Can You Get Major Medical Insurance in Texas?

We get this question often and people mean a few different things.

Basically, what they mean is...

"I want the cheapest health insurance to cover the big bills!"

We've always been big fans of this approach and we'll explain why it makes even more sense since the ACA law (2014).

First, our credentials here:

This is what we'll cover:

- Why get major medical insurance

- Is there major medical insurance in Texas

- Subsidies and the bronze plan

- Short term health plans for major medical

- The health sharing world

- How to quote and enroll in major medical

Let's get started!

Why get major medical insurance

Two pieces to this question, both revolve around saving money:

First, why have health insurance at all?

"I'm healthy...don't see the doctor!"

The convo usually starts with that and we agree...staying out of the medical system is a good bet.

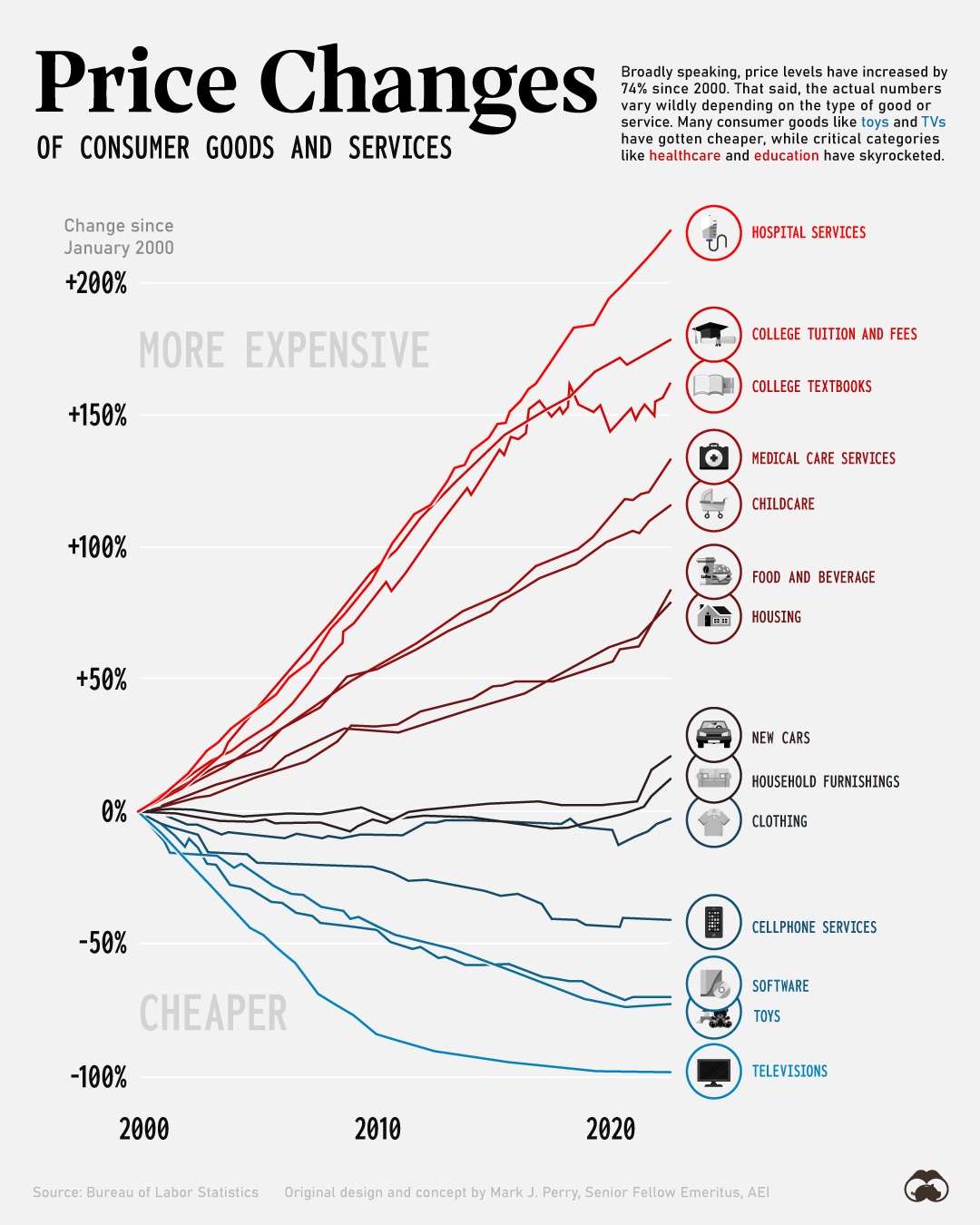

That being said, we see bills of 100's of $1000 every week. Especially since 2020 unfortunately.

