HSA (Health Savings Accounts) for Texas Individuals and Families Explained

What if there was a way to reduce your monthly premium by about $100/month (single) or double that for a family.

To borrow the cheesy sales expression... "Is that something you might interested in?"

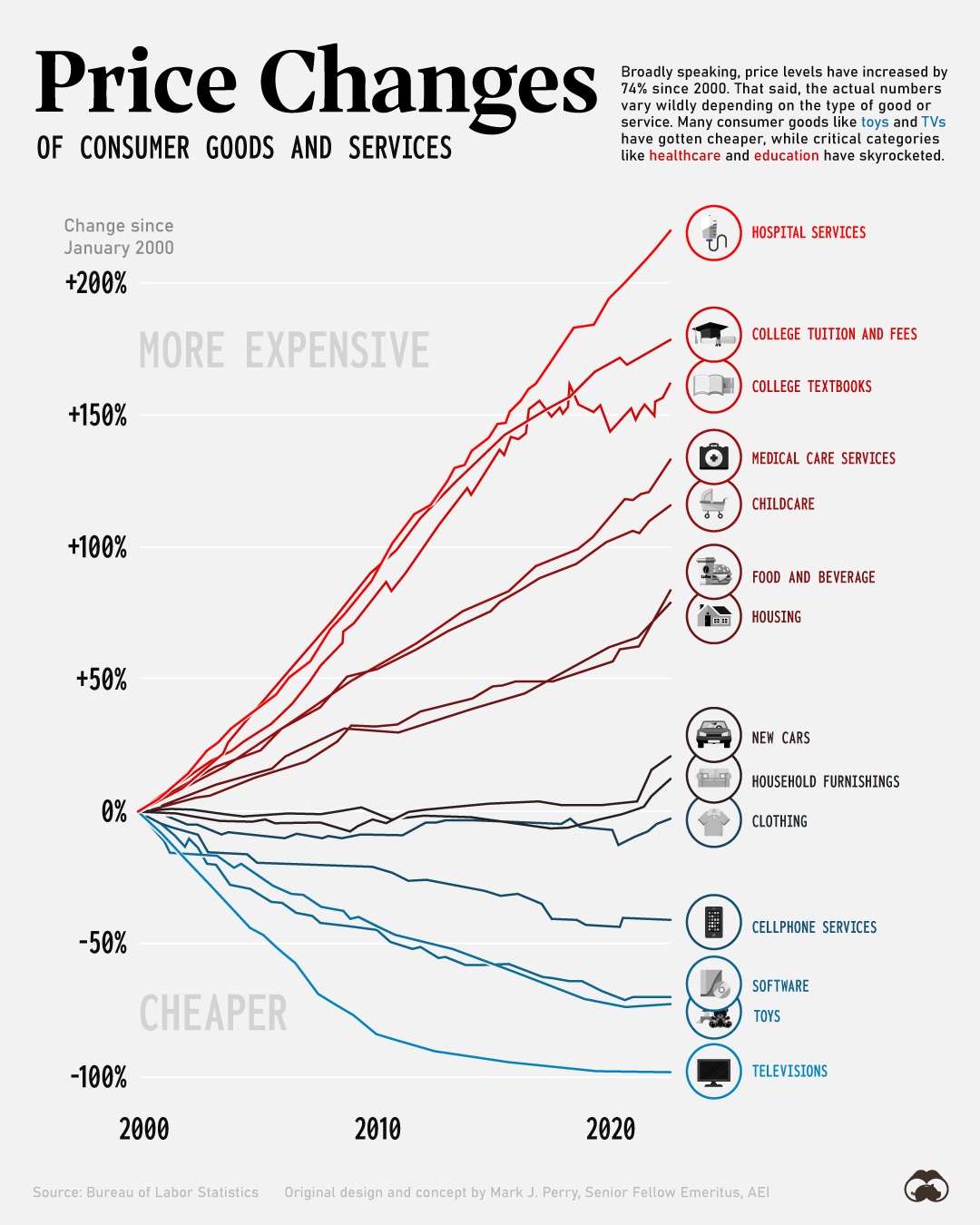

Sure...especially in today's world of medical inflation.

