Child Only Texas Health Plans Explained

We get these calls daily. How do I get coverage for just my kid(s) in Texas?

Luckily, there are options and we may even be able to get subsidies to bring down the cost.

Plus, all the ACA plans cover dental and vision for kids under age 19 as part of the medical plans!

Don't worry about the terminology as we'll explain the whole landscape and how to get the best value below but first, our credentials:

First our credentials:

This is what we'll cover:

- What are the options for child only health plans in Texas

- Can I get a subsidy for just my child on-exchange?

- What child-only plans will take my child's pediatrician?

- What's the best plan for child only plans in Texas?

- How to quote and enroll in Texas Child-only plans

Let's get started and check that one off our to-do list!

What are the options for child only health plans in Texas

First, we need to clear out some confusion about the individual/family market.

Since 2014, the whole market is pretty standardized and it has many names.

Obamacare, exchange, ACA plans. All the same thing!

Same networks, benefits, and rates by law. On and off exchange are also the same thing except for one big difference!

Subsidies to reduce the cost based on income which we'll discuss next since child-only plans are a little different here.

Usually, people are looking for child-only plans because it's too expensive to add them to their employer plans.

The good news is that we can get a plan for just a child (without the adult enrolling) but we need to follow the rules on when you can enroll.

It's generally one of two different situations:

- Open enrollment - Nov 1st - Jan 15th of each year with Jan 1st being the earliest effective date

- Special enrollment trigger

With child-only plans, the most common triggers we see are:

- Loss of coverage: prior employer, Medicaid, CHIPs, etc.

- Move within or to Texas that affects health care options

- Big family changes like births, marriages, deaths, adoptions, divorces, etc.

We have a big review on when you can enroll in Texas health insurance but check with us as there are all kinds of situations and we'll evaluate yours to see what we can do.

If your child drops off your employer-based plan, that's essentially a loss of coverage and special enrollment trigger!

The next big topic is cost and subsidies are the key there!

Can I get a subsidy for just my child on-exchange?

We can help with this as it gets confusing fast.

First, the subsidy can reduce the cost of monthly premiums AND may even offer much richer versions of the silver plan.

All based on income but whose income?

- We look at the household's best estimate for this year's income; AGI on the 1040 tax form next April

- Household is everyone that's on that 1040 tax form; even if not enrolling

So...let's say we have a single parent making $45K who has two children.

The parent can enroll just the two children and there may be a subsidy for them to enroll on-exchange.

We'll show you how to run this quote below to see how much they're eligible for.

There's one important note about enrolling just children this way if the parent has employer coverage.

If the employer offers "affordable" coverage where your share for the family (you and dependents) is less than 8.39% of gross income, we will not get subsidy.

Now, the good news is that usually, employers will contribute quite a bit to an employee's coverage but not to dependent's coverage.

So, it might be pretty "affordable" for the employee to take the plan but adding the dependents pushes them over the 8.39% of gross income.

Reach out to us and we can help with this calculation at no cost to you:

Just let us know your dates of birth, zip code, monthly share of the employer plan (how much you would pay), and monthly gross income.

We'll let you know if you meet this requirement and even run the quotes for you or for your dependent child(ren).

Again, we can enroll just the kids on a separate plan on-exchange either way. It just nice to have the subsidy which brings down the cost.

The next question usually revolves around doctors the kids use.

What child-only plans will take my child's pediatrician?

We have a full range of carriers and networks to choose from for child-only.

BCBS of Texas, United, Ambetter, Aetna, Cigna, and more. See Texas carrier comparison.

