Your Texas Health Exchange Subsidy Income Guide

This is the main show these days.

Income and the subsidy (tax credit) that can reduce Texas health insurance significantly for individuals and families.

Sometimes, down to zero!

Here's the issue...

Roughly 50% of the people that self-enroll have errors around the income calculation and it can cost them big!

We've enrolled 10's of 1000's of people in ACA or Obamacare plans over 10 years now.

Seen it all!

- People with highly variable income (self employed)

- Changing jobs. Gaining jobs. Losing jobs.

- Self-employed and people living off interest/investments

- Changing households (a big one) with marriages, births, and divorces

- People getting pulled into medicaid range and not getting any tax credit!

That's just a smidgen of what we've come across.

Here's our credentials:

Here's what we'll cover so you get the most subsidy available:

- The Texas exchange income chart

- A quick lay of the Texas exchange income chart

- What period of income

- What is "household"

- W2 versus self-employed income

- What if my income is changing

- The medicaid trap

- What happens if my income estimate is wrong?

- Quote Texas exchange plans with subsidy

- Get free assistance on the Texas exchange income calculation

Let's get started!

The Texas exchange income chart

We're proud of this. It takes all the key numbers and presents them in one place. We're using a hard copy of this many times a day when we are on the phone with people or emailing them regarding options.

Don't worry, we'll explain everything below.

A quick lay of the Texas exchange income chart

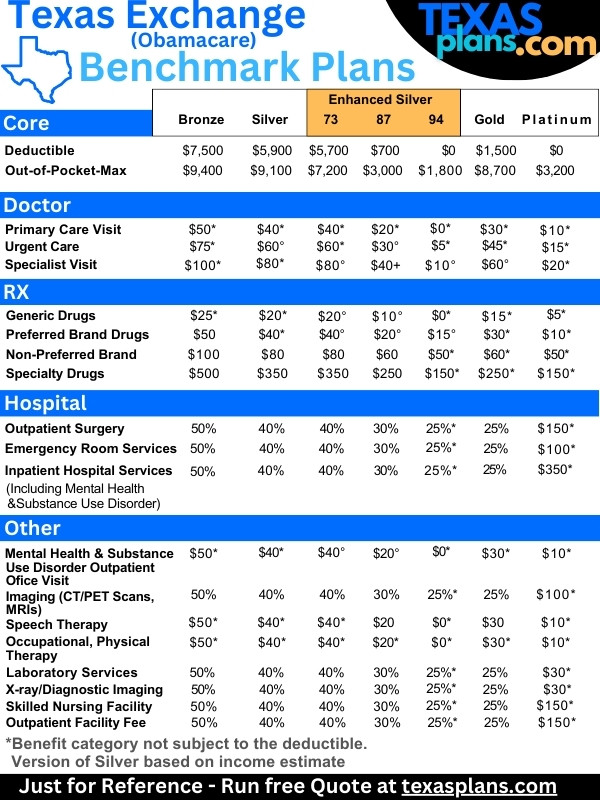

First, there are two three things driven by income:

- The subsidy which reduces your actual monthly health insurance premium

- The version of silver you're offered (70, 73, 87, 94)

- Eligibility for medicaid IF you meet other requirements

The subsidy is the big show these days. It can be 1000's of dollar per month!

The big yellow bar up top shows that it starts at 100% of the federal poverty level in Texas.

It continues up from there and there is no longer a hard cutoff at 400%.

As your income goes higher, the law basically says the subsidy should cap your share of health insurance at a certain % of the second cheapest silver plan in your area.

Age and area can really affect this! The subsidy goes up as we get older because the underlying cost of health insurance goes up.

The best approach is to run your quote here and see how it all plays out:

Then there's the enhanced Silver plans!

If your income is within certain ranges, we can qualify for very rich versions of the silver plans:

- Silver 70 - the standard silver option; mid-level deductible, copays for office and RX; high max

- Silver 73 - slightly better (3%) than the silver 70; not that big of a deal

- Silver 87 - almost a platinum level plan; lower deductible; richer copays; better max

- Silver 94 - richest plan on the market! low/no deductible; richest copays; lowest max

So for example, if we're a single person making $25K, we're eligible for the silver 87. This is almost a platinum level plan (90) for the same price of the normal silver.

Net net...if you're eligible for the silver 87 or 94, there's no reason to go higher!

We covered this in our how to pick the best Texas exchange plan or our Texas metallic plans explained.

What happens below 100%?

This is a strange quirk of Texas. Nothing.

You're not officially eligible for a tax credit since you're technically eligible for medicaid (the Federal law) but Texas has other requirements for medicaid.

If you don't meet those (pregnant, disabled, etc), then you get nothing! This seems very unfair to us since it's hitting the very people who should be helped by the subsidy. More on this below.

Reach out to us at help@texasplans.com or pick a time to chat here if you're in this situation.

What period of income

This always trips people up.

We're trying to estimate our AGI on the 1040 tax form for this year, meaning next April's tax filing.

Last year's income is last year. It has no bearing on what we're doing now with Texas health exchange income unless our income is pretty much the same.

It's best to estimate for the full year if you have highly variable income (seasonal, etc) or you might get pulled into the medicaid no subsidy bucket.

We can help with this. Just reach out to help@texasplans.com. There's zero cost for our assistance!

Okay...whose income?

What is "household"

This is everyone that files together on a 1040 tax form for this year (next April's filing) even if NOT enrolling.

That's it! Easy.

If there are changes in this makeup, we want to estimate what our household will look like Dec 31st of this year since that will be what shows on that 1040.

This comes into play with marriages, divorces, births, etc.

Reach out with any questions! 800-320-6269.

Let's look at the two big categories.

W2 versus self-employed income

W2 is pretty straightforward. It's your gross W2 income. Total income. That feeds directly into the 1040 tax form (and you do have to file to get a subsidy).

For self-employed, it's your net business income generally.

This means gross self-employment income MINUS business expenses.

Health insurance and 1/2 of the self-employment tax also come off of this.

Again, all this feeds into that AGI line on the 1040. Check it out from prior years! More on self-employed income and Texas health subsidies.

The self-employed generally need help walking through their situation so reach out to us.

What if my income is changing

This is tricky but we can update your income in the system for you if we enroll the application.

The system is tricky and if this isn't handled correctly, you may find yourself getting too little or too much subsidy.

Worst yet is when we get the calls that a change caused them to dump into medicaid and their coverage is cancelled!

Ideally, we re-estimate our ANNUAL income estimate and enter it correctly. When you submit a Texas health application through us, we scrub it to make sure this is done correctly.

We can then update and change it as needed. Just shoot us an email on your new estimate and we'll handle the rest.

No cost for our assistance and this can really save you a boatload of hassle.

Speaking of hassle.

The medicaid trap

Medicaid can be great for people under the 100% level but it's also very impacted right now.

Your doctors may not work with medicaid and you may not even qualify with the other requirements.

The health insurance premium WITHOUT a subsidy can be ridiculously high now especially for someone making around the 100% mark on the chart above.

Reach out to us if you find yourself in this range. We can make sure you're looking at the income and household piece correctly. It's a big deal and very confusing.

This brings up a good point...what happens if I expected $20K income and ended up at $15K?

What happens if my income estimate is wrong?

It all settles out at tax time the following year.

- If we under-estimated our income (made more than expected when we file taxes the following year), we'll have to pay back the tax credit we were not eligible for.

- If we over-estimated our income, we'll recoup the tax credit we were not able for.

What if we estimated $20K, got a very rich tax credit but then had big deductions or a gig that didn't go through and only make $15K (under the 100% level)?

Technically, there's a penalty in the original law but they haven't applied it since 2014 and we don't see that changing.

Why? It would hit the very people the law was intended to help and they realized after the fact how hard it is for people to estimate out a full year's income.

Keep in mind the people who wrote the law all have health insurance and steady income!

This is a clue on avoiding the medicaid trap.

So...what's my subsidy based on my income?

Quote Texas exchange plans with subsidy

Run your free quote here:

Make sure to enter your household size even if not everyone is enrolling. It affects the subsidy for those that do.

Enter your best income estimate for this full year based on above or what we discuss.

You can play with the income level up top to see what it does to pricing and those richer versions of the silver plan.

Then, there's the joy of picking a plan? What now.

Get free assistance on the Texas exchange income calculation

Reach out to us at help@texasplans.com, 800-320-6269, or pick a time to chat here.

We can save you so much time and potentially money by nailing the income piece and everyone's situation is different.

As licensed Texas health agents, there's ZERO cost for our assistance and you read our reviews above to see that we really work to help people get the most out of the Exchange.

How can we help?