Compare Texas on-Exchange (Obamacare) and Off-exchange plans

Things have really changed over the last few years.

Not that long ago, enrollment was about 60% off-exchange and 40% on-exchange.

It's completely reversed and now we're processing almost all application through the Exchange.

We'll explain why below but it's in your interest or we wouldn't do it!

More importantly, we've seen too many situations after enrolling 10's of 1000's of ACA applications since 2014 where enrolling off exchange can cost a person $1000's of dollars in lost subsidy.

More on that below.

What about the boogeyman of doctor selection and more? Doesn't exist. We'll explain below.

Here's our credentials:

Let's dive into the following so you can make a good decision:

- What's the difference between on and off-exchange in Texas health insurance

- The big difference - subsidy on and off-exchange

- Comparing the doctor networks on and off-exchange

- Comparing the plan benefits on and off-exchange

- Enrollment on or off-exchange

- How to get free assistance with either on or off-exchange enrollment

- Quote and apply for on and off exchange

Let's get started

What's the difference between on and off-exchange in Texas health insurance

This is really important to understand since 2010.

On-exchange is Texas' version of Obamacare in the State

Off-exchange just means buying coverage directly from the carriers (like before 2010)

So what's the difference? Is off-exchange better?

There are two main differences that you can get on-exchange (Obamacare) but NOT off-exchange:

- Subsidies that bring down the cost of your chosen plan monthly

- Richer versions of the silver plan; the silver 87 and 94 are on par with Platinum level plans depending on income

Essentially, the on-exchange just applies to the subsidy and offers the richer silver plans.

We looked at how to get the most out of the Texas health subsidy or how to compare the Silver plans.

