The 150% Income Trigger for Texas Obamacare

This may be the best kept secret for Texas individuals and families which also packs the biggest punch.

We're talking potentially $1000's in insurance premium plus $1000's in better benefits if you get sick or hurt.

It's buried deep down in the SEP (Special Enrollment Period) triggers and for good reason.

This little rule allows eligible people to enroll right away for the most benefit!

First, here's our credentials:

This is what we'll cover:

- Quick intro to Texas special enrollment triggers

- How the subsidy works at 150% level in Texas

- The enhanced silver 94 plan for Texas Obamacare

- How to quote your 150% subsidy and plans

- How to enroll in the silver 94 in Texas

Let's get started!

Quick intro to Texas special enrollment triggers

Most people know there's an open enrollment each year from Nov 1st - Jan 15th.

People can change or enroll in plans regardless of health and with no other qualifying event.

More on the Texas Obamacare open enrollment here.

Outside of this period, we need special triggers to enroll during the rest of the year.

Here are the big ones:

- Loss of other coverage (medicaid, employer, resulting from move, etc)

- Move to/within Texas that affects coverage options

- Family make-up changes: marriage, divorce, birth, death, adoption, etc

- Legal status changes: citizenship attainment, ending of incarceration, etc

Those are the big ones but there's a slew of smaller ones. We have a full review of when you can change or enroll in Texas Obamacare.

Hiding at the bottom of the list on the Federal website with very little explanation is this little beauty:

Your estimated household income is within a certain range.

Okay...a little cryptic.

It's not even on the main page! Buried under "complex issues" on a separate page.

Hmmmm Very sneaky, sis.

So, what exactly is this trigger and why is utterly fantastic for maybe millions of Texans?

The 150% Special Enrollment Trigger in Texas

Essentially, if your income estimate for this year (AGI on the 1040 tax form; next April's filing) is under the 150% of the Federal Poverty Level, you can enroll now.

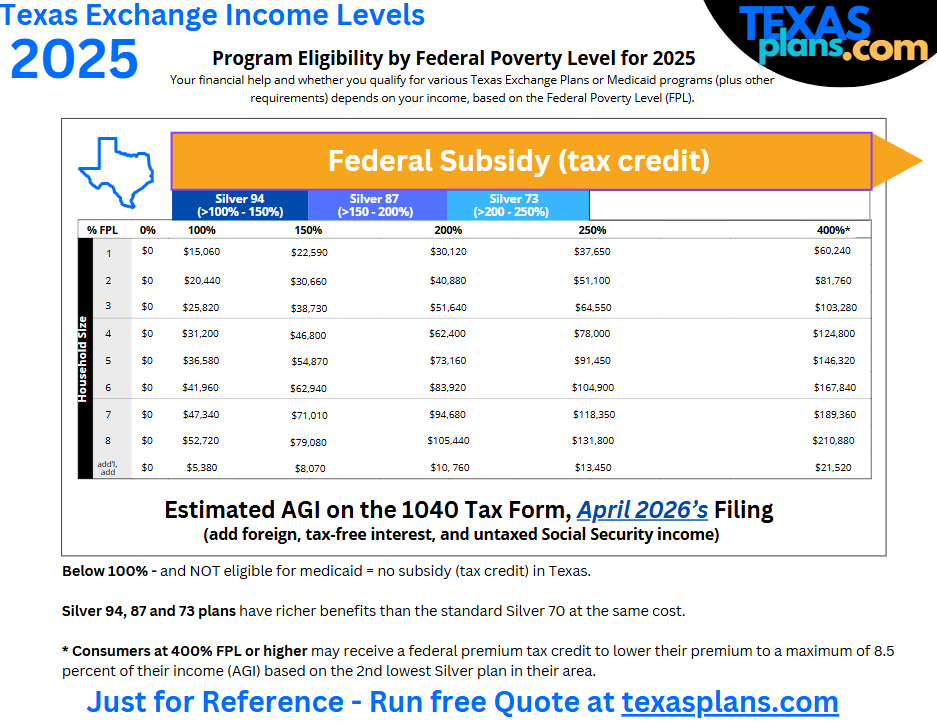

Here's the income chart:

Their definition of household is everyone that files together on that 1040 tax form mentioned above. Next April!

