Comparing BCBS of Texas versus Scott & White for Exchange Plans

This is increasingly becoming the big contest in many areas. It reminds us of the Kaiser versus Blues battle in California.

We have the original player in the market with BCBS of Texas with a network across the State.

The challenger, Scott & White went the other way. They started as a care provider, built that out, and then layered on insurance.

That's exactly what Kaiser did on the West Coast and it's worked pretty well for them!

If we were betting people, we would say this becomes the main title fight going forward in the State!

So...how do we compare BCBS and Scott & White in Texas for Exchange (Obamacare) plans?

That's what we're doing below!

First, our credentials:

This is what we'll cover:

- BCBS of Texas and Scott & White on the Exchange

- Comparing the networks for BCBS of Texas and Scott & White

- Comparing the rates for BCBS of Tx versus Scott & White

- Comparing the plans for BCBS of Texas and Scott & White

- Quoting both BCBS and Scott & White exchange plans side by side

Let's get to it!

BCBS of Texas and Scott & White on the Exchange

First, we need to highlight some basics about the Texas individual and family market now.

The exchange related quirks will apply equally to both carriers:

- Subsidies based on income will be the same with either carrier

- The enhanced silver plans will be available with either carrier

- The same core benefits must be covered by each plan

- The same rules for when you can enroll and how are the same

Okay, that makes it easier. Learn more about how to get the most subsidy since that is still the biggest deal regardless of which carrier you go with.

So, really what we're comparing are:

- Networks - doctors and hospitals you can see

- Rates - how much each carrier is charging for a given plan level (silver for example)

- Plans - what are the benefits at each level (there's a secret to this below)

Both have a strong tradition going back decades in Texas. Just starting from a different vantage point.

Insurance carrier versus medical network!

So, let's get to comparing!

Comparing the networks for BCBS of Texas and Scott & White

This usually drives the decision more than anything else.

People know if their doctors are Scott & White doctors. Or not!

When you run your quote here or below, you'll see a Doctor Finder link by each plan.

Interestingly, you may still be able to see Scott & White providers with BCBS plans!

As we're writing this, they're in a 3-year contract negotiation so these are high stakes and expect it to be a battle to the end since BCBS sees Scott & White encroaching on its territory (insurance).

Longer term, Scott & White may have the leverage but for now, it's a battle.

If you're not sure about your doctor, you can ask the office "What Texas exchange plans do you participate with?".

We can also chase this down for you at help@texasplans.com

The second note is the "type" of network.

- BCBS of Texas bread and butter is their HMO network

- Scott & White is all HMO at the Individual/Family level (Texas Exchange or Obamacare)

BCBS may also have a POS plan but it's quite a bit more expensive and not as popular (as a result).

See our big review on Texas Exchange Networks to learn more.

Otherwise, it's HMO versus HMO so that makes it cleaner.

So...how do the rates stack up?

Comparing the rates for BCBS of Tx versus Scott & White

For the next two sections (rates and plans), let's run a sample quote with no subsidy (ouch!) for a 50's year old in Travis county. Silver plan since it's by far the most popular option on the market (see enhanced silver plans to learn more).

Let's start with our generic benchmark plan guide:

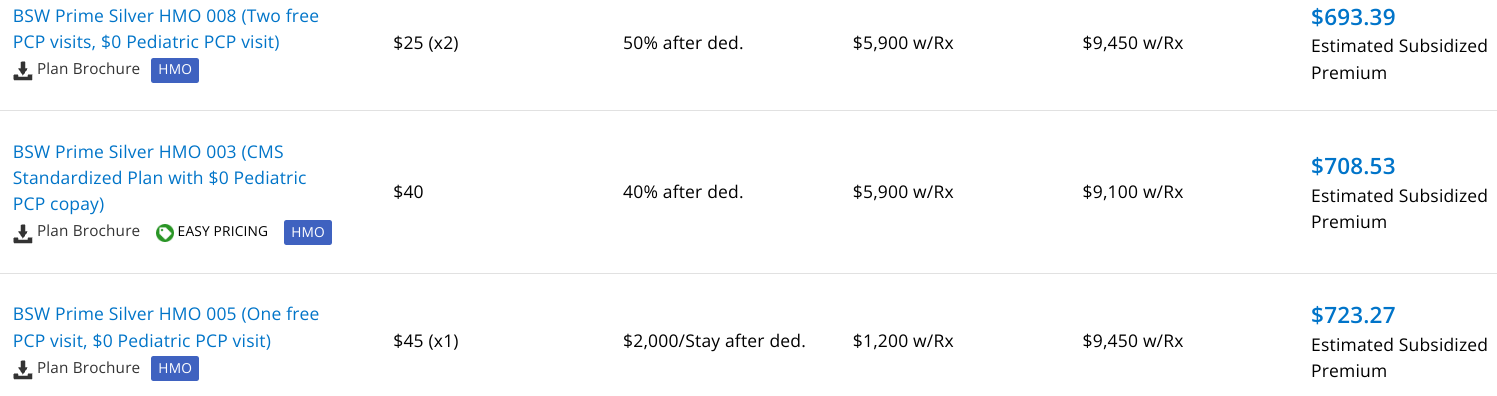

First, the Scott & White plans and rates:

Pretty clean and simple.

So, a range of $693 to $723. All HMO networks.

