How to Compare Texas Health Exchange Plans

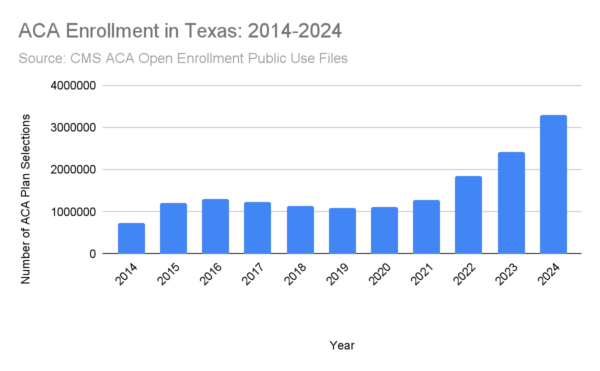

The numbers of Texans that are finding found money through the exchange keeps growing:

https://texas2036.org/posts/texas-crosses-threshold-of-3-million-covered-by-aca/

We'll explain why below but also note this is only 10% of the population!

Look...the benefits and networks are standardized for on and off exchange now.

Our goal is to find Texans the best value for health insurance and if we can get a subsidy of potentially 1000's per year for the same coverage and network...well then let's go there!

Our credentials are here:

But how do we compare all the plans available once we figured out our subsidy (more guidance on the subsidy piece)?

Below is the rough sketch that will handle about 80-90% of your questions but reach out to us with the remaining amount as there's zero cost for our assistance!

Let's cover the following:

- Quick lay of the Texas exchange plan landscape

- Tax Credits are the biggest deal

- Enhanced Silver Plans especially 87 and 94

- Finding the right network for you

- How to really compare the metallic levels

- What about just catastrophic Texas coverage?

- Quoting and enrolling in a Texas Exchange Plan

Let's get started!

Quick lay of the Texas exchange plan landscape

Texas decided to piggyback the existing Federal Exchange to save money which is smart.

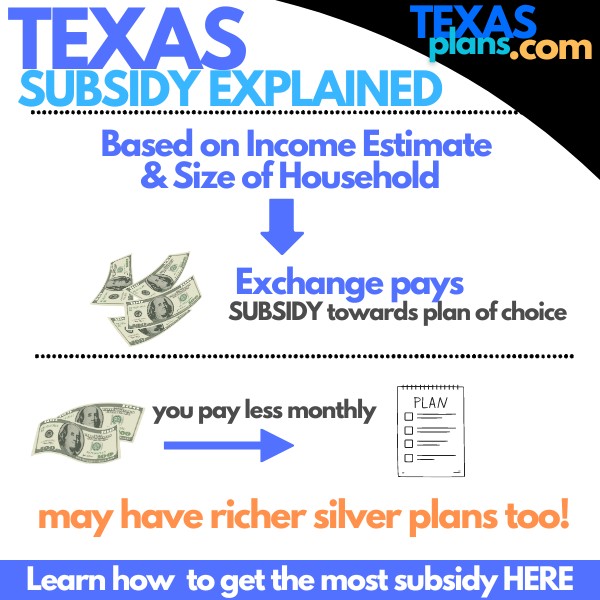

The Exchange is just a means to process and apply the subsidy (subsidy). Point.

Your actual health insurance will still be with the carrier directly. You pay the carrier. You get coverage from the carrier.

All the Exchange does is reduce the amount you pay monthly based on income. That's it!

There's no difference in benefits or doctor networks (or even price outside of the subsidy) between on-Exchange and off-Exchange (direct with the carrier which you can also quote below).

So why even go off exchange? Some people will definitely not qualify for a subsidy because income is too high. They don't look at assets for eligibility as an aside.

For these people, enrolling direct with the carrier might skip the Exchange step but that's about it.

Let's assume you'll qualify for a subsidy (you would be surprised how high income can do and do so). That's really the first question and step and our quoting tool takes care of all of it. For free!