We'll look at how the HSA does this in real after-tax money and makes the HSA version of the bronze plan very attractive.

And yes...we have HSA options available in Texas!

First, our credentials:

This is what we'll cover here:

- An intro to how the HSA works in Texas

- What plans are HSA compatible

- Comparing Texas HSA plans versus other options

- When does the HSA work best

- How to quote and apply for HSA qualified plans

HSA's have seen waves of popularity over the last 20 years (since the old MSA's).

The 2014 ACA law changed up the market quite a bit but HSA's made the cut but saw their benefit altered.

As we discussed in the Texas major medical review, there's a specific situation where HSA's still pack a financial punch and we'll cover that below.

Let's get started!

An intro to how the HSA works in Texas

Let's outline the points so you have a good sense of what HSA plans are.

First, there are two components:

- A high deductible HSA qualified plan

- A tax-favored HSA checking account

The latter is not required...you can just get the qualified health plan which makes sense in many situations (see major medical or catastrophic health plans in Texas).

The tax-favored HSA account is where the added benefit comes in.

Essenitally, you can contribute funds to this account up to a certain amount each year and pay for out-of-pocket medical and dental expenses.

The money you fund into this account is deductible to your taxes as long as you don't spend them on non-qualified expenses.

If you don't use the funds, they roll over year to year. You don't lose them like FSA's, etc.

Interest and investment is tax deferred!

It's like an IRA with the added benefit of the payout for medical/dental with no penalty or income tax liability!

The annual cap is around $4K for an individual and over $7K for two or more in a family.

This amount goes up a bit each year so check on current levels.

You don't have to fund this full amount. The minimum is usually around $50 to open an account that's the main requirement.

You can also reimburse yourself for qualified expenses you paid as long as you were on the qualified health plan.

Let's look more closely at the underlying health plan in Texas.

What plans are HSA compatible

For individuals and families in Texas, the HSA qualified options are generally at the bronze level.

When you run your quote below, you'll see a little "HSA" image by the plans that qualify.

Not every high deductible bronze plan is HSA eligible since the rules dictate that most benefits (outside of preventative) must be subject to the main deductible.

For the most part, you'll see benefits like this:

- High deductible per person (up to 2 people) of around $7K

- Max-out of pocket around $9K

- Preventative is covered at 100% in-network

That's it! Clean design really. The other bronze plans generally give you a few copays for office visit but hit you on backend for bigger bills and/or premium.

We actually really like the HSA plan design for major medical plans even if you don't get the HSA account.

Happy to walk through how the plans work at help@texasplans.com or 800-320-6269 but here are the benchmark benefits (HSA plans not included):

Alright, so is the HSA a good value? How can we compare it with the other plans?

Comparing Texas HSA plans versus other options

If you look at the benchmark plan chart above, you can see 4 basic levels:

- Bronze - high deductible, high max

- Silver - mid level deductible, copays for office and RX, high max

- Gold - low/no deductible, richer copays, high max still

- Platinum - no deductible, richest copays, mid level max

The HSA is at the bronze level usually.

So, how the HSA qualified plan compare?

One note...if you're eligible for the Silver 87 or 94 based on income, those are really hard to beat.

You're getting a big subsidy AND much much richer versions of the silver for the same price.

Almost platinum level with the 87 and richer than platinum with the 94. Sure, you can drop your premium even more with the bronze plan including HSA options but anything that comes up health wise will make the silver plans pencil out much better.

More on the enhanced silver Texas plans or the income chart for subsidy.

Let's assume you're not eligible for the enhanced silver (but maybe getting a subsidy).

The subsidy will apply the same for all the plans across the board.