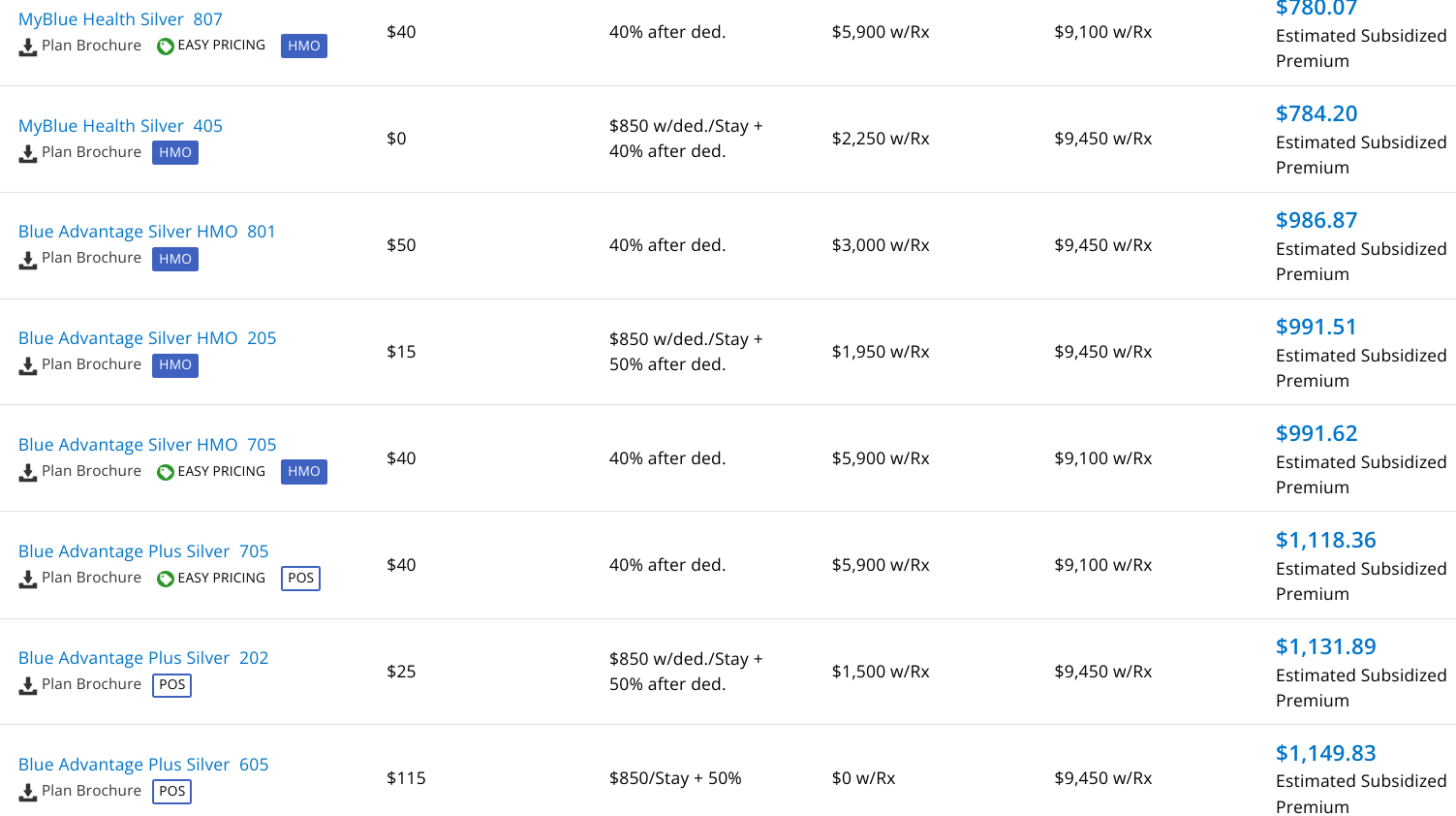

What about the BCBS offering in that same demographic?

Okay...quite a bit more to look at.

The first 5 are HMO and the last 3 are POS. That's a steep hit to have the network difference.

The first plan for each network is the same but the pricing is $780 versus $1118. Over $300+ more!

To get self-referrals and much less rich benefits out of the HMO network.

What about comparing the two rates?

- Scott & White Silver: Average around $700; low of $693

- BCBS of Texas Silver: Average around $980; low of $780

So about $100/month difference for one person (subsidy should apply equally to both options).

Now, if your providers are Scott & White anyway, that makes it easier to decide.

Let's see how those rates come out of the current negotiations as BCBS will likely want its pound of flesh!

What about the actual benefits?

Comparing the plans for BCBS of Texas and Scott & White

We'll let you in on a little secret.

There's roughly 11 different silver options as an example above.

By law, a given silver level can't differ from the benchmark benefit by more than 2% up or down!

This means they all have to walk and talk about the same (outside of network) and cover the same core benefits.

You'll notice that some plans give you office copays right away but then you'll pay for that somewhere else.

It can't differ too much! +/- 2%.

Does that mean that we just go for the cheapest plan within a given metallic level and network?

Maybe. It's not a bad bet.

Focus on the following:

- Deductible - amount you pay before the plan starts helping

- Copays - before or after the main deductible? This is a big difference

- Hospital stay - how is it handled. Extra amount due (you'll see $850/say as an example)??

Notice the out-of-pocket max is the same across the board and this deals with how the plan will treat really big bills. When are you off the hook in a calendar year, in-network.

So, what's really changing?

That deductible! It's a big difference but they're both pretty high numbers.

Hitting $2K will still require pretty big bills and in today's world, if you're getting up that high, you may be going to the out-of-pocket max.

A simple surgery can be a few thousand!

This may all sound confusing so reach out to us. There's zero cost for our assistance at help@texasplans.com or 800-320-6269. Or pick a time to chat here.

Learn more about how to compare the Texas metallic plans.

If you're feeling brave...

Quoting both BCBS and Scott & White exchange plans side by side

You can quote Blue Cross Blue Shield of Texas and Scott & White side by side here:

A few notes.

Make sure to dial in the subsidy piece since it can really drop the cost:

- Estimate your income as the AGI on the 1040 tax form; next April's filing

- Household is everyone that's filing together on a 1040 tax form, even if not enrolling

Again, we're happy to help. So many people are missing out on the full subsidy or enhanced silver plans when self-enrolling.

There is ZERO cost for our assistance and you can see our reviews above!

How can we help you compare BCBS Tx and Scott & White.

This is probably going to be a long battle for years up and coming!