Tax Credits or Subsidies are the biggest deal

We have a whole guide on getting the most Texas health exchange subsidy but a little intro since it's so important.

A few key notes:

- The subsidy is based on THIS year's income (last year doesn't matter)

- We want to estimate the AGI on the 1040 tax form for next April's filing

- Household is everyone that files together on a 1040 tax form even if not enrolling

- Generally W2 gross for employed or net business income for self-employed

- You get the subsidy right away...comes off your monthly premium

- It all settles out tax time the following year if you under or over-estimated

- We can adjust income estimates any time during the year and we can do this for you

Those are the broad strokes but check out the guide above.

How much are we talking and what's the limit?

It can really be a lot of money! We see $1000's/year all day long.

Age really affects the amount we'll get as health insurance gets more expensive with age and so the subsidies go up as well.

Below a certain amount, the system will offer medicaid IF you meet other qualifications. Above that levels we start to get the most subsidy on a sliding scale (decreases as income goes up).

The easiest way to see your subsidy estimate is to run a quote here and make sure to include your full household even if not enrolling (everyone that files together on a 1040 tax form).

People can have really complicated income situations so reach out to us. Changes mid-year (jobs, marriages, births, divorces, etc) can all rock the boat.

We'll guide you through this process at no cost. Reach out to help@texasplans.com or by chat here. 800-320-6269

Okay...that's off the table. Let's start to tackle the plans now.