An interesting note...

The out-of-pocket max (how plan treats the big bill) is about the same for the bronze, silver, and platinum.

So...all the plans treat the big bill about the same but the monthly amount definitely isn't the same!

The silver is by far the most popular plan on the market but a big part of that is the enhanced silver plans (87 and 94 being big).

Here's the secret (but you have to work with us for zero cost!):

Compare the annual premium difference between and standard silver VERSUS the deductible difference + copays for office and RX.

We can quickly size this up for you with just your zip code, dates of birth, and best estimate for this year's income.

help@texasplans.com or 800-320-6269.

Let's take an example.

- HSA plan is $200/month after subsidy

- Silver plan is $350/month after subidy

- That's just short of $2K premium difference per year

- Deductible + expected rx/office difference is around $3K

That's not a bad trade-off. Saving a guaranteed $2K versus a potential $3K!

We'll take this bet all day long with health insurance since the point is about the big bill.

Again, we're happy to help.

So...when the HSA plan pencil out well in Texas.

When does the HSA work best

Here's where we see the HSA work well in Texas:

- Higher income bracket and plan to fund the HSA account

- Older individuals or families

- Just want major medical coverage for the big bills

- Relatively healthy with low RX and office visits expenses

Let's explain why on each one.

Higher income bracket and plan to fund the HSA account

Let's say you a 20% tax bracket and fund the HSA account at $4K.

That's like $800 in real after-tax money!

It's like we're saving almost $70/month in premium for an individual. Even more for two or more people.

That definitely makes it better than the other bronze plan IF you fund the account.

That's $800 of office and RX essentially. Keep in mind that the Silver still has a pretty high deductible for services outside of office and RX.

So...funding the HSA account really locks in the benefit IF our tax bracket is higher.

If our income is much lower, we're probably qualifying for rich subsidies and maybe even the richer silver plans.

Some clients we have fully fund the HSA account and use it like an IRA for the tax benefit solely.

That's an option. Funding is completely flexible. You can fund it fully each year or not at all.

What about age and HSAs?

