What Income is Used for Texas Health Subsidies

It's probably how we spend half our time these days.

Health insurance was already complicated but now they've also added a dose of taxes, everyone's second least liked thing (after health insurance).

With 10's of thousands of ACA enrollments since 2014, we've seen it all and people's income situations can get tricky.

Job changes. Self-employment. Changing households (marriage, births, divorces, etc).

Then there's the question of what exactly should be included!

We'll go through all of that but first, our credentials:

If you just want to talk to someone about your situation and make sure it's correctly, reach out to us for free assistance:

This is what we'll cover:

- How income affects our Texas health insurance costs

- What income is included for the Texas health subsidy

- What period of time do we look at for the estimate

- Whose income is included in the estimate

- What if we're wrong with the income estimate?

- How to quote Texas exchange plans with our new estimate

- Where can I get free help with income estimate for Texas Obamacare subsidies

Let's get started!

How income affects our Texas health insurance costs

Income is the star now when quoting Texas health plans.

It by far has the most impactful piece now since it can cause our monthly premiums to drop by $1000's each year.

We may also be eligible for much richer silver plans based on income now (see the silver 87 and 94 plans in Texas).

A few notes:

- We can only get the subsidy if we apply for exchange coverage (enrollment available here).

- On and off-exchange plans are identical by law.

- Same Benefits, Networks, and Rates

It goes by many names but don't get swayed by this whether it's ACA, exchange, or obamacare.

All the same thing but the subsidy can only be found on-exchange. That's why 99% of our enrollments go that route these days.

So...we're supposed to enter our income estimate in the system and get a subsidy based on it.

If only it were that easy!

Let's break it down into the three big components but reach out to us with any questions for 100% free assistance on the income estimation process!

Let's get to it.

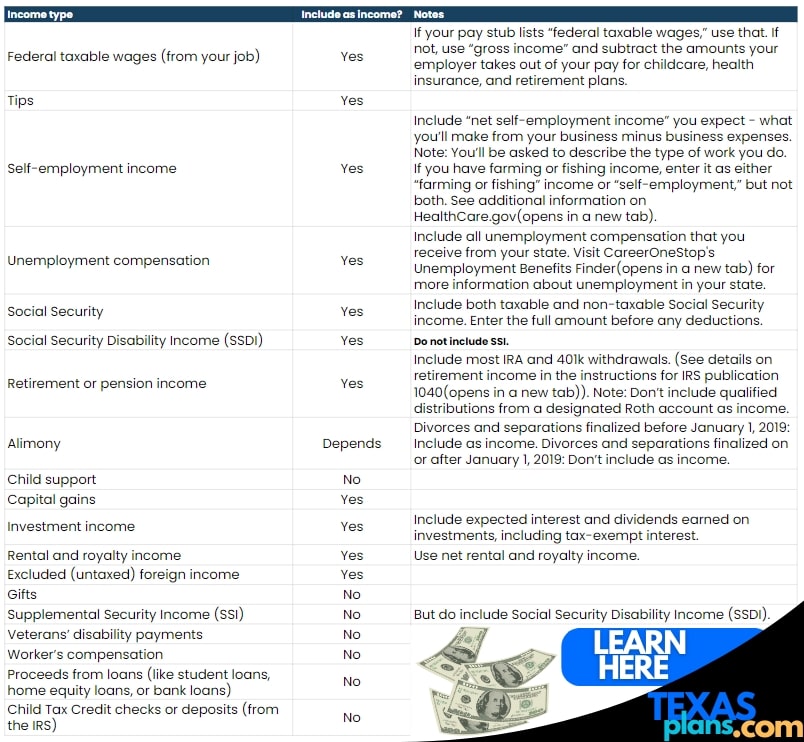

What income is included for the Texas health subsidy

We're trying to estimate our AGI on the 1040 tax form for the year we're trying to insure.

Technically, it's the MAGI but just adds three less common sources to the AGI on the 1040:

- Foreign income

- Tax-free interest

- Untaxed Social Security

Again, not very common but we're supposed to add those to the AGI.

Let's go back to the AGI since that really addresses most people.

What are the most common incomes we see day to day:

- W2 income - gross income you get from an employer before deductions (taxes, etc)

- Self-employment income (1099, sole proprietor, etc) - net business income AFTER business deductions

- Unemployment - income expected amount as well

- SSDI disability - disability income from Social Security (but not SSI)

- Social Security retirement income

- Rental income - net income after rental expenses

- K1 and other distributions - LLC, corporation, etc

- Capital gains - investment gains and income

Those are the big ones. Reach out to us with any specific situations.