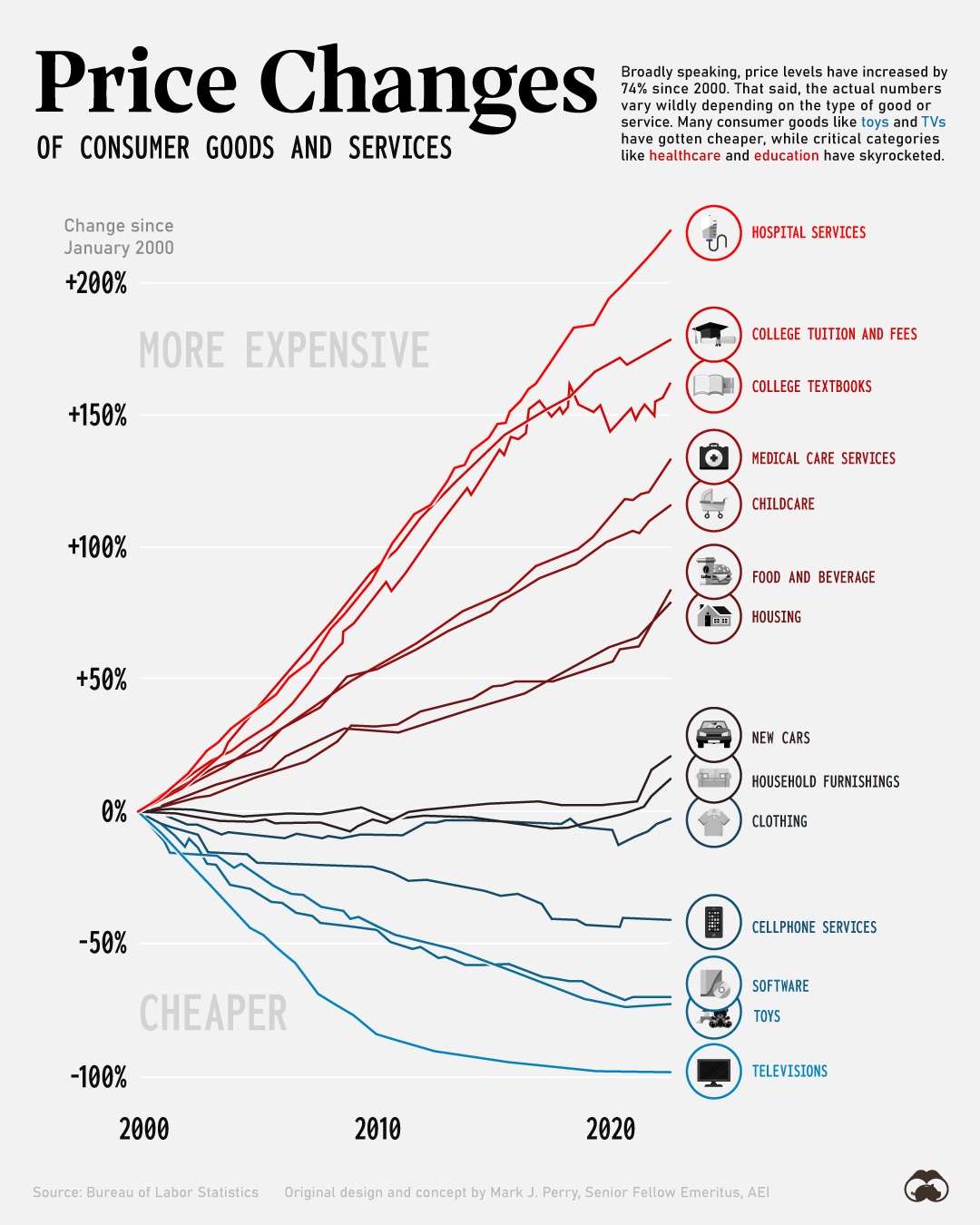

Really, everything revolves around the subsidy these days since the underlying cost of health insurance has roughly tripled since 2010 if not more.

We'll look more at the subsidy piece below but keep in mind...

If you're in the income bracket to get a subsidy but enrolled off-exchange, you'll lose it!

The only way to get the subsidy is to be enrolled on-exchange! We see people realize this after years sometimes that they've been giving away $1000's of dollars because they still had an off-exchange plan.

No doubt some agent or doctor (more on that below) told them that was better way back when.

Otherwise...

The networks on and off-exchange are the same

The benefits are benchmarked to a given level +/- 2% so very similar

The same things must be covered on and off-exchange

It's the subsidy and richer silver plans (if eligible)! That's the difference.

Let's discuss the subsidy in more detail since it literally drives the decision these days.

The big difference - subsidy on and off-exchange

We can't express how important this is between on and off exchange.

Our days are spent helping people figure out their income, household size, and resulting subsidy!

Occasionally, we'll find people who make way over the subsidy level and therefore just want to enroll off-exchange. Fine. It's probably 1 out of 100 these days.

A few notes:

- Does your income change quite a bit year to year (think self employed like real estate agents)?

- Are you close to the cut off for subsidy based on income?

- Any changes in investment income expected including rentals?

- Any changes in your family make-up (marriages, divorces, etc)?

Look, if there's ANY chance we'll qualify for a subsidy, it's found money and we need to enroll on-exchange. There's no downside.

We have the income chart for Texas health subsidy for more detail they got rid of the 400% cap.

This means that people (especially if older) can qualify for subsidies with pretty high income.

Essentially, the new rule says the subsidy should cap your exposure of health insurance at a certain percentage (just under 10%). Even with very large income then, we can still see a subsidy.

Run your quote here to see what you get and if you're situation is more complicated, reach out to us at help@texasplans.com or 800-320-6269.

Again, we do this all day long and there's zero cost for our assistance. We've seen it all!

Here's the next big question that usually comes up...

Comparing the doctor networks on and off-exchange

"Aren't the doctors off-exchange better?"

There was quite a bit of confusion back around 2010 when the law first took effect.

Here's the deal...the networks have to be the same on or off-exchange! By law.

There's just one "individual and family ACA" network but many doctor offices (still) know the branding "exchange" and use that to differentiate from employer-based networks which are broader.

