Should I Cancel Texas Employer Plan so Employees Can Get Obamacare?

We're seeing this question ramp up quite a bit since 2020 and with good reason.

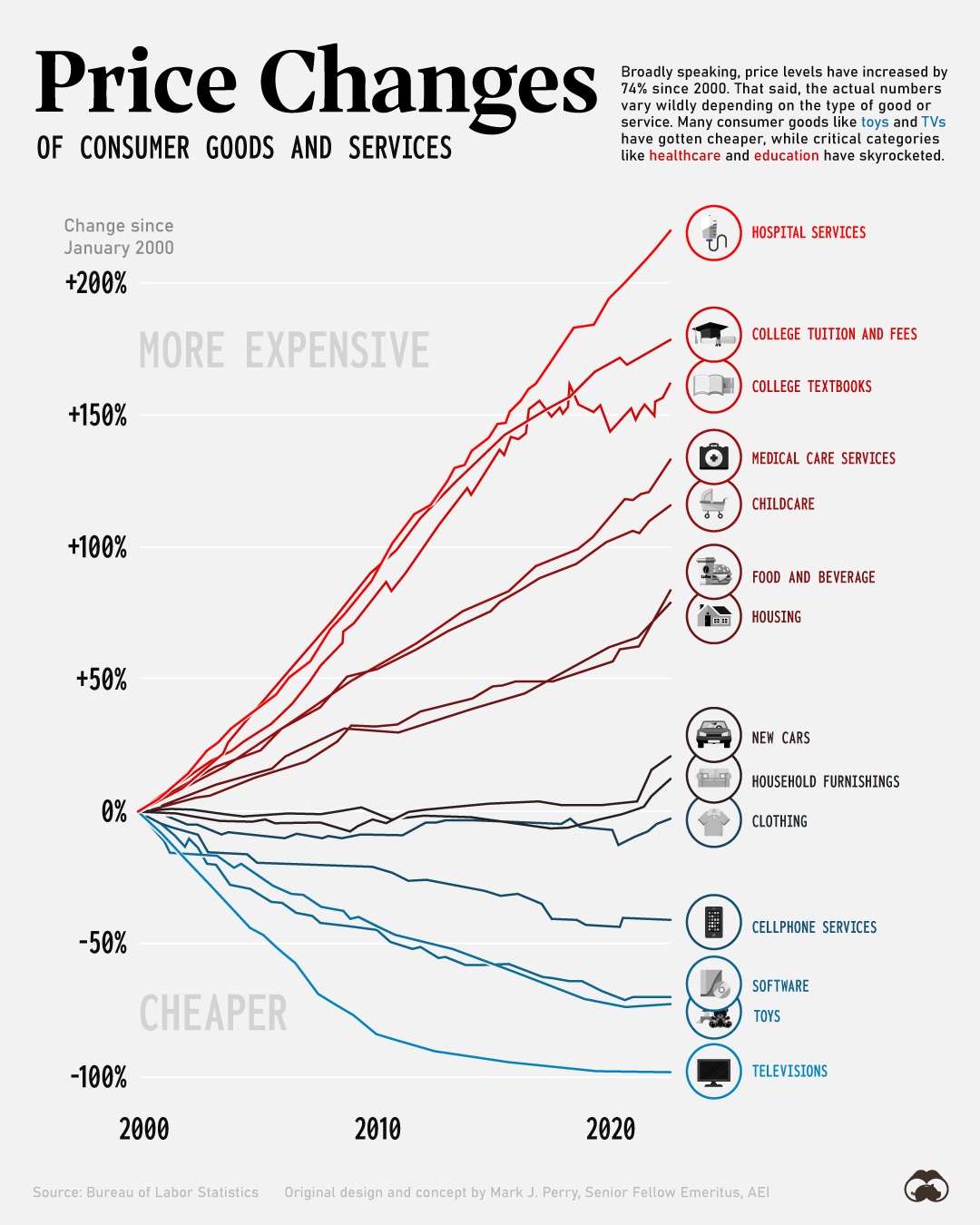

The cost of employer health insurance has exploded higher along with every other expense that companies are facing.