If you want get specific:

Again, all this should flow down to the AGI on the 1040 tax form so you can look at the previous year to get a sense of how that actually looks but keep in mind that's old news in terms of our estimate.

So...an easy example.

I make $2000/monthly. That's $24K estimate I'll enter in the system.

You can run your quote right here if it's that easy:

There are some deductions "above the line" that we see:

- HSA contributions

- ½ of the self-employment tax

- Higher education allowable deduction

Again, you can see them right there above the AGI line on the 1040.

Remember, that health insurance premium can be 100% deductible to self-employed as long as we have net income to cover the cost. Huge deduction!

But we should talk about the period of time. Let's go there now.

What period of time do we look at for the estimate

This is always the trickiest part...especially for self-employed or people whose income is in flux.

We're trying to estimate THIS year's income.

For example, if I'm looking at coverage for 2024, I want to estimate 2024's income or what we'll see on the April 2025 tax filing at that AGI line (1040 tax form).

Last year doesn't matter. It's done!

Even if your income is going to be much different from last year to this year, we still look at the current estimate.

We see situations all the time where income goes much lower or higher from year to year (such as selling a property, etc) but we're only focusing on the current year.

This can get tricky so reach out to us. It's an estimate after all.

Finally, exactly who is included in terms of this income estimate?

Whose income is included in the estimate

The simple answer is... everyone who is on the 1040 tax form together!

In the year in question (next April's tax filing).

There are many situations we see that rock this boat:

- Two single people getting married this year

- Same with divorce

- Claiming dependent parents, older children, etc

- Financially dependents who are not on our 1040

If your situation is changing or more complex, reach out to us get free assistance.

Don't go this alone as it can really cost you!

Their definition of "household" is everyone that files together on the 1040 even if not enrolling!

We can run the numbers for you.

Just let us know:

- Zip code

- Dates of birth

- Best estimate for income based on above

We'll get to work and go through any questions you have on the above. What if the estimate turns out wrong?

What if we're wrong with the income estimate?

For some people, this estimate is nearly impossible.

Self-employed people. Retail. Etc.

They may not know their "net" income until they file taxes the following April.

So what happens if we're off?

First, we can update the income estimate for you easily on this side anytime during the year so reach out if our income picture has changed significantly.

So, three scenarios:

- Estimate was too high compared to actual AGI the following April

- Estimate was too low compared to actual AGI

- Estimate was below the Medicaid level (100% - see income chart below)

This will all settle out the following year when we file taxes

- If our estimate was too high, we'll likely recoup the extra subsidy that we were eligible for.

- If our estimate was too low, we'll have to pay the extra subsidy back as part of our tax bill.

Depending on our income, we may have to pay back a percentage of the extra tax credit. They don't want to hit people in lower income ranges with a big tax bill.

There's a quirk in the system where we don't qualify for subsidies below the 100% level on the chart below.

Technically, we're in Medicaid range but in Texas, there are other requirements for Medicaid (usually pregnant or disabled - SSDI).

Here's the chart:

In the original ACA law, there was $300 penalty for estimating above the 100% level but ending up under it but they've never charged that and we don't expect they'll start.

It would hit the very people they're trying to help and estimating a full year out is really difficult for most people.

Again, avoid a nasty tax bill or maybe worse, missing out on richer silver plans and more subsidy now by getting free help with the income estimate.

How to quote Texas exchange plans with our new estimate

We make this fast, free, and easy here:

You have a rough sketch of the income piece and household is everyone that files on that 1040 tax form, even if not enrolling.

Our simplified Texas Obamacare application is here and we'll process it with a confirmation generally in 24 hours unless we see something that will prevent you from getting the best subsidy.

Speaking of which...

Where can I get free help with income estimate for Texas Obamacare subsidies

We're certified Texas health exchange agents and we've enrolled 10's of 1000's of ACA health plans with every sort of income situation you can imagine.

Our assistance is 100% free and check out the Google reviews above. We can save you a ton of time and possibly $1000 in cost. Get free help with health subsidy calculation for Texas.

Roughly 50% of people we see who self-enrolled made mistakes on the exchange app that costs them subsidies, richer silver benefits, or nasty tax surprises.

Reach out to us here: