Health Insurance for Children in Texas: Everything You Need to Know

We get calls every day from parents asking: "How do I find health insurance just for my children in Texas?"

Good news... there are solid options available, and depending on your family's situation, you might even qualify for subsidies that help reduce the cost.

Better yet, all Affordable Care Act (ACA) plans include essential health benefits like dental and vision for children under 19 as part of their medical plans. Yes, that's built right into the coverage!

Navigating the process may seem complicated, but we're here to simplify everything for you. We'll walk through all the details step-by-step below.

But first, here's a little bit about our experience:

Here's What We'll Cover:

- What are the available health plans for children in Texas?

- Can you qualify for subsidies just for your children?

- How do I find plans that include my children's pediatricians?

- What's the best health plan for children in Texas?

- How to quote and enroll in children's health insurance plans

Let's dive in and get your questions answered!

What Are the Available Health Plans for Children in Texas?

Let's start by clearing up some common confusion.

Since 2014, the individual and family health insurance market in Texas has been fairly standardized. You may hear it called by different names... Obamacare, ACA plans, exchange plans... but they all refer to the same thing.

The benefits, networks, and pricing are regulated, so no matter the name, the core offerings are similar.

The biggest distinction is between on-exchange and off-exchange plans. Both cover the same medical benefits, but on-exchange plans may qualify for subsidies to help lower your monthly premiums based on your income. For many families, especially those with children, these subsidies can make a significant difference.

Parents often explore children-only plans when adding dependents to their own employer plans becomes too costly. Thankfully, you can enroll your children in their own health plan without having to sign up for coverage yourself.

There are two key times you can enroll:

- Open Enrollment: Runs from November 1st to January 15th, with coverage starting as early as January 1st.

- Special Enrollment: Available due to specific life events such as:

- Loss of other coverage (such as through an employer or Medicaid).

- Moving within Texas, which impacts healthcare options.

- Family changes like births, adoptions, or divorces.

If your children lose coverage, say from an employer plan, this triggers a special enrollment window where you can sign them up for new coverage.

We also have an in-depth guide on enrollment periods for Texas health insurance, but don't hesitate to reach out to us for personalized advice. We'll make sure your children get covered at the right time.

Can You Qualify for Subsidies Just for Your Children?

This can seem complicated, but we're here to help you make sense of it.

Subsidies can significantly reduce your monthly premiums, potentially with richer silver plans, and they are determined based on your family's income. But how exactly does it work?

The subsidy calculation uses your household income for the current year, which can be found on your 1040 tax form (AGI, next April's filing). Your household includes everyone listed on your tax return, whether or not they are enrolling in the plan.

For instance, if you're a single parent making $50,000 annually with two children, you can enroll just the children in a health plan through the exchange, and they might qualify for subsidies that reduce the overall cost.

Here's one key rule: If you, as the parent, have employer-sponsored coverage deemed "affordable" (which means it costs less than 8.39% of your income), your family won't qualify for subsidies through the exchange. However, many employers don't contribute as much to dependent coverage, which can make those family plans pricey.

We can help you figure out whether your children qualify for subsidies and what the actual savings will look like. Get in touch with us to start the process:

To get going, we'll need some basic details:

- Your children's birthdates

- Your ZIP code

- How much you pay for your employer health plan (if applicable)

- Your household's monthly income

From there, we'll handle the heavy lifting... running quotes, calculating subsidies, and finding the best plan for your children. Even if subsidies don't apply, we can still help enroll your children on-exchange, ensuring they get the coverage they need.

How Do I Find Plans That Include My Children's Pediatricians?

This is a crucial consideration for most parents. After all, continuing with your children's preferred healthcare providers is important.

