Quote Texas Individual and Family Health Plans

CLICK

HERE:

Raise your hand if picking a health plan is your favorite thing to do.

...Not seeing many hands up, and that's okay!

The truth is, choosing the right health insurance can feel overwhelming. But here's some good news: thousands of dollars in subsidies could be waiting to lower your costs, making things a lot easier.

Many people assume they won't qualify for these subsidies, but don't worry...we're here to make sure you get every bit of financial assistance you're eligible for. And yes, we know it's complicated. That's why we're here to help at no cost to you.

The quote tool above is where your journey starts, but let's walk you through a few key things to know before you dive in. This will set you on the right track to picking the best plan for you and your family.

Why Get a Quote Through Us?

Using our quote tool means you're not just getting a number...you're getting access to a wealth of free guidance from Texas health insurance experts.

Here's how it benefits you:

- Maximize Your Subsidy: We'll ensure you don't miss out on savings. Even if you think you might not qualify for a subsidy, it's worth checking. Many people are surprised at how much they can save.

- Compare Plans Easily: Our tool lets you see multiple plans side-by-side, helping you compare premiums, deductibles, and out-of-pocket costs in a clear, simple format.

- Help Every Step of the Way: We know health insurance can get confusing, so we're here to answer any questions as you compare plans, calculate subsidies, and make your choice.

Ready to get started? Use the quote tool above to explore your options!

How to Pick the Best Covered Texas Plan

Here's a quick guide to choosing the right Texas Exchange plan for your situation:

- Run your quote using the tool above.

- Determine your eligibility for a subsidy (we'll help with that!).

- Choose the right plan level...Bronze, Silver, Gold, or Platinum...based on your needs and budget.

- Ensure your doctors are in-network and that you like the type of network offered.

Let's break each of these steps down in more detail so you feel confident about your choices.

Run Your Texas Quote with Subsidies

The first step is simple: use the quote tool to check your options. It's important because comparing plans without knowing your exact costs is like shopping blind.

The quote tool shows you not just the plan options, but also how much you'll actually pay after any available tax credits or subsidies are applied.

Remember, insurance benefits are standardized from carrier to carrier. A Gold plan from one provider will have similar benefits to another Gold plan from a different provider. This makes it easier to focus on the differences in cost, which is where our quote tool really helps.

Check Your Subsidy Eligibility

Subsidies (aka tax credits) can drastically lower your monthly premiums, and they're based on your income and household size.

Our quote tool will automatically calculate any subsidies you qualify for, so you don't have to guess.

Not sure if you'll qualify? Here's how it works:

- The key figure is your Adjusted Gross Income (AGI), which you'll find on your 1040 tax form.

- The size of your household (everyone who files taxes together) also plays a role.

Even though it can get complicated, we make it easy by handling the calculations for you. If your situation is unique or a little tricky, feel free to reach out to us at help@texasplans.com...we're happy to help!

Big guide on how to get the most subsidy or a look at the income chart for Texas subsidy. Also, what income is used for health subsidy.

Choosing the Right Plan Level

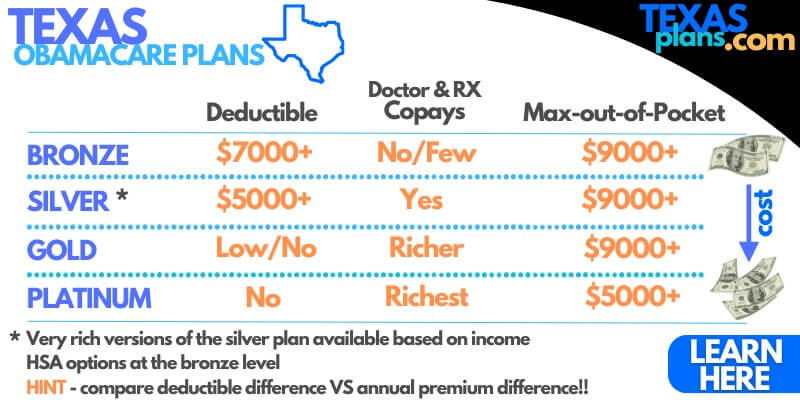

Once you've run your quote and know your costs, the next step is picking a plan level that matches your needs and budget. Texas health plans come in four levels: Bronze, Silver, Gold, and Platinum.

Here's a quick breakdown:

- Bronze: Lowest premiums, highest out-of-pocket costs.

- Silver: Balanced premiums and out-of-pocket costs.

- Gold: Higher premiums, but lower costs when you get care.

- Platinum: Highest premiums, lowest out-of-pocket expenses.

Your choice should reflect how often you expect to use healthcare services. If you're generally healthy and don't anticipate many doctor visits, a Bronze or Silver plan might work best. On the other hand, if you need frequent care or prescription drugs, Gold or Platinum could save you more in the long run.

Big guide on how to compare the exchange plans.

And don't worry...you can always adjust your plan level year to year if your situation changes.

Make Sure Your Doctors Are In-Network

Now that you've got a handle on your subsidy and plan level, it's time for an equally important step: checking if your preferred doctors and hospitals are in the plan's network.

This has become a bigger deal in recent years, as insurance networks have shrunk. In fact, they're about 30% smaller than they were before 2014, so it's crucial to ensure your doctors are covered.

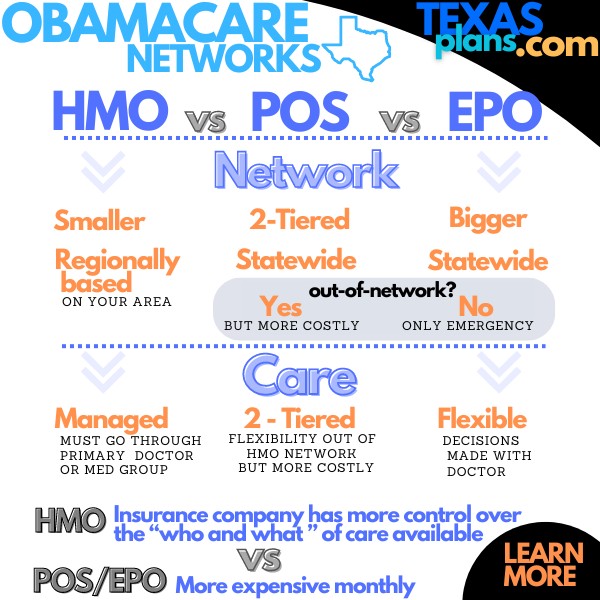

Our quote tool allows you to search for plans that include your doctors. But if you have any doubts, we can show you how to double-check by asking your doctor directly. We'll also help you understand the differences between HMO, PPO, and EPO networks:

- HMO: Lower costs, but you need referrals and can only use in-network providers.

- EPO: A middle ground...no referrals needed, but limited to in-network care.

More on comparing the Texas change subsidies.

We'll guide you through these options and help you compare how network types affect your premiums and out-of-pocket costs.

How to Quote and Enroll in a Plan

Ready to take the next step? Here's how you can quote and enroll in a Texas health plan quickly and easily:

- Get your quote using the tool above. It'll show you your premium, subsidies, and all available plan options.

- Review your plans to compare costs, coverage levels, and networks. Look for the best fit for your healthcare needs.

- Enroll online through our secure platform. The process is fast, simple, and available 24/7.

Need assistance? Our team of licensed Texas health agents is here to help you every step of the way...at no cost to you. Reach us at 800-320-6269, chat online, or email help@texasplans.com.