Texas Obamacare (Exchange) Plan Levels Explained

Bronze. Silver. Gold. Platinum.

All this metallic nonsense but what does it really mean for you and your family?

We're going to tell you our secrets from enrolling 1000's of people in Obamacare plans over 10 years now.

Here's our credentials:

These are the topics we'll cover:

- Before diving into the metallic plans, some housekeeping

- A basic overview of the Texas exchange plan levels

- The silver 87 and 94 slam dunks

- Why the out-of-pocket max matters

- Why the bronze level should be considered

- Our strategy for picking a Texas exchange plan

- How to quote and enroll in Texas exchange metallic levels

Let's get started!

Before diving into the metallic plans, some housekeeping

The real secret behind the Texas exchange revolves around subsidies.

This is free money towards your choice of health plan. Any plan except for the catastrophic option (for under 30's).

Completely based on income for this year and we look at how to get the most out of the Texas health subsidy.

Then, there's carrier and network. The doctors you can see. The quote below will have a link by each plan for doctor networks to check this.

Just a head's up...BCBS still dominates the Texas exchange with Oscar, United, and Ambetter as a distant competitors. Lots of small carriers follow up.

We just want to say before jumping into the plans...the Texas exchange subsidy is JOB #1. We can help you lock in the income piece at help@texasplans.com or pick a time to chat if more complicated here.

We also look at how to pick the best Texas health exchange plan.

Alright...time to roll up the sleeves.

A basic overview of the Texas exchange plan levels

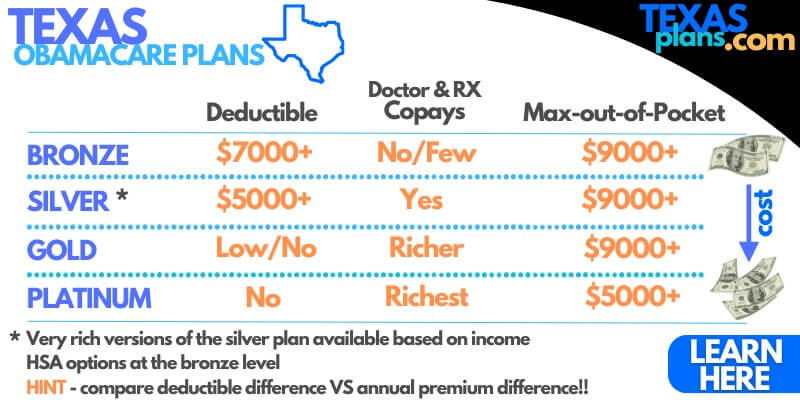

You have 4 basic plan levels for Obamacare:

- Bronze - high deductible plans

- Silver - deductibles come down a little and copays start for office visits and RX

- Gold - Lower deductibles with richer copays

- Platinum - low or no deductible with richest copays

Some important points:

- Subsidy applies to any plan but is based on the silver plan cost

- The silver is by far the most popular choice (we'll explain why below)

- Preventative is covered at 100% on all plans, in-network

- Each plan has to meet cost benchmarks +/- 2%

The last one is important!

It means that a gold plan has to walk and talk the same as other gold plans even from a different carrier.

+/- 2%

This makes it much easier to compare the levels. It then becomes a question between levels rather within levels.

Meaning...is the bronze or silver a better fit for me rather than is a silver between carriers a better fit.

You'll notice a number after the levels:

- Bronze 60

- Silver 70

- Gold 80

- Platinum 90

This basically states that the bronze is expected to pay 60% of the average person's expected health care cost in a given year. It's just a benchmark (that the 2% is based on).

Each plan level is getting 10% richer essentially.

That being said, many people are going with the Texas exchange silver plan and here's why.

The silver 87 and 94 slam dunks

There are actually 4 different "flavors" of the silver plan:

- Silver 70

- Silver 73

- Silver 87

- Silver 94

The Silver 70 is the standard option. Mid level deductible with copays for RX and office visits starting before the main deductible (amount you pay before getting help) on most plans.

The others are what's offered based on income. When you run your quote below, the system will automatically show you what version your eligible for based on the income entered.

Email us your income estimate (this year) and size of household and we'll let you know if you're close to the threshold at help@texasplans.com

The 73 is 3% richer. It's okay but not that big of a deal.

The silver 87 is almost a platinum level plan and the Silver 94 is the richest plan on the market!

All for the price of the standard silver!