Lots of heart and cancer issues out of the blue. My wife had a surprise clot in her heart last year.

$350,000 all told. We paid $7K with our major medical plan.

Don't fight this trend:

So, that's the reason to have health insurance at all. Cover the really big bill so you're not donating kidneys to the local hospital.

Next up, why major medical versus the other plans.

Something interesting happened after 2014.

The plans became "guaranteed issue" which means that they can't decline based on health. No waiting periods for pre-x conditions. Much more MUST be covered.

All good things but there's a cost to this. We remember getting calls like this:

"Sign me up for the Platinum plan...I'm getting my knee replaced!"

Not kidding. Calls like this all the time.

The net effect of this is simple after a few years. Each move up in benefits will cost you about what the benefit difference is.

Meaning...if the deductible drops $4K, you'll probably pay $4K in annual premium to get this benefit bump.

Another secret...the out-of-pocket max (how the plans treat really big bills) is about the same for the bronze, silver, and gold plan!

The platinum plan drops the max but you're going to pay for it!

These benefit-cost effects increase as we get older by the way. For a person in their 50's and 60's, it's hard to justify going richer than the bronze plan unless we're getting a massive subsidy or the enhanced silver plans based on income.

We'll discuss those below.

So...what counts as major medical in Texas now?

Is there major medical insurance in Texas

Yes but maybe not what you're expecting.

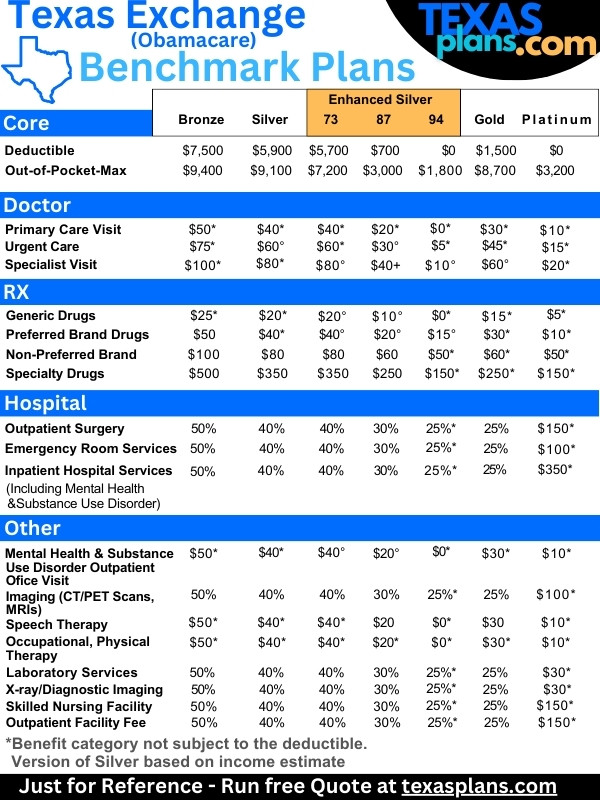

The ACA law in 2014 set benchmarks on what different plan levels have to cover.

The bronze is the lowest level on the market now:

One note. Obamacare just means ACA or individual family plans. There's no difference if you go off-exchange or on-exchange.

Same benefits, networks, and pricing. So what's different?

Subsidies! This brings down the cost of your monthly plan of choice including the bronze level.

It's all based on income now and we'll look below at how to run the correct quote.

Look...regardless of what you think about the ACA law, this is found money. Don't miss out on it since it can be $1000's per year.

We have to enroll on-exchange to get the subsidy but we can help you with the whole process and make it easy and fast.

There's no cost for our assistance at help@texasplans.com or 800-320-6269.

We have three different types of major medical to look at:

- Bronze plans on exchang\

- Short term plans in Texas

- Health sharing plans (not health insurance)

So...let's start with the most legit option.

There are actually 2 versions of the bronze plan. Let's go there first.

Subsidies and the bronze plan

The bronze plan is pretty close to major medical on-exchange.

There are two different versions of it:

- Standard bronze plan

- HSA bronze plan

Some carriers don't offer a bronze plan at all while others can offer many different versions.

BCBS is an example of this.

