Top Tips to Master the Texas Obamacare Open Enrollment

They've crushed the Holidays for us but let's at least get some positive from it.

Every year during open enrollment, we need to "re-shop" the market since things can change quite a bit.

We'll look at the key points below to make sure you're getting the most subsidy, lowest rate, and best fit for your needs.

Roughly 50% of people who self-enroll are missing out on subsidy or worst yet, getting too much that they'll have to pay all back at tax time.

Let's avoid both of these situations.

First, our credentials:

This is what we'll cover:

- The basics of Texas Open Enrollment for health insurance

- Updates to income during open enrollment - the biggest deal!

- Watch out for changing income caps and other pitfalls!

- Changes in carriers, plans, and networks with open enrollment

- Tips on comparing the different plan levels

- Quoting and enrolling in new coverage during Open enrollment

- Get free expert advice on changes during open enrollment

Let's get started!

The basics of Texas Open Enrollment for health insurance

First, the lay of the land.

Open Enrollment is technically from Nov 1st to Jan 15th.

To get a Jan 1st eff date, we must enroll or change coverage by Dec 15th unless we're losing other coverage (employer, medicaid, from move, etc).

If we enroll from Dec 16th to Jan 15th, we'll get a 2/1 effective date at the earliest.

After that, we need a special enrollment trigger and you can learn more about when you can enroll in Texas obamacare here.

One note... we use the term Obamacare but the same rules apply to both on-exchange and off-exchange enrollment.

We can only get the subsidy (more on this next) and richer versions of the silver plan based on income On-Exchange!

Almost 99% of our enrollment these days is on-exchange since the benefits, networks, and pricing is the same on or off.

Our free on-exchange enrollment is so much easier here:

Open enrollment is the time to make changes for the following year including:

- Basic household info including who will file together on a 1040 tax form (definition of a household)

- Income estimate for the following year (more below)

- Plan selection - we can move to any plan or carrier regardless of health!

Those are the big ones but we're happy to walk through the whole process!

Usually, it comes down to income and plan selection based on the income. Let's go there now.

Updates to income during open enrollment - the biggest deal!

The whole individual family health insurance world revolves around income and subsidies.

It can mean $1000's in your pocket!

The biggest mistakes we see usually come down to income since health insurance enrollment is almost like a tax form these days.

We have a big review on getting the most subsidy for Texas Obamacare.

There are two pieces:

- Household is everyone that will file on a 1040 tax form together even if not enrolling

- Income estimate for the AGI on the 1040 tax form; April of the following year.

So... if we're in open enrollment, Nov 1st of 2024, we're trying to estimate our income for 2025, or the AGI on the April 2026 tax form!

This can be really tough for many people. Think self-employed, people in work transition, etc.

Reach out to us at help@texasplans.com or 800-320-6269 to go over this. We've helped 1000's of people do the very same thing and there's zero cost for our assistance.

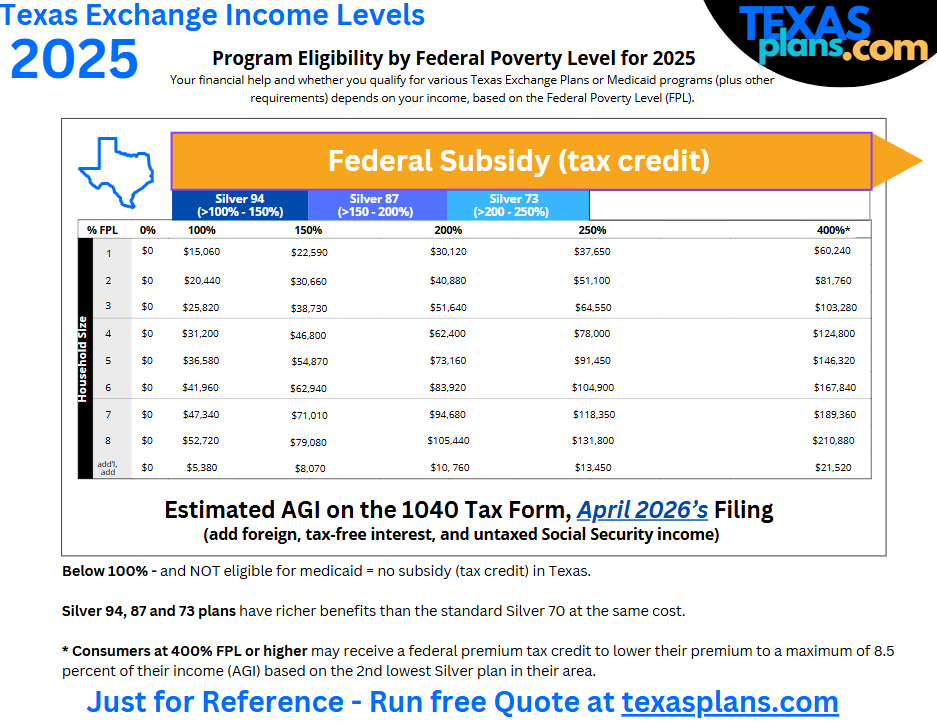

Here's the income chart as a basis but our quote engine will automatically calculate the new subsidy during Open Enrollment.