Enhanced Silver Plans especially 87 and 94

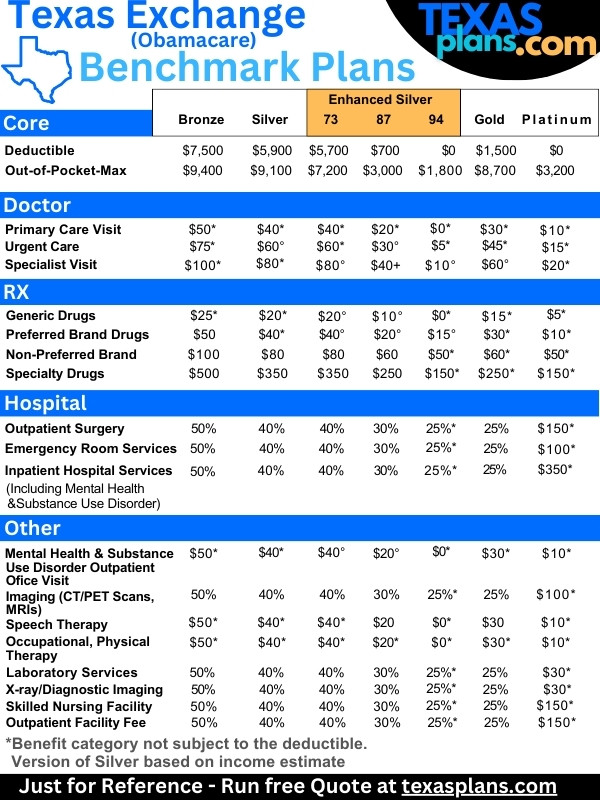

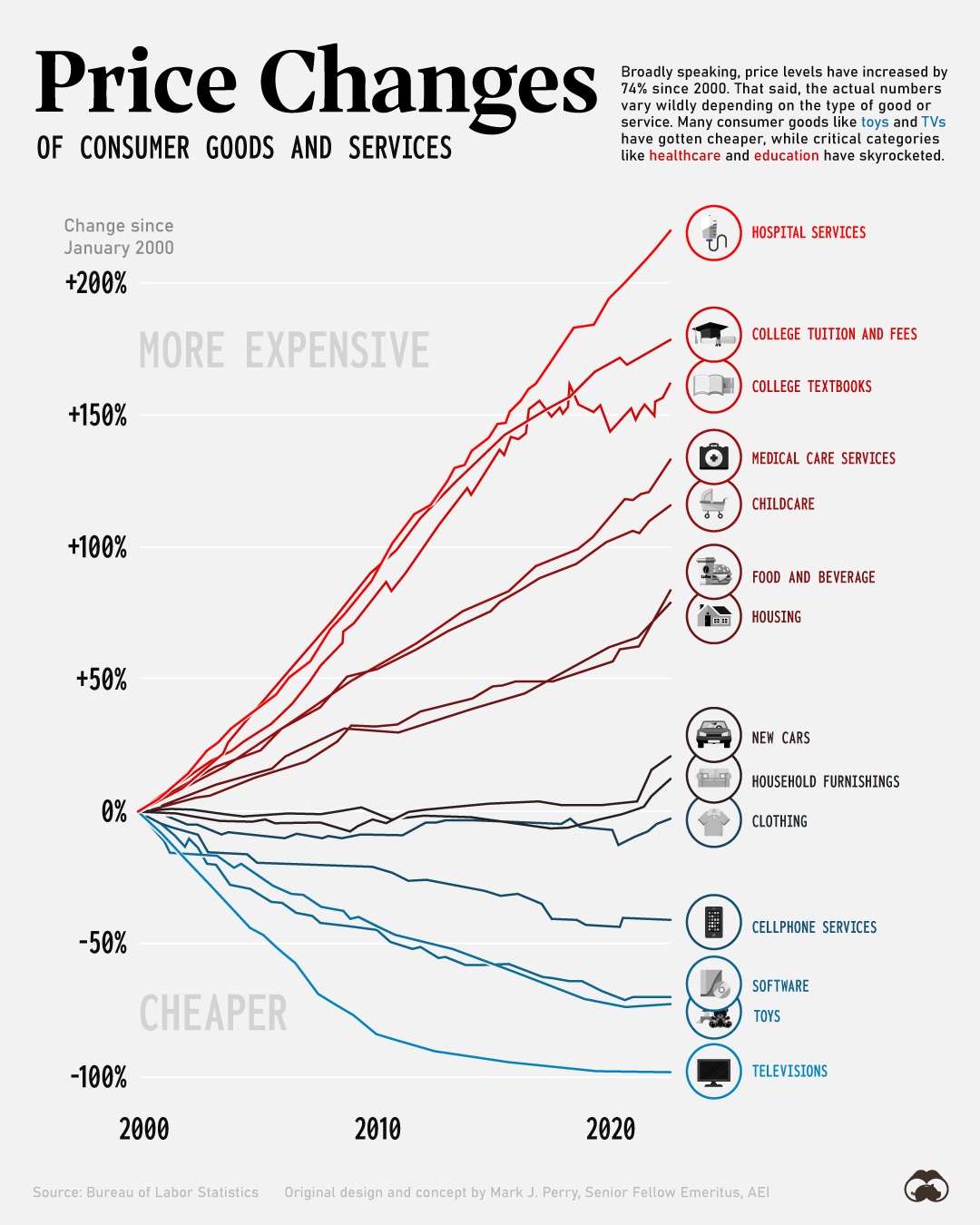

If our income falls within certain ranges, we can qualify for much richer versions of the Silver plan for the standard silver rate. Check out the chart above!

Total quote system will automatically reflect this when you enter your income.

There are 4 levels:

- Silver 70 (the standard silver; expected to cover about 70% of the average health care cost)

- Silver 73 - About 3% richer than the standard; not that big of a deal

- Silver 87 - Almost a platinum level plan for the cost of Silver!

- Silver 94 - 4% richer than platinum plan!

Look, if you're offered the 87 or 94, that's a slam dunk. They're ridiculously rich and the subsidy will also be high since it's all based on income.

You could go down to a Bronze plan to get lowest price (sometimes zero) but if anything healthwise comes up, the silver 87 or 94 will more than pay for itself.

Don't fight the tide on this one:

With just your date of birth, zip code, and best estimate for this year's income, we can run the quotes for you and analyze everything at help@texasplans.com or pick a time to chat here.