The individual family (whether on or off-exchange) networks are smaller than the employer based plans and are more tilted towards HMO with some PPO and POS sprinkled in for fun.

HMO dominates and this will only continue. The employer plans will probably follow behind since costs are going crazy in health care.

Here's where the confusion comes from. Some doctors will tell members that they don't take on-exchange or Obamacare such and such carrier. They say that they take off-exchange but they mean the employer based plans or old grandfathered plans.

Unfortunately, neither of those are available to enrollees in the individual/family market these days.

Worse yet, they'll show in the online doctor finder network (see next to each plan when running quote) but the doctor will tell them they don't participate.

This is a different deal where the doctor's office is just being difficult.

We expect this to go away over the new few years and here's why.

The enrollment in on-exchange has exploded since 2020. Almost 40% in one year!

The doctors will have to come onboard and stop pushing back as more and more Texans join the plans. Or be out of a business!

More on comparing the Texas exchange networks.

What about the plans themselves? Any differences?

Comparing the plan benefits on and off-exchange

There's generally a "standard" benefit plan at each of the 4 levels:

- Bronze: high deductible; lowest cost; high max

- Silver: mid deductible; copays now for office and RX; high max

- Gold: low deductible, richer copays; still high max

- Platinum: low/no deductible; richest copays; possible reduction of max

Learn about how to compare the four different plan levels in Texas.

This "standard" plan is generally on and off-exchange with the same pricing.

Look at how we take care of you!!

There can be different "flavors" at each metallic level but they can't differ from the standard by more than 2% up or down.

So...a silver plan is going be to really similar to another silver plan regardless of the carrier, network, or whether on or off exchange!

This makes it much easier and there's no real advantage to going off-exchange.

So, we've covered networks, subsidy, and benefits. What about enrollment?

Enrollment on or off-exchange

This depends on which way you go.

First, off-exchange during open enrollment is pretty easy. After that...good luck.

The carriers really make you jump through hoops to qualify for SEPs (Special Enrollment Periods).

The on-exchange application is so much easier IF you process it with a group that does this all day long.

Our simplified Texas on-exchange application generally takes 5-10 minutes versus the 45 minutes standard one.

More importantly, we go through it on this side to make sure you're getting the full subsidy and that nothing will cause an issue in the system.

This can be a lifesaver! There's zero cost for our assistance with enrollment.

You can enroll off-exchange through the same quote tool here but a few caveats:

- Make sure you're not eligible for ANY subsidy (check with us at help@texasplans.com)

- Watch out for enrollment outside open enrollment; the carriers really push back

- Make sure you look at all the carriers to get the best value and network

Really, it's the subsidy as we've beaten home many times above. Let's go through your situation and we'll do a quick spot check based on all the different pieces that can affect this.

Here's the net net...

Roughly 99% of our enrollment these days are on-exchange. From 40% a few years ago.

The pendulum has swung! How do you navigate all this without pulling your hair out?

How to get free assistance with either on or off-exchange enrollment

In 5 minutes, we can quickly size up whether on or off-exchange is right for you. Another 5 and we can even pinpoint the right plan.

The average time to enroll on the exchange is about 45 minutes!

And it's like filling out a tax form. That much fun.

As licensed Texas agents, there's zero cost for our assistance and look at our reviews above.

We really do try to help people find the best options. If we don't see one...we'll tell you. Do it all the time.

There's still a lot of push back in industry from the 2010 changes but our goal is simple.

If we can find you equivalent coverage for a much better rate (after subsidy), well, that's in your interest. Let's go there.

What if you want to quote both on and off exchange plans to check what we're saying?

Sure.

Quote and apply for on and off exchange

You can access both on and off exchange plan rates in Texas here:

A few notes.

- Household is everyone that files taxes together for this year (next April's filing)

- Income - estimate for this year's AGI on the 1040 tax form (next April's filing)

Make sure to enter that into the system so you can see what the subsidy will be. Most likely, this makes the decision!

Reach out with any questions. help@texasplans.com 800-320-6269 or pick a time to chat here.