What if I lost employer health coverage in Texas?

It's the last thing you want to do but the Cobra bill can be expensive!

Are there options even on a short term basis if you expect to have other employer coverage soon (fingers crossed!)?

Yes! There are two basic options to look at depending on the period of time you're expecting to need coverage.

We'll go through how to calculate which is best for you but first, our credentials on the matter:

Let's look at options if we lost employer coverage with these topics:

- Understanding Cobra versus individual family plans if we lost coverage

- Health exchange coverage if you lost work coverage

- Short term plans if you lost employee coverage

- How to compare health exchange versus short term

- How to quote both options and even enroll online

Let's get started!

Understanding Cobra versus individual family plans if we lost coverage

First, we need to touch base on Cobra if it's an option you have.

Cobra is basically continuation of your employer plan that you pay the full pop for.

You have 60 days to elect it from the last date of group coverage but go based on the date you get in the letter.

One note...Cobra goes retroactive back to the last date of coverage even if you elect it later.

For example, if your employer plan goes through May 31st, you'll essentially have June and July to elect Cobra but the coverage will start June 1st!

This means you have to pay the back premium!

That's the big issue with Cobra...it can be really expensive at the absolute worst time.

So...what options do we have?

Essentially, there are two ways to go in Texas:

The short term works if we really only need a few months (new coverage starting) or need a mid month start date.

If we're eligible for a subsidy based on income estimate, the health exchange option might be cheaper.

Let's walk through both!

Health exchange coverage if you lost work coverage

First, understand that the rates, benefits, and networks are identical on or off exchange!

It's called ACA, obamacare, or exchange coverage but all the same!

Anything individual and family is now standardized since 2014 but there's one big difference.

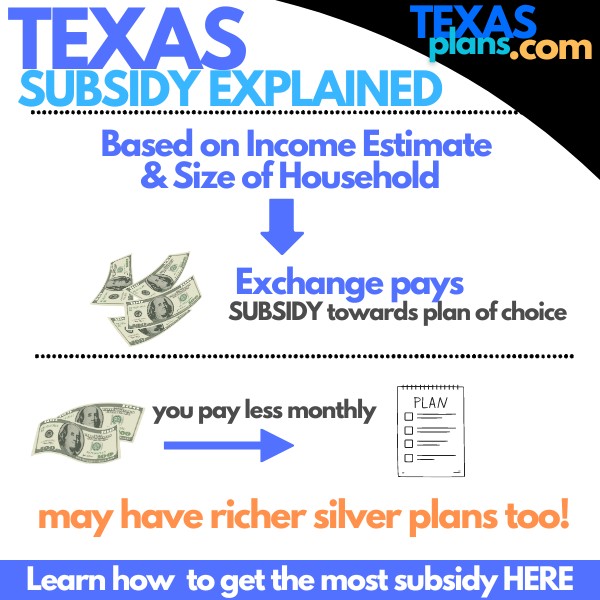

On exchange, we can get subsidies which will bring down the cost of coverage if we qualify based on income.

We looked at how to get the most subsidy in detail but this can really swing the decision.

Run your quote here with the following guidelines:

- Income is estimate for the full year's AGI on the 1040 tax form; next April's filing

- Household is everyone that files together on that 1040 even if not enrolling

We're happy to help with this as it gets complicated especially if you just lost your job!

There's zero cost for our assistance and we just need zip code, dates of birth, and income estimate to run the quotes for you.

Learn how to pick the best Obamacare plan.

One note versus Cobra. The networks can be different between Cobra and obamacare (any individual/family plan) so check that first.

The quote tool above allows you to enter your doctors directly!

You can cancel month to month so that's not an issue if you get other work coverage.

What if we're not eligible for a subsidy and/or we only need temporary coverage?

There's an option for that!

Short term plans if you lost employee coverage

We have a full review on Texas short term health insurance but a few notes.

We're lucky in Texas to have United Healthcare and their strong network for short term!

This works well in the following situations:

- Just need temporary coverage till other options start up

- Need coverage to start mid-month (exchange plans can only start on the 1st following enrollment)

- In relatively good health and just want to cover major medical health issues

Again, check out the review but many people opt for short term if they've lost their job with the thought that they'll have other employer coverage soon.

You can cancel monthly as well.

So...which options is best for you?

How to compare health exchange versus short term

The two options are pretty different. Here are the key highlights but reach out to us with any questions.

If you're eligible for a subsidy, the obamacare plans are way to go most likely

If not, it's then a question of your time table!

Some people are transitioning to self-employment status and the coverage may be needed longer term. Health exchange options will work better there.

Generally, for under 3 months, the short term works fine.

Understand that the ACA or obamacare plans are more comprehensive in what they cover and you cannot be declined based on health.

Short term can decline coverage and they're not as robust so if health is a serious issue, that pretty much makes the decision.

As for cost, it comes down to the subsidy. Otherwise, short term is generally cheaper.

So, it's a combination of:

- Time of need

- Health status and what is covered

- Cost (the subsidy drives this)

Again, check out the Short term guide to learn more.

Of course, we're happy to help with any questions and there's zero cost for our assistance.

So...how much do these options cost versus Cobra?

How to quote both options and even enroll online

We make this free, fast, and easy here for Exchange (obamacare):

Or here for short term:

Remember for the exchange quote:

- Income is best estimate for this year's AGI on the 1040 tax form; next April's filing

- Household is everyone that files together on that 1040 even if not enrolling

Health insurance can get confusing especially when Cobra's in the mix so reach out for some guidance.

We can walk through the pros and cons of all options.

Call 800-320-6269

Chat online here

Pick a time to talk here