Alright...whether we're eligible for the enhanced silver plans or not, we next need to look at network.

Finding the right network for you

This is the second biggest deciding factor.

What network do we feel comfortable with and that partially drives us to certain carriers.

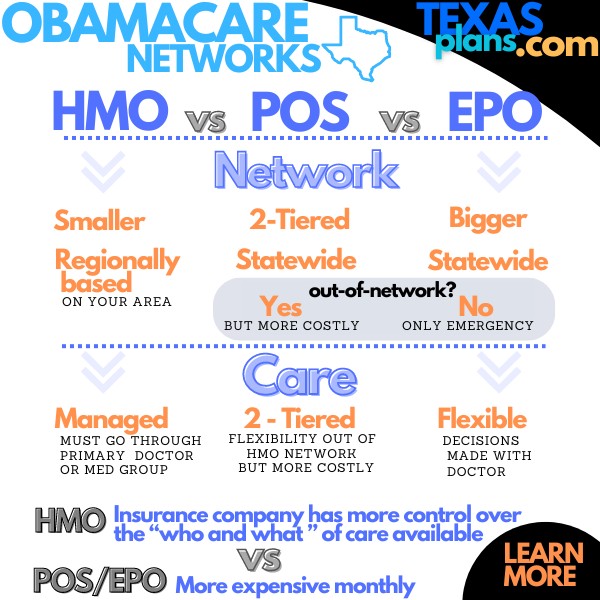

The big three:

- HMO

- EPO

- POS

People generally have a sense of preference here but let's explain how they differ in actual day-to-day terms.

HMO's are more structured:

- You have to stay in a network (outside of true emergency) that's based around where you live

- Care is more managed meaning you'll need approvals and referrals

- Pricing tends to be cheaper

EPO's offer more flexibility and control but at a cost:

- You are not locked into a medical group or area

- You refer yourself out

- More decisions are made between you and your doctor but there are still some checks

- Pricing is more expensive as a result

POS tries to straddle the two!

HMO networks if you behave (follow HMO rules). Broader networks otherwise with higher costs.

When you run your quote, you can filter by network type on the left but you'll notice big price differences.

This choice of network partially narrows the carrier field. Let's now dig into the actual plans. Big review of Texas health exchange networks.

How to really compare the metallic levels

First, let's introduce the insurance lingo designed to mess everyone up!

- Deductible - amount you pay before getting help from the plan (outside of in-network discount)

- Coinsurance - % you pay after the deductible up to the max

- Copays - fixed amounts you pay; generally for office visit and medications

- Out-of-Pocket Max - your exposure in a bad year; in-network Jan - Dec

Big walk through the Texas Exchange Metallic plans.

Okay...so far so good. Then the Texas exchange plans!

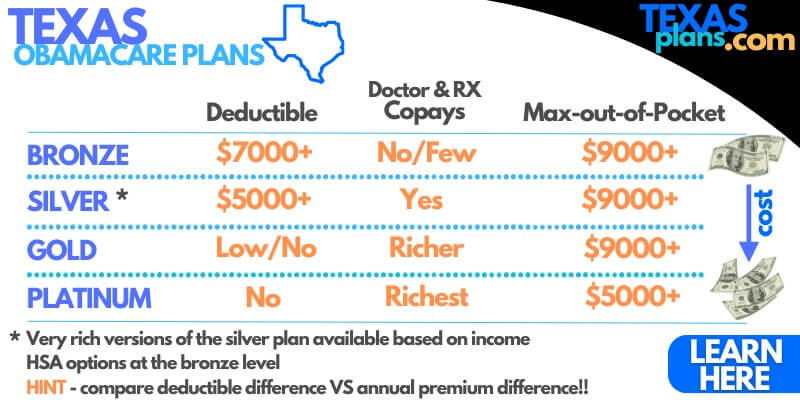

There are four basic levels that increase in cost:

- Bronze (60) - high deductibles

- Silver (70) - mid deductible with copays for office and RX before main deductible generally

- Gold (80) - low deductible with richer copays

- Platinum (90) - lowest deductible with richest copays; might have lower max

This is where the rubber hits the road.

