What's the Cheapest Health Insurance in Texas?

We get this question often from people who just want major medical but it's more complicated these days.

Depending on income, we may see plans with ZERO cost!

We'll explain below but let's go through how to find the cheapest plans in the Texas markets across three different situations.

- Eligible for a subsidy based on income

- Short term health plans for major medical

- Not eligible for a subsidy (Income too high)

Very different outcomes but we need to investigate each.

Health sharing plans don't really make sense in Texas since we have a robust short term health option from United health with comparable design, better networks, and actual requirement to pay claims!

First, our credentials:

This is what we'll cover:

- Cheapest Texas health plan if you're eligible for a subsidy

- Cheapest Texas plan with no subsidy

- Short term health plans as cheapest Texas health plans

- How to quote and enroll in the cheapest plan options

Let's get started and reach out with any questions.

Cheapest Texas health plan if you're eligible for a subsidy

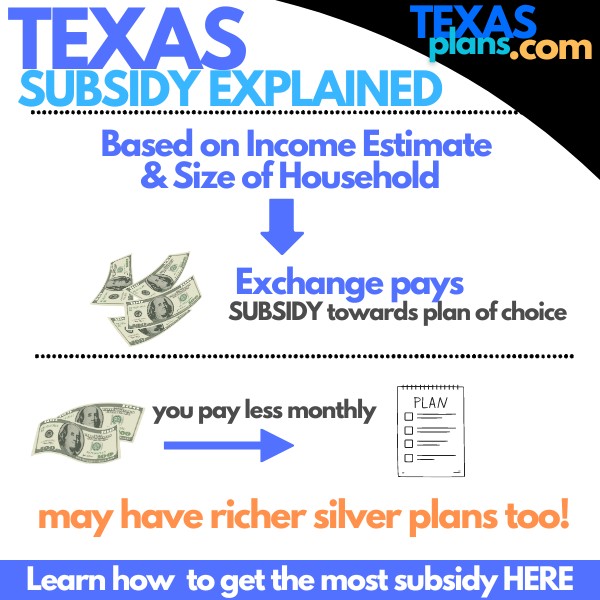

This is the biggest deal since 2014. There can be huge subsidies based on income and most people don't realize they're eligible.

We have a big guide on how to get the most Texas health subsidy but a quick intro is needed.

We see monthly premiums drop significantly even at higher incomes depending on the situation (age primarily).

A few notes:

- Income is the estimate for this year's income or the AGI on the 1040 tax form; next April's filing

- Household is everyone that files together on a 1040 tax form even if not enrolling

Income is tricky and many people (roughly 50%) make mistakes here that causes them to get less than they should.

We're talking potentially $1000's per year in found money!

Lean on our free assistance since we spend most of our days just helping people figure out the income piece.

It's not easy! Don't go it alone.

If we're eligible for a subsidy, it can definitely result in the cheapest health plan options and there's no reason to go any further.

You can quote your situation here:

The subsidy comes right off the monthly premium so for an example:

- Total premium $450

- Subsidy: $300

- Actual monthly charge: $150

Again, we see lots of premiums under $100 and even down to zero!

We're happy to run this quote for you with the following info:

- Zip code

- Dates of birth (everyone on the 1040)

- Best estimate for income

Okay...what if we don't qualify for a subsidy? What's the cheapest plan then.

Cheapest Texas plan with no subsidy

Let's assume we make too much money to get a subsidy (again, check with us!!).

What's the cheapest plan then on or off exchange?

First, understand that Obamacare is just a term to refer to individual family plans since 2014, whether on or off exchange.

The rates are identical! As are the networks and benefits.

If we're definitely not going to qualify for a subsidy, we can go either way but most enrollment these days is on-exchange since it's a simpler process (which is interesting).

Okay...then what is the cheapest plan on the standard market for full coverage?

There are four basic levels of coverage and for the cheapest options, we're looking at the bronze plan.

Typically, we have two bronze plans:

- Standard bronze: high deductible, few/no copays, high max out of pocket for big bills

- HDHP or HSA qualified bronze: high deductible/max with option to fund tax-favored account

The rates are generally pretty comparable between the two at first glance but that's not the entire story.

We have a big review on Texas HSA plans for individuals and families but here's the calculus.

We're assuming your tax bracket is higher since you're not qualifying for a subsidy above.

If an individual funds $4000 (there are annual caps) at a 30% tax bracket, that's $1200 in real after tax savings.

So...it's like you brought down the HSA qualified premium by $100/monthly compared to the other bronze plan!

If you don't use the funds in the account, they roll over year to year and investment/interest is tax deferred.

Like an IRA that you pay for medical/dental expenses with pre-tax money. Plus, it's a deductible in terms of what you fund in the account.

The amount you can fund doubles for households of 2 or more.

This makes the HSA qualified plan the cheapest on the market if we don't get a subsidy but want full coverage!

Again, check out the guide or our major medical texas health insurance guide.

Alright, what if we really want bare bones plans?

Short term health plans as cheapest Texas health plans

Texas is lucky in that it still has a robust short term health options.

Look...we prefer the two other options above because they have much more "coverage" and protection built in but if we're not eligible for a subsidy AND we can't afford the Obamacare options without a subsidy...

There's short term which may go to 360 days (we know a trick on how to fill in the extra 5 days...check with us).

We have a whole review on Texas short term health insurance which goes through the options but here's the lay of the land:

- United health has a strong short term offering with extensive networks in Texas

- We can pick down hospital only plans at very low costs

- We can tailor plan design with higher deductibles and out-of-pocket maxes to reduce cost

- Coverage can start midnight following enrollment and go for 360 days

Again, check out the review but without a subsidy, short term can definitely be the cheapest plan on the Texas market.

It definitely beats health sharing plans which are running into issues with hospitals not accepting them due to non-payment history.

Costs are now comparable or better with the United short term options anyway!

Speaking of pricing.

How to quote and enroll in the cheapest plan option

You can run your standard plan quote here with or without subsidy:

Make sure to enter your income estimate and full household.

If any of this is complicated (it is!), reach out to us and we'll do it for you at ZERO cost to you.

For short term, you can quote that here:

If we missed open enrollment and don't have a special enrollment trigger (see what if I missed Texas open enrollment), short term may be the default option till open enrollment which is fine.

This is a review of the cheapest health insurance options in Texas! We're happy to compare the options for you.

Call 800-320-6269

Chat online here

Pick a time to talk here