All things health related:

What many employers don't realize though is that the move may actually be better for their employees depending on the type of business.

We'll explain the strategy and when it works below but first our credentials:

This is what we'll cover:

- Compare Small Business and on-Exchange plans, networks, and pricing

- The subsidy question for on-Exchange versus small business

- When does canceling small business work for Texas companies

- Can you have it both ways?

- How to make the change successfully

Let's get started!

Compare Small Business and on-Exchange plans, networks, and pricing

Let's first understand what we're discussing.

This can be from the point of view of the employer or the employee but these days, we get many Texas employers asking the question:

"Can we cancel our employer plan offered to employees and have them get Obamacare?"

Yes you can. In some cases, it may save both employer and employees quite a bit of money.

Let's first walk through what's the same and what's different along these lines:

- Texas business health benefits versus on-Exchange

- Texas business networks versus on-Exchange

- Texas business pricing versus on-Exchange

Texas business health benefits versus on-Exchange

Since 2014, this is an easy comparison since the benefits are standardized for the small business (1-100 employees) and individual/family markets.

They both have the bronze, silver, gold, platinum levels (see how to compare metallic plan levels).

Each level is tied to a benchmark so a Gold plan will walk and talk pretty similarly to another gold plan within and across carriers by +/- 2%.

This is true for both small business or individual/family plans.

That's new since 2014 and all the other protections are there:

- No waiting period for pre-x

- Can't be declined based on health

- No lifetime or annual cap on benefits

Essentially, the 2014 law brought individual/family plans up to where small business was (for the most part).

Along with this increase came pricing changes as we'll talk about below but first, the one difference we need to discuss.

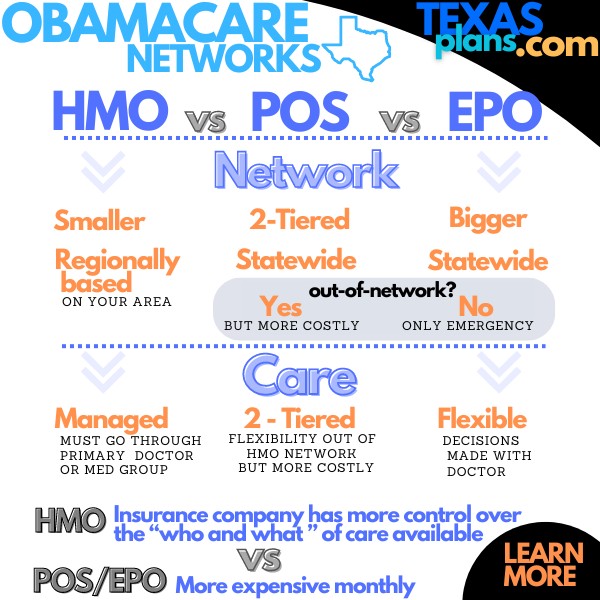

Texas business networks versus on-Exchange

There might be a difference here depending on what type of small business network you have.

PPOs are not available on the individual/family market.

The closest we have are:

- POS plans with BCBS - HMO at its core with some added flexibility

- EPO - works like a PPO but no benefit out of network (other than true emergency)

We don't have access to nationwide networks unless it's a true emergency so that's an issue with individual family.

How does this really play out?

If your employer plan is already an HMO, that's not a big deal then.

If you have a PPO, this is different but not as much these days within Texas compared to the EPO.

Why?

The PPOs have slowly whittled away what they pay out of network providers. You really don't want to use out-of-network these days in a non-emergency or expect to pay quite a bit out of pocket!

Expect this trend to just continue as it has since 2014. Anything to bend the cost curve.

We expect HMO's and EPO's to fully dominate small business by decade's end as a result.

For now, the out-of-State difference is probably the bigger issue. If that's not a problem then the EPOs will feel pretty good.

Just double check your doctors in the quote tool here:

Okay...now that's out of the picture, let's focus on why you searched for this to begin with.

The subsidy question for on-Exchange versus small business

As an employer, you and your employees may be missing out on $1000's in subsidies that are available to people through the exchange plans.

It's all based on income for the current year (AGI on the 1040 tax form; next April's filing).

We see monthly premiums come down to zero in some cases!

