majority of the rest of the market are HMO's.

So the race is won!

Keep in mind that the benefits are pretty much standardized +/- 2% at a given metallic level.

This means that a silver plan will walk and talk about the same in expected out-of-pocket (when sick or hurt) regardless of the network and carrier.

Sure, there one might reduce the deductible but then it has to make up for it in other places.

The subsidy will apply to all plans regardless of the network choice so no difference there.

Learn more about getting the most out of the Texas On-Exchange subsidy.

So, what is really different?

- Size and location of network

- Ability to refer yourself out

- Benefits outside network

- Control over healthcare decisions (between you and doctor)

Generally, these increase from HMO to EPO to POS as we'll see below.

One note...the networks are IDENTICAL on and off exchange so don't let the doctor office tell you differently. More on that below.

Let's actually break each one down now. We'll start with the dominant flavor in Texas.

The HMO model in Texas

Everything is moving this way since 2014. What exactly is an HMO?

First, it makes sense to explain how it works.

The HMO is essentially a mini single-payer plan!

They have a fixed bucket of money to spend. They divy this up to the doctors who then have a fixed bucket to care for their patients.

It works best in more populous areas where you have lots of patients and lots of doctors to make the work out.

A $250K heart attack can more easily be spread amount 1000 people than amount 100!

Since there's a fixed bucket, the model has various ways to keep costs under check:

- Smaller networks of doctors; usually around a particular medical group and hospitals

- Doctors are based within a certain distance from your residence

- A primary care doctor who refers out and has more say-so over care

- Pre-authorizations and more "managed" care

- No benefits out of the chosen medical group aside from true emergencies

So...how does this actually work for you?

HMOs work well unless you really want flexibility and access to providers outside the network.

And are willing to pay for it (as we'll see below)!

The HMOs are generally going to be the cheapest networks on the market when you run your quote.

Unfortunately, cost has become a bigger issue than care flexibility in today's world. HMOs do a good job of incentivizing everyone to watch expenses starting with the doctors since they have skin in the game now.

Practical effects of this?

- You may have to wait a bit more to jump into a given course of care

- Referrals are needed for many specialists

- Cheaper versions of medications may be substituted in

None of these are bad in practice. In fact, in some cases, they may prevent unneeded medical care. Some doctors are quick to cut!!

They have an incentive now to try less intrusive avenues.

What about the EPO model?

The EPO model in Texas

The EPO works like a PPO except you don't have benefit out of network other than a true emergency.

This is a big reason Oscar is #2 on the Texas exchange market after BCBS. They went all EPO!

What does this mean versus the HMO above?

- You don't have to pick a primary care doctor and you refer yourself out

- The networks tend to be bigger and not locked into a regional area

- More decisions are made between you and your doctor but there can still be pre-authorizations

- There is still no benefits outside the EPO network other than a true emergency

The PPO is different in that there is some level of benefit outside the network but as of late, this has really been watered down.

Not too much difference between a PPO and EPO practically these days.

The EPO is best for people who want more control and flexibility assuming the price is right.

What about the POS?

The POS model in Texas

This is BCBS of Texas' richer model available now to individuals and families.

They will generally have a version of a plan with both an HMO and a POS model.

The POS basically states that you have the core HMO model from above.

IN addition, you can go outside this network and refer yourself out but get much less rich benefits than if you were to go with the HMO rules.

This is as close to the old PPO's that we can get on the Texas exchange.

The POS is for people who want the most flexibility/control over care and choice of doctor. And are willing to pay for it!

Let's look at that piece now since pricing just might make the decision for us.

Why pricing may matter more than network

Health insurance is expensive! Sure, the subsidy since 2024 can really bring the cost down but still.

The underlying cost has probably tripled or more.

- HMO's are going to be the cheapest option on the market

- EPO's (Oscar) can usually match the HMO or get pretty cose

- POS plans (BCBS currently) can be a few $100 more per month for the same plan as HMO

So...how do we really compare these?

First, check our doctors on the provider online finder through the quote below next to each plan.

You can ask your doctor's office "What Texas health exchange plans do you participate with"?

One note...some doctors will say they don't work with Exchange plans but they take the direct to carrier plans.

They're IDENTICAL networks! The doctor is just being difficult. You can't get a subsidy off-exchange for the exact same coverage and this can mean a lot of money out of your pocket.

This is very frustrating to us and we expect to slowly go away as the enrollment in the Exchange has exploded higher in the last few years!

It will be hard for the remaining holdouts to keep this up.

Once you've figured out what plan level you want (see our metallic plan guide), then check out the doctors within plans you can afford.

We're happy to do this for you at help@texasplans.com. Just send over zip code, dates of birth, and best estimate for this year's income (to calculate the subsidy).

Guide on income for Texas subsidy.

Again, price may dominate here and BCBS really has the dominant HMO network in the State which should reflect in the pricing!

Now, there are pockets around Texas where smaller players are gaining. Because of network!

Regional networks come on strong

One of the fastest growing Texas exchange plans belongs to Scott & White. This is a case of the network becoming the insurer instead of the other way around.

They are a medical provider first and an insurer second. In certain areas though, they have a very strong brand and network which attracts many people to their plans.

They can also price well since they're offering both care and insurance for that care. Very similar to Kaiser in other States.

Expect to see more of this sort of regional player in Texas going forward since HMO's don't really need a Statewide presence. They can focus on a given area and medical group just fine.

You'll see them in the quote right alongside BCBS, Oscar, and other players.

If you know your doctor is within a given group like Scott & White, that makes it easier.

Speaking of quotes.

Quoting Texas health exchange plans with online doctor finders

We make this fast, free, and easy here:

Next to each plan, you'll see a Doctor FInder link to check their actual network according to the plan you're looking at!

If you don't see your doctor in the network, we recommend calling the office and asking them what "Texas Exchange do you participate with"?

If they say no, ask them if they take the off-exchange plans direct with the carrier. If they say yes, this is an issue. They're the same network!

We're happy to help chase this down for you at help@texasplans.com

Networks can (and do) change at open enrollment each year so it's important to double-check at year end to make sure everything's still okay on that front!

Reach out with any questions to help@texasplans.com, 800-320-6269, or pick a time to chat here.