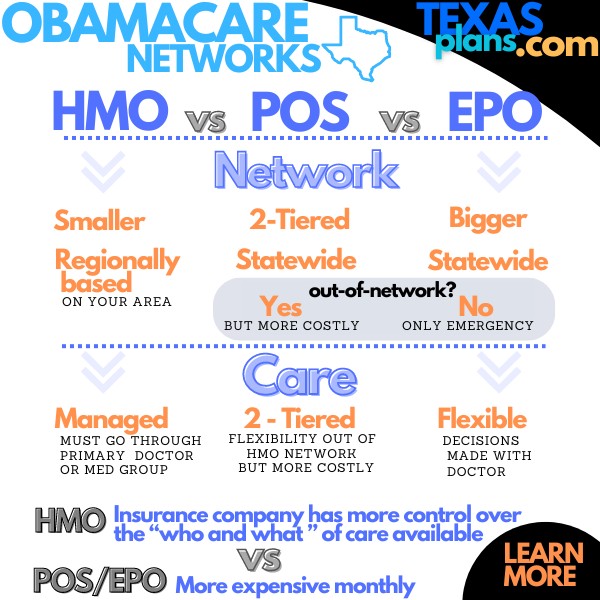

Then there are the networks which generally reflect HMO or EPO on the individual/family market in Texas.

Big guide on how to compare the Texas health exchange networks but we make this even easier!

In the quote tool below, you can enter your doctors and the system will show you which plans will participate with them!

We can't tell you how helpful this is compared to the old way of doing things.

You can always call the doctor's offices and ask them "what Texas exchange plans do you participate with" but the online tool is so much easier.

EPOs work like PPOs but there are no benefits out of network other than a true emergency.

It's really a comparison between HMOs and PPOs these days.

What about the actual plans?

What's the best plan for child only plans in Texas?

This comes down to cost and your expected medical care needs for the child-only plan.

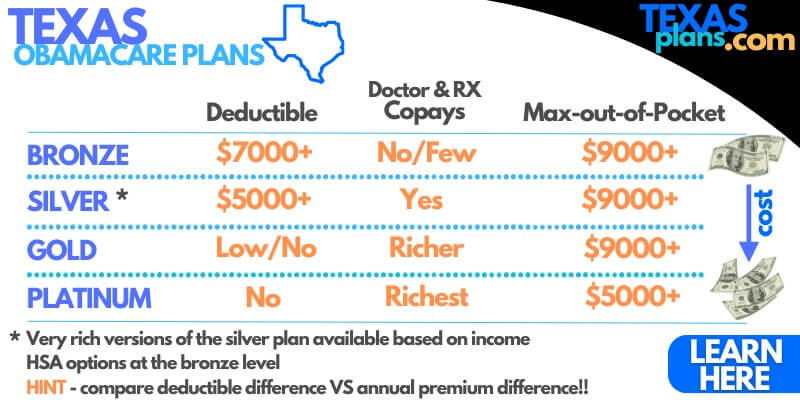

There are four basic levels on the market (again, on and off exchange are the same now):

For most people, the silver is the most popular by far since it starts to offer copays for office visits and RX but the deductible keeps the costs lower.

If a child has more extensive health care needs beyond office and RX, the gold gets rid of the deductible!

You then compare the deductible difference versus the annual premium savings to see how that stacks up but there's good news for kids in this regard.

The premium jump from silver to gold is usually not too bad for kids!

Not true for people age 40 and up.

For this reason, if your child(ren) have more serious health care needs or always seem to end up in the ER, going up the scale might make sense.

Here are the benchmark plans but we're happy to walk through this part of the puzzle since everyone's needs are different.

Finally, the part that matters and this is a little trickier for child-only plans.

How to quote and enroll in Texas Child-only plans

You can quote plans for your child(ren) fast, free, and easily here:

You'll have access to either on OR off-exchange plans (direct with the carrier).

If we might qualify for a subsidy, it's important to quote on-exchange.

Enter your size of household (for example, 3) but only your child's information (zip code and date of birth).

If you don't want Medicaid or CHIPs, we can enroll with no income information and get the standard plans but with no subsidy.

Again, roughly 50% of people who self-quote and enroll end up missing out on benefits because it's so confusing so reach out to us, tell us what you want to do, and we'll chase it down.

There's zero cost for our assistance here:

We also have a simplified online enrollment form so you don't have to battle through the full exchange app with its many pitfalls (that 50% error rate above!!).

How can we help?