Texas United Health Obamacare Review and Guide

We knew this was going to be the big battle in Texas for years.

BCBS of Texas has been a dominant force on the individual family market but United is the biggest carrier nationwide and they're aggressively making moves in the state.

It only entered the market in 2024!!

In some areas, United Healthcare® has the lowest priced silver plans (the most popular by far) as we'll see below.

On top of that, United Healthcare® has always had a strong network (the doctors you can see) as a result of their size across other markets like Medicare and employer based plans.

Let's review United healthcare®'s options, which is best, and how to quote or enroll but first, our credentials:

Here's what we'll cover:

- United Healthcare® and Obamacare intro

- United Healthcare®'s rates on the Texas individual family market

- Are United Healthcare®'s Texas networks good?

- How to compare United Healthcare®'s Obamacare plans in Texas

- Quoting and enrolling in United Healthcare® obamacare in Texas

Let's get started!

United Healthcare® and Obamacare intro

First, understand that on or off exchange in Texas is the same thing and it's generally called Obamacare.

That just means they share the same rules from the massive 2014 ACA law so:

- Same networks

- Same benefits

- Same rules

- Same pricing!

The big difference is that we can get subsidies or tax credits on-exchange so almost all our enrollment goes that way these days.

It's found money!

United Healthcare® has long been a powerhouse in the Medicare market and with employer based plans but the move into the individual family plan is more recent.

They've moved into more counties over time and are very competitive in key areas now.

When comparing individual family plans, you want to focus on the following:

- Pricing

- Networks

Why did we skip benefits? Those are now standardized so a silver plan will be pretty comparable to another silver plan +/- 2%!

That then puts the focus when comparing United Healthcare® versus other options on pricing and network.

Let's look at those!

United Healthcare®'s rates on the Texas individual family market

This is a big reason United Healthcare® made such a splash in Texas Obamacare markets.

Let's look at a sample quote at the silver level for Travis county, single person age 54:

see comparing silver plans).

see comparing silver plans).United has the lowest pricing at the silver level here compared to BCBS, Aetna, Ambetter, Oscar, and others.

Again, the benefits are identical since we picked the "standard" silver option to make it easier to compare.

The United and BCBS rates are pretty comparable but the other carriers get more expensive fast and remember...the benefits are identical! Standardized by law.

Any subsidy you're eligible for will apply equally to any carrier including United health.

Keep in mind that rates are determined across the individual family market by:

- Age

- Size of family

- Income (for the subsidy)

- Smoking status

You'll be able to run your personalized quote below but let's then move to the next question which usually starts the conversation.

"Which plan works with my doctor??"

Are United Health's Texas networks good?

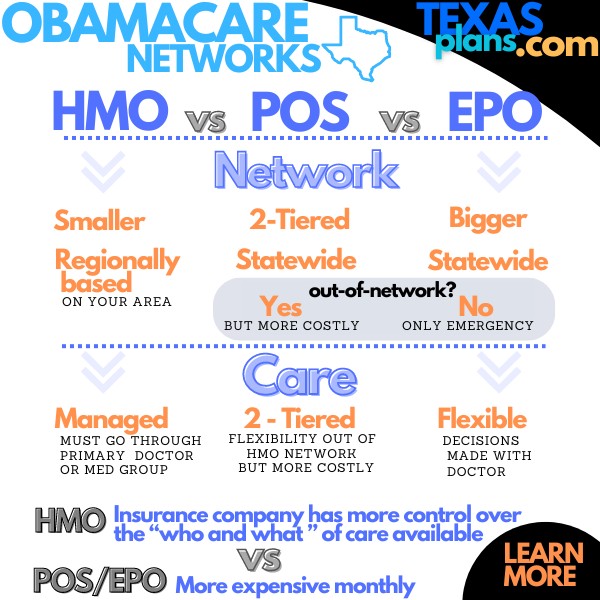

You'll notice both the United Healthcare® plan and BCBS' above are HMO.

That's the dominant option available now with some EPO's mixed in from Ambetter and Oscar.

You can learn all about the Texas Obamacare networks but the market is clearly moving towards HMOs and we expect to continue as a way to contain spiraling health care costs.

We have a big review on comparing the Texas networks but we make this even easier.

When you run your free Texas obamacare quote below, you'll be able to enter your doctors info right away and then the quote system will show which plans work with them!

This is a fantastic tool and one we wish we had before!

You can save tons of time and frustration trying to chase this info down but if you have to ask the doctor, this is the question:

"What Texas Obamacare plans do you participate with?"

They know how to answer that question now and with the recent explosion in enrollment, more and more are joining with each year.

Let's look at the plans now.

How to compare United Healthcare®'s Obamacare plans in Texas

We have big reviews on how to compare Texas obamacare metallic plans or how to pick the best Texas obamacare plan but a few highlights that apply to United health.

First, there are 4 basic levels and any plan in a given level can't be that different from the benchmark.

Here are the benchmark plans:

So, we have 4 basic levels with United health Obamacare:

- Bronze - high deductible; no/limited copays for office visits or RX; may have HSA option

- Silver - mid deductible, copays for office and RX; high max

- Gold - low/no deductible, richer copays, still high max

- Platinum - no deductible, richest copays, mid level max out of pocket

To really understand these terms, check out the guide on comparing metallic plans.

You can always run your situation by us and we'll guide. There's zero cost for our assistance and we've done 10's of 1000's of these reviews.

Call 800-320-6269

Chat online here

Pick a time to talk here

Otherwise...

Here's our 3 step guide to picking the right plan:

- Silver 87 and 94 are slam dunks!

- Compare the annual premium difference versus deductible difference

- Bronze and Silver are hard to beat, especially as we get older

Silver 87 and 94 are slam dunks!

Depending on your income, you may be offered really rich versions of the silver plan. There are two levels (87 or 94) which basically platinum level plans for the same price of the normal silver.

You don't need to go any higher than silver for this reason and it really makes the bronze look less competitive since any health issue will quickly pay for itself generally.

We can help you compare and more importantly, make sure you're entering the income info correctly to the right subsidy!

Roughly 50% of people who self-enroll are missing out on tax credit. $1000's annually.

If you're not eligible, then what?

Compare the annual premium difference versus deductible difference

Let's say we're comparing the Silver (standard) and Gold plan.

Look at your premium difference over a year's time versus the deductible difference (roughly $6K in the example above).

If our premium difference is $300/monthly that's about $3600 savings each year. Compare that to the $6K deductible IF something big happens.

Saving a guaranteed $3600 versus a potential $6K isn't a bad bet in terms of health insurance.

That's a good way to compare the different levels and again, we're happy to walk through this with you.

Otherwise, go low!

Bronze and Silver are hard to beat, especially as we get older

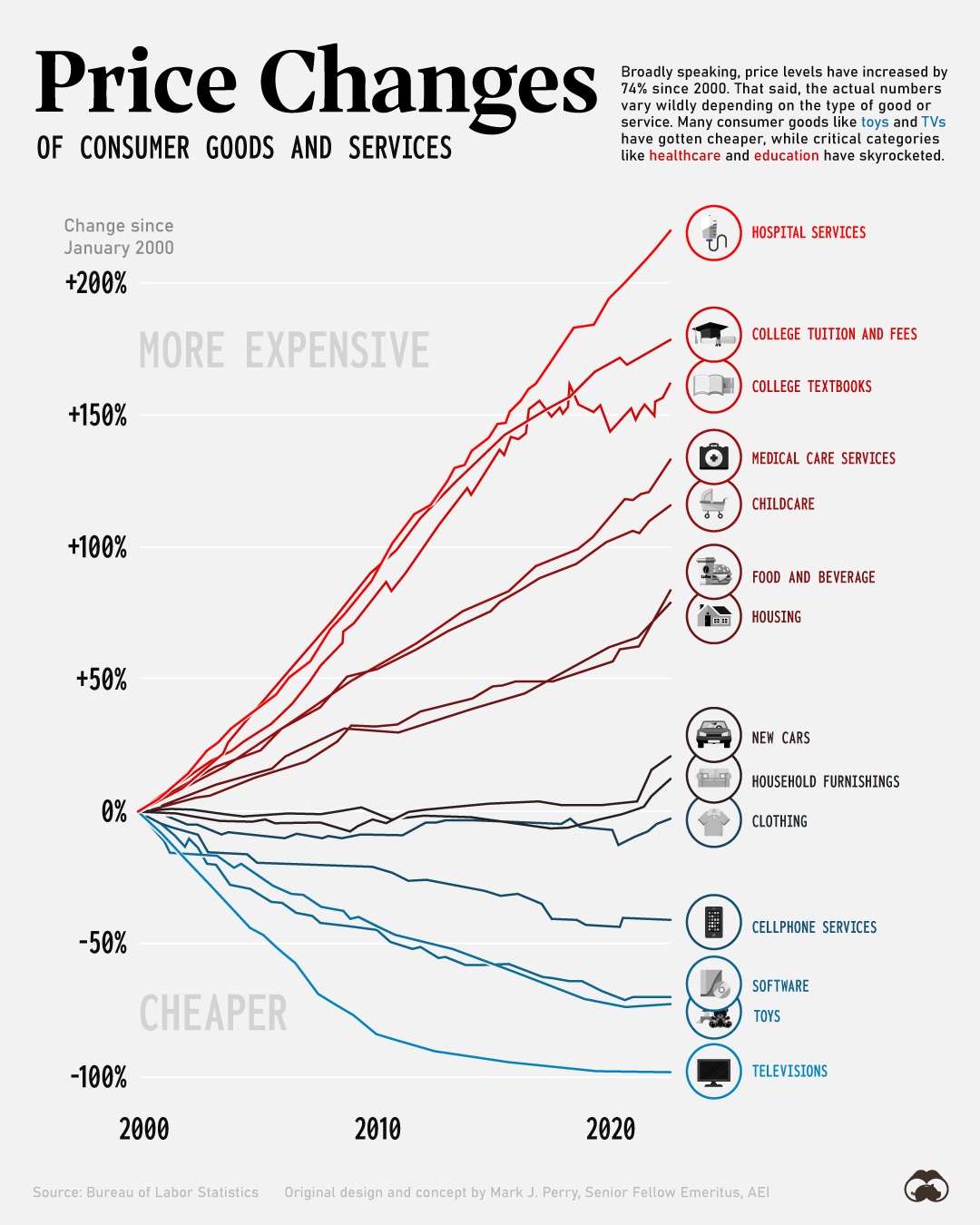

Healthcare is expensive. We're finding these days that bronze and silver make the most sense many times.

Especially for people who want major medical or catastrophic health insurance.

The bronze, silver, and gold all have the same out of pocket max so they cover the really big bill the same.

It's really about cost though and this goes up as we get older. If you're paying $3-5K annually to move up a step, it's hard to justify that.

Will you really have that many copays and/or expenses towards the deductible?

Here's the deal since 2014 when the plans were made guaranteed-issue (can't be declined based on health).

The cost difference between plan levels keeps getting closer to any possible benefit difference!

Meaning, there's less to gain by going richer (to gold or platinum). Especially if we're in our 40's 50's, and 60's.

It's really important to look at your specific situation since subsidies might affect this calculation.

Let's go there now for United Healthcare!

Quoting and enrolling in United health obamacare in Texas

We make this fast, free, and easy here:

A few notes to get the best Texas United quote:

- Income is the estimate for this year's AGI on the 1040 tax form (next April's filing)

- Household is everyone that files together on a 1040 tax form even if not enrolling

Again, we're happy to help with this as the income is where most people make mistakes.

Call 800-320-6269

Chat online here

Pick a time to talk here

You can add your doctor info as a filter (recommended) and even select just United Healthcare if you like.

The system will show you how much Obamacare subsidy goes towards your plan of choice and even if we'll get the enhanced silver plans.

You can enroll right through the system and if we're outside of open enrollment, let us know as we'll investigate special enrollment triggers (see when can I enroll in Texas obamacare).

Of course, we're happy to help with any questions!