Older individuals or families

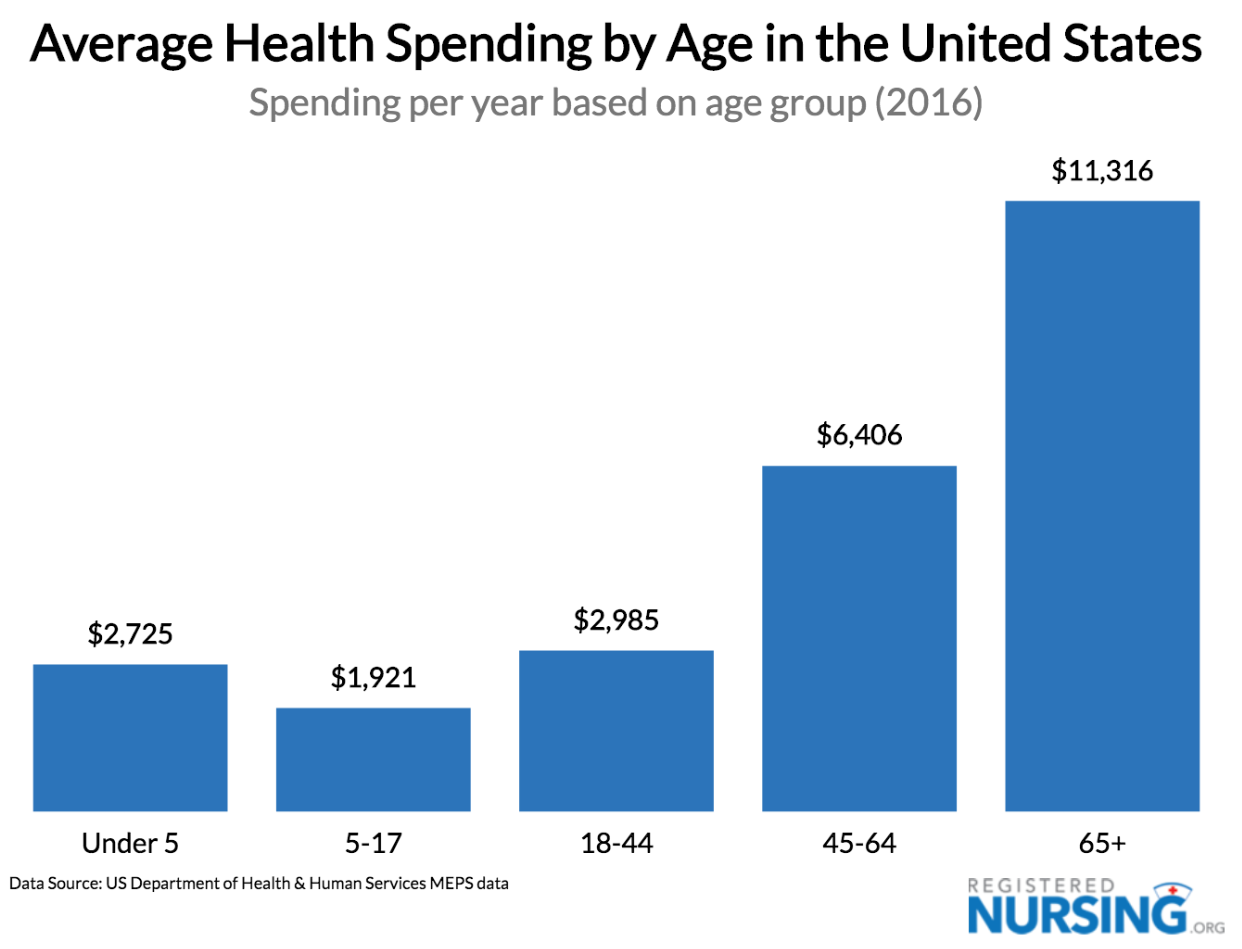

Age drives health costs directly:

Premium reflects this increase and that makes the calculation above (annual premium savings versus benefit difference) get better and better.

The deductible, etc isn't changing at all but our annual savings may jump from the $800 above to $1600+

You'll be able to run your quote below but just know, it's hard to beat the HSA bronze plan in your 50's and 60's even with more health care issues.

We can walk through your situation with you around this trade-off at help@texasplans.com or 800-320-6269.

Just need date of birth, zip code, and best estimate for this year's income (AGI on the 1040 tax form; next April's filing).

Then, there's people who want to cover the big bill!

Just want major medical coverage for the big bills, relatively healthy with low RX and office visits expenses

This was the original intent of health insurance after all.

Don't get wiped out by a $100K bill and have the hospital own your left kidney.

We got away from that with copays, etc but it's come back to bite us as there's a cost to everything.

Health insurance costs have roughly tripled since 2014 and just keep exploding higher.

That's why you want some type of insurance but the HSA is a smart way to address the risk of the big bill.

Now you know how to compare the annual premium difference, pay with pre-tax money (HSA account), and save.

Just a side note...I've been on the HSA for 20+ years if that says anything.

Enough explaining. What's the cost?

How to quote and apply for HSA qualified plans in Texas

This is fast, free, and easy here:

As we mentioned:

heal

- Income estimate is your AGI on the 1040 tax form; next April's filing

- Household is everyone that files together on a 1040 tax form even if not enrolling

Again, don't do this part alone since a small mistake can means $1000's of saving left on the table.

There's zero cost for our assistance. help@texasplans.com or 800-320-6269.

If you want an HSA qualified plan, you can narrow search to just those plans to see what carrier offer it and even put your doctors in the search.

It still works for many people in Texas. If we can find savings, we'll get you on the right pack. Love finding a few $1000 for Texans!