Blue Cross Blue Shield of Texas versus Oscar on-Exchange

Lately, this has been the title fight in the Texas Exchange marketplace (Obamacare).

Sure, there are some small regional players vying for position but it's still a BCBS world for individuals and families.

Let's compare the two for people who are making a similar decision. The secret sauce may just be the doctor networks!

First, our credentials:

This is what we'll cover:

- Quick intro when comparing BCBS Texas and Oscar

- The network difference between BCBS and Oscar

- Comparing pricing between BCBS TX and Oscar

- Does plan design matter with BCBS Texas and Oscar

- How to quote and enroll in either BCBS or Oscar

Let's get started!

Quick intro when comparing BCBS Texas and Oscar

First, some ground rules.

The subsidy (subsidy) will apply to either BCBS or Oscar at the same level. This is dependent on your income estimate for this year and size of household.

Check out our guide on how to get the most Texas exchange subsidy.

Secondly, the benefits are somewhat standardized.

They have to meet a benchmark of expected cost to you +/- 2%.

This means that a Gold plan with BCBS will be very comparable to a gold plan with Oscar.

That's true for all the metallic levels:

- Bronze

- Silver

- Gold

- Platinum

If you're eligible for the enhanced silver plans (73, 87, or 94), they will apply equally to either BCBS or Oscar.

BCBS is the dominant on-Exchange carrier in Texas with about half the market! Oscar is the runner-up and that may change over time.

Scott & White is aggressively growing and United Healthcare is a nationwide powerhouse so don't count them out.

So...what exactly are we comparing with BCBS and Oscar?

Network and pricing!

Let's go there now.

The network difference between BCBS and Oscar

This is really where the rubber meets the road in Texas.

What doctors/hospitals can you see and how care is managed.

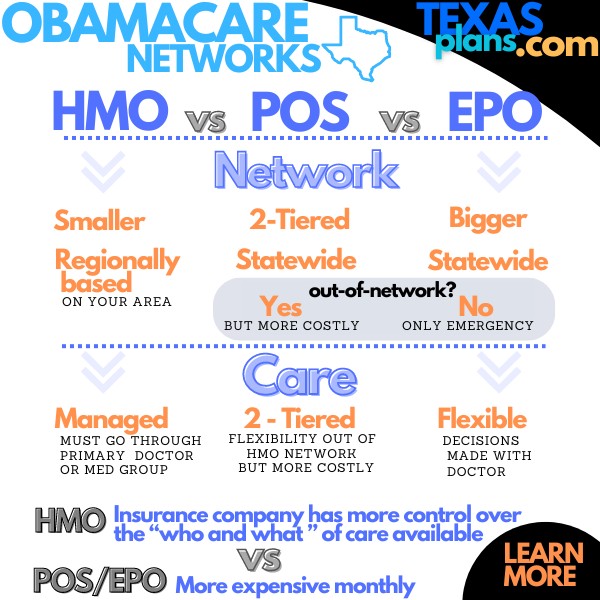

BCBS has gone with HMO and POS networks for their plans.

The HMO means you have to stay in the medical group which is within a certain area from your residence.

There are no benefits outside the network other than a true emergency.

Care is more "Managed" which means the carrier has more say-so on what care, how fast you can get it, etc.

Most of the Exchange market is HMO these days and we expect that to continue.

The POS is a hybrid.

It has richer benefits in the HMO network but allows you to refer yourself out of the network to specialists but with less rich benefits.

You're going to pay for this flexibility as we'll see in the pricing section next though.

Oscar's choice of network is a big reason it's the #2 contender!

They went with an EPO which works like a PPO when in-network. You refer yourself out and have more control over the course of care with your in-network doctor.

There's no benefit out-of-network other than a true emergency.

The big difference between HMO and EPO is how managed the care is.

Meaning...HMO's are more likely to require pre-authorizations or direct the course of care.

Referrals are generally required from your Primary Care Doctor for specialists versus an EPO where you just make an appointment with an in-network specialist.

You're also not locked into a medical group or primary care doctor with an EPO.

We've been on both EPOs and PPOs and they're pretty comparable since PPOs don't pay that well out of network anymore anyway!

Ask your doctor "what Texas Exchange plans do you participate with?".

There can be some pushback from doctors these days. Keep in mind that the networks are identical for off-exchange so don't let the doctor offices tell you differently.

With enrollment on-exchange jumping double-digits each year lately, the resistant doctors will have to come on board as the market moves ahead of them.

There's also a "find doctor" online search link next to each plan when you run your quote here:

Network is a big deciding factor and is really the ace in the sleeve for Oscar.

So...how much do we pay for these differences??

Comparing pricing between BCBS TX and Oscar

First, the POS plans with BCBS can run $300/month more than their HMO's. Per person!

That's hefty.

If we can get a comparable EPO with Oscar and network flexibility is important to us, it's probably priced better that way.

Each area is different so make sure to run your quotes with the subsidy included.

Generally speaking:

- BCBS Texas HMOs will be lowest priced

- Oscar's EPO will be priced slightly higher

- BCBS Texas POS plans will priced the highest

You can see how important the network style is to pricing!

Each year, it resets at Open Enrollment so we have to re-evaluate for our clients to see who best priced for the right fit but expect the network differences (unless they change) to still drive pricing.

There's zero cost for our assistance and we're happy to compare the two carriers for you.

Remember, the plan levels have to match a benchmark +/- 2%!

What about plan design?

Does plan design matter with BCBS Texas and Oscar

Each carrier can have a dozen+ different plans across the various levels.

There may even be 5+ at the most popular level, Silver (more on comparing the metallic plan levels in Texas).

This makes the network and pricing even more important.

Sure, one plan might reduce the deductible but then you'll may more for office copays and/or RX.

You'll notice that the Max out of Pocket is very comparable for Bronze, Silver, and Gold plans which make up the majority of what people actually enroll in.

Of course, if you're eligible for the Silver 87 or 94, you'll see all these plans get quite a bit richer for both BCBS and Oscar!

We cover that in our How to pick the best Texas Exchange plan.

It's hard to turn those down. Check out our income chart or run your quotes to see if you qualify.

We're not going to lie...it can confusing to compare the individual plans.

Here's a quick cheat:

- Deductible: amount you pay before the plan kicks in

- Copays: fixed amounts you pay for office visits or RX; sometimes before deductible silver and up

- Coinsurance: % of costs you share, usually after deductible is met

- Out-of-pocket max: your exposure in a really bad year; Jan - Dec

We're happy to jump on a phone (book time here) or email us at help@texasplans.com

We can size this up pretty quickly for you.

Or, you can quote right away here!

How to quote and enroll in either BCBS or Oscar

We make this fast, free, and easy:

A few notes to get the best quote.

Make sure to enter your income estimate (AGI on the 1040 tax form; Next April's filing) and size of household (everyone that files together on a 1040 tax form even if not enrolling).

You'll see the subsidy up top and you can play with the income to see the effects. Check out our Texas Exchange Subsidy Income Chart for the breaks.

Of course, reach out to us with any questions! There's zero cost for our assistance and you can see by the reviews, we try to really help people.

Don't forget our How to pick the best Texas Exchange plan guide for key tips.