Compare Silver Plans on Texas Health Exchange - Obamacare

There's a good reason that the silver level is by far the most popular option on the Texas health exchange or Obamacare.

Not only does it generally make the most sense across the four levels but depending on income, you can get MUCH richer versions of it for the same price.

This really is the secret behind the silver plan and we'll go through the income levels specifically below.

If you're eligible for the silver 87 or 94, there's no reason to go higher!

First, our credentials:

Okay, this is what we'll cover:

- How the silver plans differ from the other Texas exchange levels

- The enhanced silver 73, 87, and 94 plans

- The income levels for each silver level

- Understanding the silver benchmark

- How to quote silver 87 and 94 plans in Texas

Let's get started!

How the silver plans differ from the other Texas exchange levels

First, a lay of the land will really help. We go deeper into understanding the Texas exchange metallic levels but a quick primer.

There are four basic levels for Texas Obamacare (Exchange):

- Bronze: high deductible; most services are subject to this amount you have to pay first

- Silver: mid-level deductible and copays may be available right away for office visits and RX

- Gold: low deductible, richer copays

- Platinum: low/no deductible, richest copays, might have lower out-of-pocket max

Just a refresher:

- Deductible is an amount each year that you have to pay first before the plan will kick in

- Copays are fixed amounts you pay per service; i.e. $10 for a generic monthly RX

- Out-of-pocket max: really important! When does it go 100% to the carrier for rest of year in-network (covered benefits)

Okay...we the basic out of the way. What about the silver.

First, there's the standard silver plan (called silver 70). If you're offered this when running your quote, it means your income is higher than the range for enhanced silver plans (more on that below).

You may still get the subsidy though! Check out how to get the most subsidy on the Texas exchange.

So, let's break down the Silver plan based on the components above.

Silver 70:

- Deductible: range from $3000-$6000 per year

- Doctor visit Copays: average $30-40 for doctor visit (specialists will be higher)

- RX Copays: $5-10 for generic, brand may be after main deductible above!

- Out-of-Pocket Max: $9000+ across the board

A few notes.

The plans are standardized around a given benchmark.

This means that a silver plan has to walk and talk about the same +/- 2% from any other silver plan on the market!

Even across different carriers. That's the "70" in silver 70. It means the plan should pick up about 70% of the healthcare cost for the average person.

This is where it gets exciting at the silver level. Beside the subsidy which can bring down your monthly premium amount (by a lot!), you can also get richer benefits and that only happens at the silver level!

Let's go there now.

The enhanced silver 73, 87, and 94 plans

Based on income, you may get what's called "cost sharing". You'll see it at the top of your quote you can run here "cost share reduction".

If you qualify, you'll see 73%, 87%, or 94%.

Just a head's up...the Gold plan is 80!

So the silver 73 isn't that big of a deal (3% richer than the standard silver) but we'll take it. It's free money in the form of richer benefits.

The 87 and 94 though are a completely different deal and if you qualify for them, they're a slam dunk!

- The Silver 87 is almost a platinum level plan for the same price (after subsidy) as the silver 70!

- The Silver 94 is actually the richest plan on the market! 4% richer than the silver plan.

Net net...

If you're offered the silver 87 or 94, there's no reason go anywhere else!

We discussed this in how to pick the best Texas Exchange Obamacare plan.

Some people just want the lowest priced plan (catastrophic) on the market so they'll get the bronze plan even if qualified for the silver 87 or 94.

The issue is that even simple medical care needs will quickly pay for themselves on the silver 87 or 94 versus the bronze.

One ER visit and you just payed much more with the bronze!

We're happy to walk through your options at help@texasplans.com or pick a time to chat here.

You may just be on the cusp of the silver 87 or 94 and not know it in terms of income.

We help people with this all the time since roughly 50% of self-enrollees (in the Texas exchange) make mistakes on the income that can cause to lose subsidy AND richer silver benefits.

There's zero cost for our assistance!

Speaking of income.

The income levels for each silver level

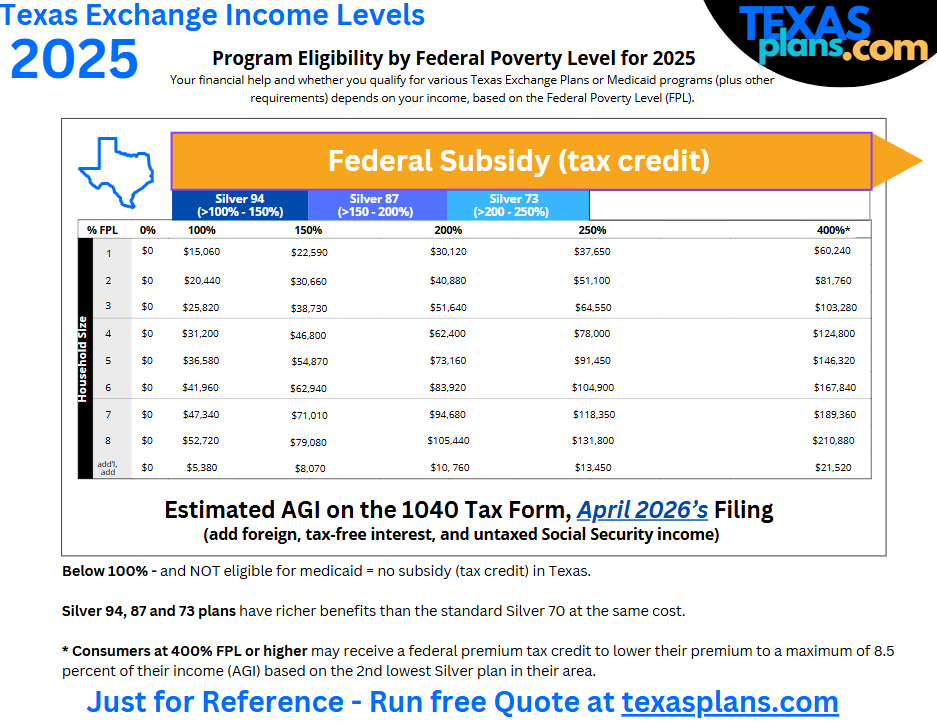

To make things easier (it's what we do!!), we created this chart for you:

You can see the price break by size of household (everyone that files together on a 1040 tax form whether enrolling or now) for each level of the silver.

We made it prominent on the chart since it's the second most important piece of Texas Obamacare after the subsidy!

Income is tricky. This eats up about 50% of what we spend our time on with people since it's so important to get right.

Picking health insurance is almost a tax thing now because of it. More on how to get the most out of the Texas Obamacare subsidy but lean on us for this.

People'e income and households can get complicated quickly and after enrolling 10's of thousands of on-Exchange plans, we've seen it all over 10+ years.

Let's now make this easy to see what you qualify for.

How to quote silver 87 and 94 plans in Texas

We make this completely free and easy for you here:

A few notes.

- Household size is everyone that files together on a 1040 tax form; Next April's return

- Income is generally the AGI on the 1040 tax form; reach out to us with any situation that's complicated (isn't it all??)

At the top, you'll see what version of silver you're offered.

If there's no cost sharing, it will just show "0%". That's the standard silver 70.

One note...below 100% on the chart above, you're technically eligible for Medicaid IF you meet the other qualifications (generally pregnant or disabled).

If you don't meet the other qualifications, you'll get NOTHING. No subsidy and no enhanced silver benefits.

Work with us if you're in this situation to make sure we're looking at income correctly which is a very confusing matter on its own.

There's zero cost for our assistance and you see by the reviews above that we really do try to help people find the best options on the Texas health exchange!