How to Pick the Best Texas Health Plans for Individuals and Families

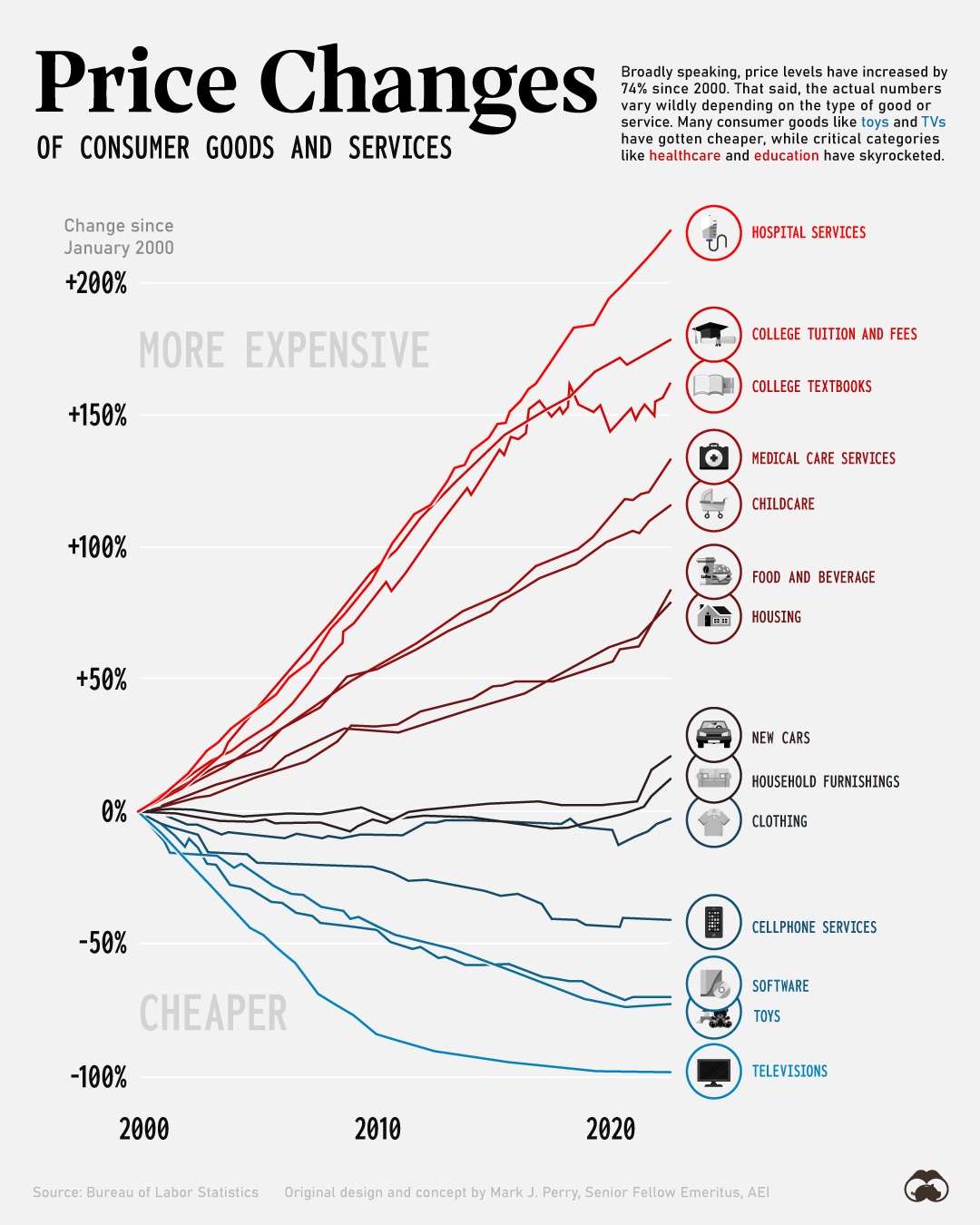

It's become one of our biggest expenses which is surprising in today's world.

The reason for this is that the underlying cost it's protecting us from is going through the roof!

We're seeing medical bills over $250K all the time now with clients unfortunately with an explosion of heart-related issues and cancer since 2021.

Of course this trickles down into the cost of health insurance but there's a huge factor we can take advantage of.

The subsidy!

We'll look at how to get the most out of this as well as a tried and true strategy (over 25+ years) to find the best fit for you.

Here's our credentials:

This is what we'll cover:

- A quick lay of the individual/family health landscape in Texas

- Texas on and off-exchange plans - the First decision

- Comparing the Texas health plan levels

- Understanding the Texas health networks

- Top Texas carriers for individuals and families

- Quoting and Enrolling your family in coverage

Let's get started!

Of course, we're happy to help with any questions at help@texasplans.com or pick a time to chat here.

A quick lay of the individual/family health landscape in Texas

There are three basic segments of the Texas health insurance market:

- Business plans through an employer

- People with Medicare; usually over age 65

- Individuals and Families who purchase their own coverage outside of Medicare

We're focusing on the latter here but we're happy to help with the other two as well!

The IFP (Individual Family Plan) market has changed quite a bit since 2014!

The big changes:

- There are subsidies available depending on current income

- People cannot be declined based on health and there's no waiting period for pre-existing conditions

- There are four basic levels of coverage which are standardized to some extent

- We need to enroll during open enrollment or if we have big life changes

Sure, there's lots of different angles here but those are the broad strokes.

The first decision to make is whether to go on or off exchange. Let's start there!

Texas on and off-exchange plans - the First decision

First, we need to have an open mind here. This is about money out of your pocket. The politics won't pay your monthly premium.

Our goal is whatever works best for our customers. Point.

So...what's the difference between on and off exchange plans?

The big difference is the subsidy:

If our income is within a certain range, we can qualify for subsidies (more on that below) but only if we enroll through the Federal Exchange for Texas plans.

Basically, the Exchange administers the subsidy towards your choice of plan directly with the carrier.

That's it. Your coverage isn't "through" the exchange. It's direct with the carrier and the subsidy reduces your monthly premium.

Our free quoting system will show you the net rate after the subsidy is taken out. More on that below.

Why go off-exchange then?

If we know for sure that we won't qualify for a subsidy based on income, we can get coverage off-exchange.

The plans can be identical with the on-exchange as are networks and benefits! The difference is that we can't get the subsidy.

The only argument is that we avoid the extra steps of dealing with the Exchange so if we definitely won't qualify for a subsidy based on income (run your quote here), then off-exchange is an option.

The only other option outside of these two is Short term health plans. These are not as robust as the standard plans and they have to be renewed to keep active but they can be priced better if we don't get a subsidy.

Again...this is all complicated so reach out to us for free advice at help@texasplans.com or pick a time to chat here.

Our 2 cents:

If we MIGHT qualify for a subsidy by year end based on income, we should enroll on-exchange.

- Same benefits and networks

- Chance of reducing monthly premium significantly

Short term is there for people who DON'T qualify for a subsidy and can't/don't want to pay full premium for off-exchange plans with no subsidy but are okay with more narrow plan.

Okay...so what about those plan levels?

Comparing the Texas health plan levels

Goodness. How many plans do we have to compare?

We'll let you in on a little secret.

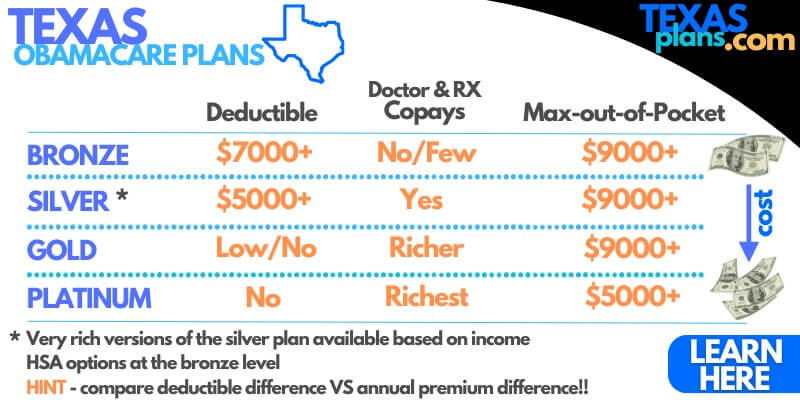

The plans are benchmarked to 4 basic levels:

- Bronze - generally high deductible plans; HSA options are usually here

- Silver - still higher deductible but with copays for RX and office

- Gold - lower deductible with richer copays

- Platinum - low/no deductible with richest benefits and lower out-of-pocket max for some

First, let's define the key attributes:

- Deductible is amount you pay first before the plan kicks in

- Copays are fixed amounts you pay; usually for office consultations and RX

- Out-of-pocket max is the cap on your exposure if you have really big expenses

There can be lots of different options at each level so how do we compare? We have a guide to comparing the Texas Exchange metallic plans.

Here's the secret..

A plan at a given level (silver for example) is benchmarked +/- 2%

This means that silver plans will be pretty comparable. Sure, one might have a lower deductible but then it will make up for it in other places.

Let's look at the benchmark plans:

Just a head's up...the silver plan is by far the most popular and this makes sense since you generally pay for going up the scale to richer plans in your premium.

In fact, compare annual premium difference against premium difference (deductible and max) is a good place to start.

We can do this for you at no cost!! help@texasplans.com or by chat here.

The bigger difference is the networks and of course, the monthly premium.

Premium is easy. Networks...not so much.

Understanding the Texas health networks

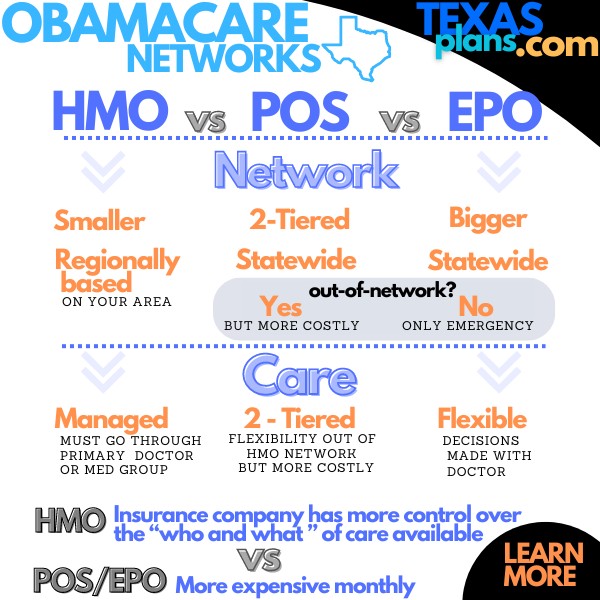

You have three basic flavors of networks and it's a big deal day-to-day:

- HMO

- EPO

- POS

These feel really different.

Here's the rough sketch:

- HMO - richer benefits but less control/flexibility over care and choice of doctors

- EPO - a bigger list of doctors you have access to for discounted rates; more control - works like a PPO but with no benefit out-of-network

- POS - a mix between the two: HMO benefits in network; less-rich benefits out-of-network

People generally have a sense from past experience on their preference.

"I hate HMO's. I love HMO's"

Well...no one LOVES HMO's but some are comfortable with the trade-off they offer.

How do we navigate this?

When you run your quote below, you can actually enter your doctors right into the quote engine!

With HMOs, you're required to stay within a medical group that's based on where you live.

Again...more structured and this works best in more populous areas.

Otherwise, sometimes it's just handy to call your doctor and ask them "What Exchange or obamacare plans do you participate with".

We say Exchange since the networks are identical on or off-exchange and the doctor offices all know the branding "Exchange" or Obamacare.

We don't want to think we mean employer-based plans since those are different networks (bigger, generally).

Again, we're happy to help with this process.

That then brings up carriers.

Top Texas carriers for individuals and families

We're fortunate in Texas to have a good range of carriers to pick from with the biggest ones:

- Blue CrossBlue Cross Blue Shield (dominant player with roughly a quarter of enrollees)

- Aetna CVS (growing quite a bit lately)

- AmBetter

- United

- Oscar

- Cigna

- Scott and White (regional player tied to their network)

- Molina

- Imperial

- Moda

- And more!

This is confusing so we broke out a whole comparison of Texas exchange carriers.

Really, since the benefits are standardized, it's been BCBS, Oscar, Aetna, United, and AmBetter dominating with smaller players growing quickly (but from a smaller base).

The big difference between the carriers is network!

Our recommendation?

Ask your doctor what plan they participate with and then we can narrow from there. Plug your doctors into the quote below is the easiest approach.

If you're flexible on network, compare monthly premium and network at the Silver level (most popular) to establish who's strong in your area.

We can go up or down from there depending on budget and health care needs.

Again, reach out to us. We'll analyze all this for you!

How do we get started?

Quoting and Enrolling your family in coverage

We make this free, fast, and easy:

Make sure to enter your income and household makeup. Learn more about getting the most subsidy.

- Income is best estimate for this year's AGI on the 1040 tax form; next April's filing

- Household is everyone that files on that 1040 even if not enrolling

The number of Texans qualifying for subsidies is exploding (not sure if this is good or bad but we'll take it).

It's found money and a big reason to enroll on-exchange.

Generally, we can enroll during Open Enrollment end of each year or if we have big life changes:

- Move (significant enough to change plan options)

- Birth, Death, Marriage, Divorce

- Change in eligibility status (legal status, etc)

Those are the big ones but there are smaller, less-known ones we can help with.

The online app is available for Exchange and off-exchange directly through the quoting engine.

For Short Term plans, you can quote/enroll right here.

Let us know how we can help. The above info hits 80% of the decision-making but that leaves 20% to mess things up :)

There's no cost for our assistance and we aim to please (see reviews).