Generally speaking you can expect:

- High deductible around $7000/annual

- High out-of-pocket around $9500/annual

- A few or no copays for office before deductible

- Preventative is covered at 100% on all plans in-network

Pretty straightforward. You'll get discounted rates in-network even with the high deductible which can drop the cost significantly.

We see hospital bills come down from $20K to $3K all the time! Kind of suspicious in our book but that's our current setup.

The HSA throws on a tax benefit to this general set-up.

You can basically add on a tax-favored account that allows you to pay out-of-pocket medical and dental expenses (not the premium) with pre-tax money.

This extra account isn't mandatory as you can just have the health insurance plan by itself.

We actually like the HSA qualified plans since they're structured a little better.

Either way is the major medical option in our current health insurance world in Texas.

Again, if your income is within a certain range, you can qualify for big subsidies towards the two plans above.

Don't sleep on this. We see bronze plans come down to zero!

Here's the income chart:

We'll talk about what income and more below.

Next up...short term.

Short term health plans for major medical

Some people don't qualify for a subsidy and they really want stripped down plans like we used to have before 2014.

The closest equivalent to that today is with short term.

United health has a solid short term health plan in Texas so we're lucky in that respect.

The pro's and cons...

Pro's:

- Cost can be lower than bronze if we don't qualify for a subsidy

- Can get up to 360 days of coverage (there's a 5 day gap there)

- Lots of options on what to cover and by how much

- Good network with United Healthcare (solid carrier)

- Can enroll throughout the year

Con's:

- Watch out for the higher numbers as they sound good till something happens

- Doesn't cover the full range of benefits that bronze plans cover

- RX can be a discount card which can expose you to costs if that is needed

- Can't get full year of coverage

- Waiting period for pre-x and can decline based on health

Really, this comes down to cost. If you're not getting a subsidy (check with us), the short term may be cheaper especially if you water down the benefits.

This is tricky. Sure, you can pick a deductible/max over $20K and a really low premium but what IF something big happens.

Do you have $20K laying around? The average person has a big medical issue every 7 years.

Compare the premium difference between this approach and back-end exposure if you have something big.

There's also a hospital only plan which is the lowest priced option. This is okay since many of the big bills are in a facility but it's the aftermath can be an issue.

All the follow up and RX from a serious hospital issue can be 10's of $1000s. Just a note.

If we've missed open enrollment for the bronze plan and we don't have a special enrollment period trigger (see when can I enroll in Texas coverage), short term may be the only option we have.

At least till next open enrollment or a big life change.

We can enroll in short term any time of the year and get coverage day after enrollment if approved.

Finally, the last option.

The health sharing world

These have lost some of their luster over the past 5+ years.

They are not health insurance but act like membership plans. Similar to the short term plans above in basic design but they're not mandated to pay bills!

Even though they advertise pretty good networks (multiplan), the problem is that hospitals are starting to turn down access when they see the cards now.

Since the health sharing plans don't have to pay, there have been too many issues with hospitals and they're responding accordingly.

Look...you don't want a $30K bill sitting out there and you're fighting with a health sharing company and the hospital is coming after you.

Defeats the purpose of all the money you paid the health sharing company.

The best one we came across is OneShare but short term with United Health is such a better option if we really can't get the bronze plan with subsidy.

Our 2 cents after dealing with all three for over two decades. Hate to see people end up in bad situations trying to save a few bucks.

All of this comes down to cost. Let's go there.

How to quote and enroll in major medical

First, let's see if you can get a subsidy:

- Best estimate for this year's income (AGI on the 1040 tax form; next April's filing)

- Household is everyone on that 1040 tax form even if not enrolling

We spend most of our days helping people figure out this income piece because it gets complicated quickly for Texans.

Self-employed. Changes in income. Changes in household (marriages, divorces, etc).

There's zero cost for our assistance at help@texasplans.com or 800-320-6269.

Let us make sure you're not leaving money on the table.

You can run the quote yourself for free here:

Again, don't do this alone. Let's find every dollar available.

For short term, you can quote those here:

If we're outside of open enrollment, we may have to get short term till a trigger pops up we can take advantage of.

We can also go through that with you.

You can also quote OneShare health sharing here but the short term is a better fit dollar-for-dollar. The health sharing plans aren't terribly cheap anymore.

Compared to United's short term.

You can enroll for each right through the quote tools above!

We're happy to help with any questions. Just make sure you're not exposed to all the nasty stuff we keep seeing out there since Covid. Just out-of-the-blue stuff as we learned the hard way.

Be well. Be safe. Be protected.