So, for an example...

An individual who makes between $14,580 and $20,783 (2024 info; changes each year so reach out to us if you're close).

It's between the 100% and 150% level. Below 100%, you get nothing unless you're eligible for medicaid (usually pregnant or disabled).

But...if you're between 100% and 150% for your estimate (full year), it's game on!

This allows you to enroll now.

Many things can drive this enrollment:

- Not aware that you're eligible to qualify based on your income. About $10/hour at 40 hours or $400 weekly. $1700/monthly for a single individual (goes up with dependents).

- Loss of income or job resulting in drop in income estimate into the range

- Increase in income out of the medicaid range (below 100%)

Most people just don't realize they're eligible for huge help on health insurance for both the monthly premium AND the benefits.

We see plans down to zero per month in premium.

You can run your quote here:

So...how does the subsidy work?

How the subsidy works at 150% level in Texas

The subsidy comes off monthly and it's based on your income estimate for the year.

It decreases on a sliding scale as our income goes up but the 100%-150% level has the highest subsidy!

As we mentioned above, it's not uncommon to see premiums down to zero! This is found money so make sure to take advantage of it.

- Again, we need our income estimate for the full year to fall in this range.

- We must enroll through the Exchange and we can complete the app

here.

- We need to file taxes for the year in question (next April's filing).

This gets complicated so reach out to us for free help at help@texasplans.com or 800-320-6269. Pick a time to chat here.

Let's take an example:

- Monthly premium is $300/month

- Subsidy based on the income estimate is $290/month

- Your bill from the carrier of choice will be $10/monthly

Again, it's not unheard of to see premiums of zero.

We'll show you how to run your quote below.

Let's talk about the other benefit that being under the 150% range gives you in Texas.

The enhanced silver 94 plan for Texas Obamacare

If you're in this 100-150% range, you're also eligible for the silver 94.

This plan is 4% richer than the platinum plan but for the same price as the normal silver.

Here's the benchmark silver 94 as an example:

It's the richest plan on the market! No reason to go higher and it's a big reason the silver the most popular plan by far.

You can go down to the bronze for a lower price (with the subsidy) but any thing that pops up healthwise will quickly make the silver 94 pay for itself.

So, now we have the following trifecta:

- Can enroll anytime during the year

- Richest subsides for the lowest monthly premium, sometimes zero

- Richest plan benefits with the silver 94

No wonder it's buried on a back page since there are 100's of 1000's that are eligible in Texas.

For a family of 4, it's under $45K household income currently (goes up each year).

Let's see what you qualify for now.

How to quote your 150% subsidy and plans

You can run your quote free and fast here:

A few notes.

- Income estimate is the AGI on the 1040 tax form, next April. Full year estimate.

- Household is everyone that's on that 1040 even if not enrolling

If your income is more complicated, reach out to us as experts for free assistance here:

- help@texasplans.com

- 800-320-6269

- Pick a time to chat here

Don't do the income piece alone since the outcome (above) can mean $1000's in your pocket.

We've helped 10's of 1000's of people navigate this process and there's zero cost for our assistance.

Learn how to compare the Texas carrier or Texas networks since we have the plan dialed in already (Silver 94).

What about enrollment?

How to enroll in the silver 94 in Texas

This is also easy!

You can access the online application here (free to apply):

We're happy to walk through any questions you have and if you want to complete an online app offline and have us enter it, no problem. We'll catch any issues before submittal this way and there's no cost for our assistance!

We need to apply prior to the 1st of the month that we want the plan to start so don't delay.

Especially if we can find plans with zero premium and super rich benefits.

Happy to help compare the carriers and networks as well.

Reach out to help@texasplans.com or 800-320-6269. We love helping people lock down this savings.

It really is $1000's of found money.