Big secret...the plans have benchmarks and they can't differ by more than 2% up or down

This means that a gold plan will be pretty comparable to another gold plan regardless of network or carrier.

That makes it a little easier.

So how do we compare what can be dozens of options?

Look at the annualized premium difference up and down the scale (say from Silver to Gold) and compare with what you're giving up with a focus on the deductible/max.

Copays are NOT where the real cost is in healthcare these days!

A simple surgery can runs 10's of 1000's pretty fast these days and we see bills at $250K all the time.

This is why you at least need some type of plan to protect from the big bill.

A few other key notes:

- Preventative is covered at 100% on all plans

- POS have benefits out-of-network but don't expect much. It's really been watered down

- You can check the doctor networks right through the quote. You can also ask your doctor "What Texas Exchange plans do participate with" if they don't show in the online directory

- BCBS is still the dominant carrier with Oscar, Aetna, United, and smaller regional players (Scott & White) gaining

This can get confusing real fast. Lean on us! You saw the reviews.

There's zero cost for our assistance in comparing the Exchange plans.

Or run your quote here:

What if you just want the cheapest plan on the market for catastrophic coverage?

What about just catastrophic Texas coverage?

We mentioned above that the Silver 87 or 94 is hard to turn away from but what if we just want protection from the big bill.

We're actually big fans of this whether just a Bronze plan or even the HSA flavor of it.

This especially works if:

- We're not eligible for subsidy

- In relative good health

- Older (50's-60's especially)

Why for these three?

If we compare the annual premium difference between the bronze and silver, it can be a lot of money!

Maybe 1000's per year.

That pays for a lot of copays and smaller bills. If the year goes smooth, we pocket that money.

You'll notice that the out-of-pocket max (protection from big bill) is pretty comparable from Bronze to Gold levels.

That means they're going to treat the $100K bill pretty similarly.

If we get enough premium savings, it makes sense to go down the scale and "self-insure" the smaller stuff.

That's whole theory behind the HSA (Health Saving Account) plan.

Certain plans (will have HDHP in name) will allow you to open up a tax-favored account that you pay out-of-pocket medical and dental bills (not premium) with pre-tax money.

That can mean a savings or 20-30% depending on your tax bracket!

We're happy to walk through how the HSA works. The account is not required...just an option if you're on an HSA qualified plan.

Reach out with any questions on find the best catastrophic Texas health insurance including HSA's.

One step removed is Short Term health plans available in Texas. These are not as robust as the Exchange plans but may be less expensive for people who just can't afford any of the plans including Bronze level plans.

You can quote those here and we're happy to help. Guides on Texas catastrophic health plans or Texas Major medical.

Speaking of quoting...

Quoting and enrolling in a Texas Exchange Plan

We make this fast, free, and secured here:

A few notes.

Make sure to enter your income estimate and size of household (even if not everyone is enrolling). It's this year's income estimate (AGI on next April's tax filing).

You can play with the income estimate up top when the quote comes up to see how it affects your options.

Reach out to us if you think you might be close to one of the enhanced Silver plans. When we run quotes for people, we automatically alert them if this is the case.

It can make a huge difference in your benefits!

Email us dates of birth, zip code, and best estimate for this year's income to get a second pair of eyes on hit.

There's no cost to use the quoting system or our assistance!

Email is help@texasplans.com or pick a time to chat here if your situation is more complicated (or not since health insurance is complicated already!).

We offer free online enrollment right through the quote if you find a plan you like. The subsidy will automatically be calculated and you'll get an invoice for the "net" premium.

Of course, as Texas health agents, we're here to help you throughout the year as well with changes, questions, and updates. Learn more what to expect from us as Texas health exchange agents.