Texas Short Term Health Insurance Explained

Coming from a State that banned short term coverage, we definitely know it's value and place.

Almost daily, someone calls with a need for temporary coverage and there's not much we can do in other States!

Fortunately, Texas decided to be pragmatic and let people pick coverage according to their needs.

Short term has a definite role to play in the Texas individual and family market side by side with Exchange plans (Obamacare).

We'll explain when you should definitely look at the other option if available.

First, our credentials:

We'll cover these topics:

- A quick intro the Texas short term health coverage

- Who does short term health work best for

- Short term versus Obamacare

- United health's short term plan benefits

- How to compare United's short term plans

- Quoting and enrollment for short term

Let's get started!

A quick intro the Texas short term health coverage

After 2014, everything changed and short term almost didn't make the cut.

In Texas, United health dominates the short term market and they do it really well.

Short term plans do not have to meet the full ACA (Affordable Care Act) requirement list for health plans and there are noticeable differences we'll get into below.

The big draws for short term are:

- Can start midnight following enrollment if approved

- Can go month to month up to 3 years

- Reduced benefit structure so less expensive if NOT eligible for a subsidy through exchange (see how to get most subsidy) based on income

- Different plan designs from more catastrophic (hospital) to richer options with copays

- Broad choice of deductible (amount you pay before plan kicks in)

So...what gives? Why would people pick a short term health plan in the age of Obamacare?

Let's go there in practical terms.

Who does short term health work best for

This is usually a question of who doesn't want to enroll in the Exchange or CAN'T enroll!

Short term usually works for the following:

- Missed open enrollment and doesn't have a special enrollment trigger (move, loss of coverage, etc).

- Not eligible for a subsidy and can't afford full Obamacare plans

- Doesn't want to pay for the full plans on the Exchange

- Just need coverage for a few months (say, till new employer plan starts up)

In a nutshell, that's it!

We usually see a mix of people who are not able to enroll in the Exchange (check with us since there are special triggers we can look at for you around income).

Or people who want a cheaper option. The tax penalty is gone now at the federal level but going without any type of protection these days is a sucker's bet.

Especially since COVID, we're seeing $250K bills for heart and cancer left and right unfortunately. Younger and younger as well.

If you go to a hospital, the first question they ask you is "What insurance do you have?"

You can quote the different short term options here:

So...what are the big differences between short term and Obamacare in Texas?

Short term versus Obamacare

First and foremost, the subsidy!

With Obamacare, if your income is within a certain range (see Texas exchange income chart), you can get really big subsidies that reduce your cost of our care and maybe even richer versions of the silver (see Texas enhanced silver plans).

This can be tricky for people to calculate so reach out to us at help@texasplans.com or 800-320-6269.

There's zero cost for our assistance and if you're eligible for a subsidy, the Exchange plans are going to make the most sense.

IF we can enroll right now.

That's the other big difference. Texas Obamacare has enrollment periods around:

- Open Enrollment: Nov 1st - Jan 15th

- Special Enrollment: loss of coverage, moves, family make up changes, subsidy eligibility at certain levels, etc

Big life changes. Reach out to us to make sure we look at all options.

In this case, we may have to get short term until we get to open enrollment, new employer coverage, or some other trigger. It's a great option to fill gaps!

Outside of these gap coverage needs, short term is used by people who can't afford or don't want to afford Obamacare with all its requirements.

This assumes they don't qualify for a subsidy!

Obamacare has many requirements that are positive but they carry a price-tag:

- Can't be declined based on health

- No waiting period for pre-existing conditions

- No lifetime max

- Must cover mental health, pregnancy, and a required set of benefits

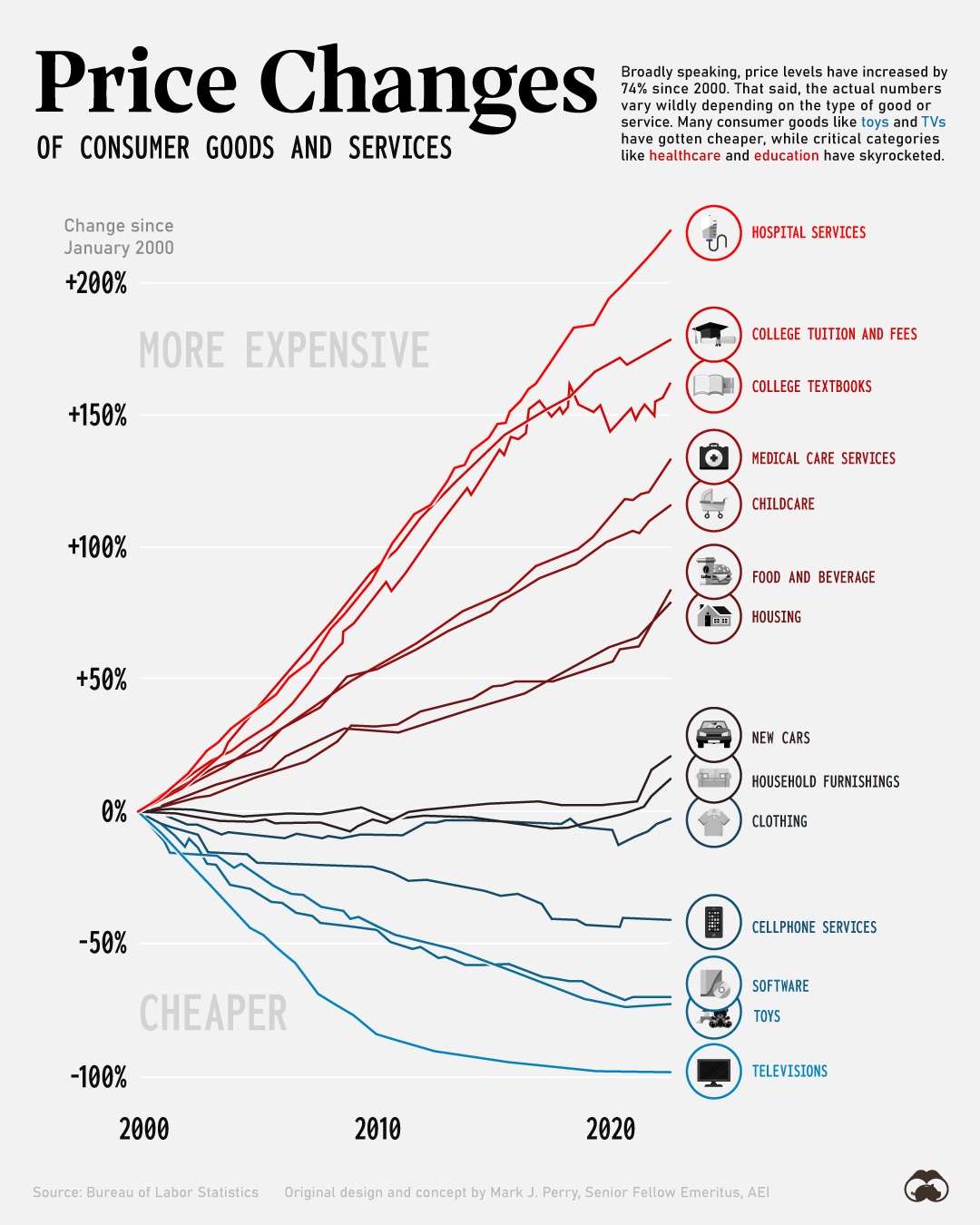

Costs roughly tripled from 2014 due to these requirements and some people are priced-out of the market (again, no subsidy).

Short term can be an option here and it's definitely better than No coverage at all! The goal with insurance should be to protect from catastrophic expenses that can wipe you out.

Don't be on the hook to a hospital for a decade!

Short term can do nicely here. So, who's the big player in the Texas short term health market?

United health's short term plan benefits

United health is one of the top 3 carriers in the country size-wise. They went full bore into short term coverage including in Texas.

We're fortunate we have a legit carrier as we've seen many one-off short term carriers come into a market in the past and then blow up.

That's not going to happen with United!

One note...short term in Texas is listed under the Golden Rule brand but it's United as the underlying carrier.

United has four different short term options in the Texas market with increasing benefits:

- Hospital and Surgical - catastrophic care for facility based needs

- Tri-Term Value - adds in other benefits (office, etc) after deductible is met; RX card

- Copay Select Max - adds in copays for office and RX; coinsurance up to max after deductible

- Plan 80 Max - you pay up to deductible then plan takes over for covered benefits

You can quote all these options here:

Reach out to us with any questions at help@texasplans.com or 800-320-6269.

So...how do we actually compare these options?

How to compare United's short term plans

First, let's introduce the key pieces we're layering on as we up the scale in coverage.

The deductible is biggest driver of cost within each plan.

You can pick from $2500 to $15000 for most plans.

This means you'll pay this amount before the plan starts to help.

After the deductible is met, you then start paying a coinsurance. This is a percentage you pay till you hit a separate out-of-pocket max.

So for example, we have a $2500 deductible Tri-Term plan which has a $10,000 max.

- We get a $30K bill (very easy these days...an ACL knee repair for example).

- You pay the first $2500 (deductible)

- Then pay 30% (you picked the 70/30 coinsurance option) till you pay another $10K.

- Your out of pocket for the $30K bill would be $10,750: $2500 + $8250 (30% of $27,500)

Okay, so now you know the backend exposure, you can choose accordingly. Don't just go for the cheapest plan and have $20-30K exposure for bigger bills. Can you really afford that?

The CoPay Select Max has a $4500 max instead of Tri-Term's $10K. That's a huge deal that most people don't think about.

The back end (out-of-pocket max) is why we're really buying insurance to begin with!

So...run your quote below and look at the annual premium difference versus this exposure for really big bills.

You can usually see a sweet spot between what you want to pay (either in premium or if bad things happen).

Usually, people aim for Hospital/Surgical (want lowest cost catastrophic plan) or Tri-Term/Copay Select max if they're filling a gap.

Reach out to us. This stuff is complicated and we do it all day long. There's zero cost for our assistance.

So...how about those rates?

Quoting and enrollment for short term

You can run your Texas short term health quote here:

A few notes:

We can pick midnight following enrollment (and approval) as our effective date.

You can even use this till your Obamacare or employer plan starts up (say for a 30 day period).

The plans are not allowed to go a full calendar year so there's a little dance we have do at Open Enrollment each year to make sure you have a backstop. Reach out to us if you're looking at this longer term (more than 360 days).

A few other key notes:

- No benefits will be paid during the first 12 months for a preexisting condition.

- Preventive care has a 6-month waiting period.

- You have to stay in United's network for benefits outside of true emergencies

- You can always cancel month to month!

Pick a time to chat here Email us at help@texasplans.com or call 800-320-6269.