In Texas, there are several major carriers that offer children's health plans, including:

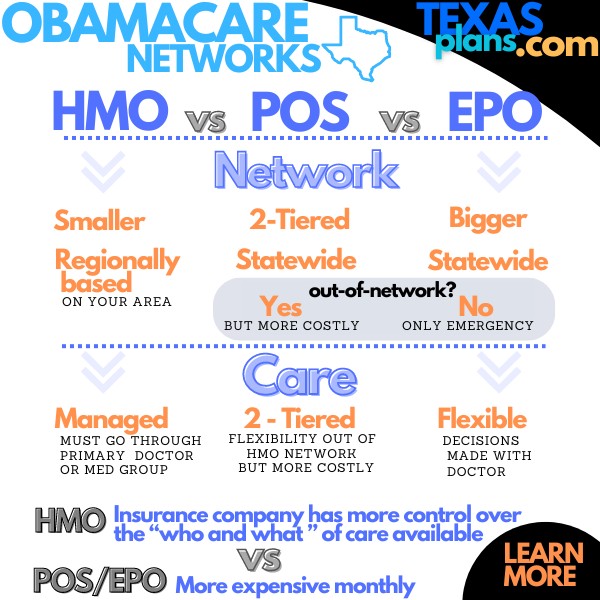

These carriers offer a variety of networks, most commonly HMO or EPO plans within the individual and family marketplace.

Our easy-to-use quote tool allows you to search for plans that include your children's pediatricians. Simply enter their details, and the tool will show which plans your doctors are part of... saving you from having to call around to each provider.

Here's a quick overview of the network types:

- HMO: Lower premiums, but you must use in-network providers for care (except in emergencies). Care is more "managed".

- EPO: Similar to a PPO in flexibility but without coverage for out-of-network care (unless it's an emergency).

Curious about the full range of network options? Check out our guide here for more detailed comparisons.

What's the Best Health Plan for Children in Texas?

Finding the right plan for your children depends on your budget and their healthcare needs.

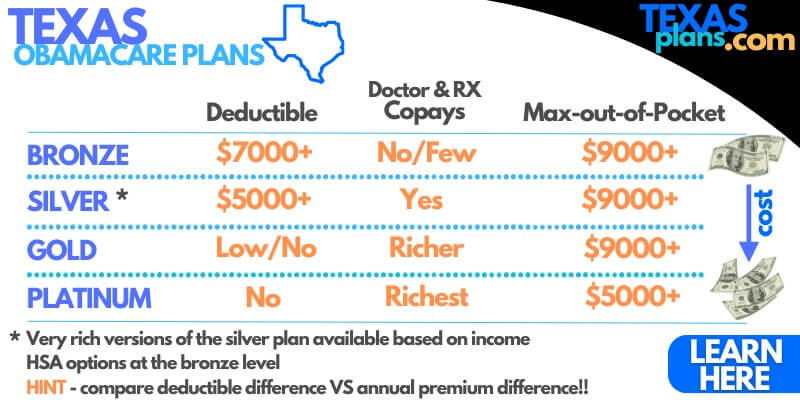

Texas health plans come in four main levels:

- Bronze: Lowest premiums, highest deductibles.

- Silver: A balance between premiums and out-of-pocket costs, often the best value for most families.

- Gold: Higher premiums but lower costs when healthcare services are needed.

- Platinum: The highest premiums but with very low out-of-pocket expenses... ideal for those expecting significant medical care.

For most families, Silver plans hit the sweet spot. They provide affordable copays for routine doctor visits and medications while keeping monthly costs manageable. If your children need more frequent care, you might find that Gold plans offer even better savings in the long run.

The good news? The difference in premiums between Silver and Gold plans is often smaller for children than it is for adults, making the upgrade more affordable if necessary.

We'd love to walk you through your options... every family's situation is unique, and we're here to help find the best plan for yours.

How to Quote and Enroll in Texas Children's Health Plans

Ready to get started? You can easily quote children's health plans for free by clicking below:

Both on-exchange and off-exchange plans are available. If you're eligible for subsidies, make sure to check on-exchange plans first to maximize your savings.

When entering your household information:

- Be sure to include the total size of your household (for example, 3 people), but enter only your children's birthdates.

- Not interested in Medicaid or CHIP? No problem! You can still apply for standard health plans without entering your income information... though you'll miss out on any potential subsidies if you leave it out.

Many parents miss out on important benefits by going it alone. Let us help with the details to ensure your children get the best coverage. Remember, our assistance is always free:

We're also here to guide you through the paperwork and avoid common mistakes... half of people who enroll on their own miss out on key benefits because of confusing forms and rules!

That's everything! How can we assist you today?