We have a big guide on the income chart and how to use it but a few key traps to watch out for around open enrollment.

Watch out for changing income caps and other pitfalls

The income caps (for medicaid at 100% on the chart above) get updated each year around open enrollment.

So, you may be on the silver 94 (a very rich plan - see enhanced Texas silver plans) this year based on income and when up increase the income cap, you drop into medicaid eligibility.

You may find out one day your rich plan is canceled! We see this all the time if people don't re-evaluate their income.

We can easily help people process these changes in the system since that's never much fun either.

The same thing goes for the richer silver plans (73, 87, and 94). You may be on the silver 87 and with the new income revisions, find yourself on the much less rich silver 73.

Check in with us for the new income guidelines as we generally have those right around open enrollment.

The other issue we see is if a carrier pulls a plan that you were on. If you're not paying attention, you may find yourself without coverage.

This also goes for requests of information to verify certain things like income, eligibility, etc.

Open enrollment is a good time to make sure everything looks good in the system.

Then there's the joy of plan changes and comparisons.

Changes in carriers, plans, and networks with open enrollment

If there are going to be changes, it usually occurs during open enrollment for the following year (Jan - Dec).

- Carriers can come and go

- Plans get updates and some are added/removed within carriers

- The standard benchmark benefits get updates slightly (hopefully)

- Networks can change all over the place!

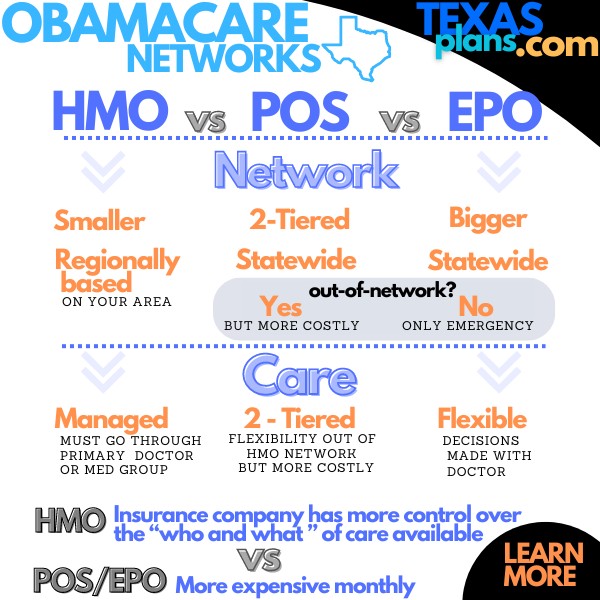

The last one is tricky. There's been a general trend towards HMOs on the market (see comparing Texas obamacare networks) and this will likely continue.

We have a sprinkling of EPOs on the market which work like a PPO but with no benefits out of network other than a true emergency.

It's more a question of whether your doctor is STILL in-network with your plan AND is your current plan still the best fit for you next year based on open enrollment changes.

Our quote engine below will have a doctor finder link by every plan for the Texas open enrollment but let's touch base on the plans.

Tips on comparing the different plan levels at open enrollment in Texas

This is always the hard part. Let's face it... you're not comparing health plans the other 360 days of the year (lucky you)!

We have a guide on how to pick the best Texas obamacare plan or how to compare the Texas metallic plans but a few quick tips.

- Figure out your subsidy first based on income (reach out with questions on this)

- See what carriers/networks your doctors participate with

- Narrow down the plan level that fits best (silver is by far the most popular)

Sounds easy. It's not and we're here to help.

The rule of thumb is...

Go with the lowest priced plan at a given metallic level that takes your doctors!

Just a head's up... If you're offered the silver 87 or 94, those are really hard to beat.

Here's the benchmark plans which will updated (hopefully ever so slightly) at open enrollment.

So... let's see those new Open Enrollment rates and plans.

Quoting and enrolling in new coverage during Open enrollment

The new open enrollment rates and plans will be loaded into the system by Nov 1st and you can access them for free here:

A few notes:

- Household is everyone that will file for taxes together on a 1040

- Income estimate is for the following year generally (since we're in Nov-Dec) and is the AGI on the 1040 tax form, the year after that!

Reach out to us if any of this is confusing.

For 2024 Open Enrollment, basically your income estimate for 2025, April 2026 tax filing AGI.

If your income is really variable from year to year, reach out to us and we'll explain how to strategically do this in your favor.

Speaking of which.

Get free expert advice on changes during open enrollment

We have helped 10's of 1000's of people who through open enrollment since 2014.

Seen it all!

There's zero cost for our open enrollment assistance and you can see by the reviews above that we really do try to help people navigate this tricky period.

More importantly, in 10 minutes we can usually size up the best approach and get you enrolled with confidence.

Again, half the people we come across who self-enrolled have issues that can really cost them.

help@texasplans.com or 800-320-6269. Pick a time to chat here.

How can we help crush Open Enrollment in your favor!