In many situations, we help employers cancel their employer plans and also see their employee share of health insurance costs drop significantly.

Again, those subsidies can be ridiculously high depending on income and size of household (everyone that files together on a 1040 tax form).

If your employee's incomes are in the right ranges, you may see:

- Employer small business health insurance drop to zero (you could take some of this and increase wages, etc)

- Employee share of health care costs drop by 50%+

Also, there can be richer versions of the silver plan based on income (see Texas silver plans).

So...how much income is in the sweet spot?

When does canceling small business work for Texas companies

Three things drive the feasibility of getting these subsidies:

- Annual household income for this year

- Age (older is better)

- Size of household (everyone that files together on a 1040 tax form)

We looked at how to get the most subsidy but let's see where it might work best. First, our Texas subsidy income chart:

So...if the employee is in the Silver 73 - 94 levels (100% - 250% on the chart), they'll likely get a big subsidy and even a richer version of the silver plan (silver 73, 87, or 94).

This is really the sweet spot of the income calculation where we see maximum subsidies!

Very low premium generally.

Keep in mind it's household income so we need to take that into account and also the number of people in the household even if not enrolling.

This can get confusing but we're happy to help you (zero cost for our assistance) run the numbers at help@texasplans.com or 800-320-6269. Pick a time to chat here.

The subsidy is on a sliding scale so we can still see pretty reduced premiums all the way up to probably 266% to 300% depending on age.

Again, the older the employee, the higher the income can go and still get a good subsidy.

The best bet is to run the quote here since every area and situation is different:

Again, we're happy to walk through the pros and cons of the switch.

Net net...

The federal government is now paying the contribution. This is found money.

Can you have it both ways?

We'll see employers who essentially want to keep the small business plan for themselves and maybe employees who don't qualify for a subsidy and have everyone else get on-exchange.

This is usually to keep a network (PPO), etc.

So...a few notes on that approach.

Having on-exchange is a qualified waiver so it doesn't hurt our small business participation requirements but the subsidy is a different matter.

If an employee is offered an employer plan, their share of the premium can't be higher than just under 10% of their gross monthly income.

For example...

- An employee makes $2000/month

- Their share of coverage on employer health plans is $150/month

In this case, their employer coverage is "affordable" and they can't get a subsidy on the market.

Now, if the employer plan is shut down completely, that's not an issue. It's only if they're offered employer coverage and it's affordable.

There are ways to address this if it's already under that threshold of their gross income.

An employer can reduce the company contribution for example.

Again, many employees will get a much better deal with the subsidy depending on their income.

For higher wage owners, you can increase their contribution levels but increase wages but you can't say that the increase is to offset the health insurance premium.

So...this works in certain situations (lower wage employees generally) or low contribution levels.

If an employer pays 100% of the employee's premiums, that's not going to work.

Again, this gets complicated fast so reach out to us and we'll help you navigate whether it works for your company at help@texasplans.com or 800-320-6269.

Let's say the small business premiums are crushing your company and it's not really a question (lot of those calls since 2021).

How to make the change successfully

First, there's zero cost for our assistance and we've enrolled 10's of 1000's of on-exchange plans since 2014.

We want the individual/family plans in effect before canceling the group plan obviously.

So an example...

Let's say we want the transition to occur 8/1.

We would quote and submit all the individual family plans during July, the earlier the better so they have cards, etc in effect.

Once we have confirmation (we'll hand walk them through the process) of enrollment on-Exchange, we would send notification to the employer carrier to cancel.

That's it...one of your biggest bills just disappeared!

Here's the beauty of this approach that we see every month.

- The employees generally have much less out of pocket

- They can pick and choose what carrier, network, and level of plan that fits their needs

- No more complaining about the employer plan issues, rate increases, and more

- Some will qualify for the rich silver plans which means much less out of pocket

You can always set an employer plan back up. But we get a feeling you won't want to.

This is the direction everything is going except white-collar industries and large businesses.

If your employees make between roughly $15K and $40K annually (more if older), it's probably a sizable amount of money you and they are missing out on right now.

Found money.

Zero cost for our assistance and we can get the biggest carriers on the market!