If you're offered the silver 87 or 94, it's really tough to turn down and there's no reason to go richer (Gold or Platinum).

Some people are eligible for this plan actually want the lowest priced plan so they go with the bronze.

Pretty simple health issues during the year can easily pay for the difference of getting the silver 87 or 94 though. Just a head's up.

Happy to walk through this comparison.

One other curious note on the Texas exchange plan levels.

Why the out-of-pocket max matters

People are so fixated on copays, etc that they skip over the most important part of the plans.

The out-of-pocket max. If we get really big bills in a year (unfortunately, we see it almost daily these days), what is our exposure in-network?

You'll notice that the max is pretty comparable for the bronze, silver, and gold plans!

Pretty high at around $9K on average.

That means that even the much more expensive Gold plan will treat the big bill the same way.

Sure, it might have a low/no deductible but for big bills, you're still on the same hook.

The platinum plan brings that max down but the cost can really offset this.

Just put a check by that one for our discussion on strategy below.

What about the other side of the spectrum. So-called catastrophic coverage.

Why the bronze level should be considered

This especially holds true for older people (40's - 64).

The plans are all guaranteed issue meaning...they can't decline you based on health and there's no waiting period for pre-x.

So...as a result of about 10 years of this...

The premium difference over a year's time basically offsets the benefit difference!

Early after 2014, we had people call up and say during Open Enrollment:

"I'm going to get a hip replacement, I want the Platinum plan".

They would game the system and we totally get that. We help people figure out what will reduce their costs all day long.

With a few years of this though, the difference in cost between say the Platinum and Gold plan basically matched the benefit difference.

For that reason, it's not a bad choice to look at the Bronze plan if you're in relatively good health and older.

We can help you with the comparison at help@texasplans.com or pick a time to chat here.

There are also HSA qualified plans at the Bronze level where we can pay out-of-pocket expenses with pre-tax money.

And yes, any subsidy you're eligible for will apply to the bronze plan as well.

Let's take all this and give you our strategy to apply now.

Our strategy for picking a Texas exchange plan

If you're eligible for the silver 87 or 94, stop right there. Pick a carrier and network based on doctors. You can quote and enroll right below!

Otherwise, do you have a lot of expected office visits and RX?

The Silver and above starts to offer copays before deductible for these benefits.

From there, you can compare the annual cost difference from moving up the scale (say from silver to gold) to the deductible and copay difference.

Meaning...if it costs us $200/month ($2500 year) to go from silver to gold and our deductible drops from $6K to $1500, that's not a bad trade-off IF we expect more healthcare costs (over the $1500 Gold deductible).

Again, we can do all this for you for zero cost at help@texasplans.com or 800-320-6269.

Same goes for Gold to Platinum. Otherwise, Bronze or Silver makes up the majority of plan selections!

Make sure to dial in the income piece and check with up to see if you're close to a cutt-off for the silver 87 or 94 since they're so rich.

We see people all the time who put income a few $100 over the cap and miss out on almost platinum level benefits for the same price!!

Literally every day! It's an estimate for the full year and people's income (especially self-employed) bounces around. It's the estimate for AGI on the 1040 tax form NEXT APRIL.

Once we dial in an Exchange metallic level, we then turn to carrier and doctor network.

That...is our secret sauce and we just addressed 80% of the decision making. Check in with us for the other 20% of your particular situation.

Speaking of which.

How to quote and enroll in Texas exchange metallic levels

We believe in giving you this free, fast, and securely here:

A few notes to get the best quote.

- Make sure to enter your income estimate (AGI on the 1040; next April's filing)

- Enter size of household (everyone that files together on a 1040 tax form)

You can play with the income up top when the quote comes up.

Filter plan options on the left and even specific carriers.

Below a certain level, the system won't show subsidies if you're eligible for medicaid. Reach out to us in this situation to make sure we're entering the information correctly.

BCBS still dominates the Texas Exchange market these day but some regional players are attractive.

Finally, don't go it alone. Reach out to us. You saw the reviews above. We really do work to help people find the best options with no pushing.

Enrollment is super easy.

We have a simplified Texas health exchange application.

It will take 5-10 minutes versus the standard federal Exchange app of 45+ minutes (very easy to make errors).

We process it through the exchange after scrubbing it for any errors or entries that might cause issues.

We can also catch if you're close to the enhanced silver 87/94 income levels or might be missing out on some other benefit.

There's ZERO cost for our assistance!

How can we help. 800-320-6269. help@texasplans.com Pick a time to chat here.