Texas Short Term Health Insurance vs. Obamacare

We get this question quite a bit and not only for temporary coverage.

If you're not eligible for a subsidy, what are the best options to keep costs down.

For a person eligible for a subsidy based on income, there's no real reason to go any further since the Federal government is subsidizing your cost of insurance.

We'll look at the thresholds below but what if we don't qualify for a subsidy based on income?

Then it's a question of the full-priced Obamacare plans or short term.

Very different options as we'll discuss below but first, our credentials:

These are the topics we'll look at so you can make a good decision:

- Definition of Obamacare and why the subsidy is so important

- How is short term different from Obamacare

- Comparing the plan benefits between short term and Obamacare in Texas

- Comparing the networks between short term and Obamacare

- Comparing the rates between short term and Obamacare

- How to quote or enroll in either short term or Obamacare

Let's get to it!

Definition of Obamacare and why the subsidy is so important

We first need to clear up some confusion.

All individual family plans since 2014 are standardized now and they're generally called Obamacare, ACA, or exchange plans.

All the same thing! On or off-exchange has the same rates, benefits, and networks!

The big difference is that on-exchange, we can get really big subsidies based on income which directly brings down the cost of care.

So the first step is to make sure you're not missing out on this free money.

We walk through it in our how to get the most Texas health subsidy but here's the income chart.

If your income is below roughly the 300% mark (more if older) for your household, definitely run the quote below to see if you qualify.

- Income estimate is for the AGI on the 1040 tax form; next April's filing

- Household is everyone that files together on that 1040 even if not enrolling

We're happy to help with the income piece since that's usually where people get tripped up.

Zero cost for our assistance.

Here's the deal. If you qualify for a subsidy, there's very little reason to look at short term unless:

- You need a mid-month effective date; Obamacare can only start 1st of the following month at the earliest

- You missed open enrollment and don't have a special enrollment period (see when can I enroll in Obamacare)

Again...Obamacare is just the term that most people know for individual family plans since 2014. Nothing political. Don't miss out on money in your pocket!

Okay. So...let's assume from above that short term plans are in play for our situation. How do we compare them?

How is short term different from Obamacare

Short term and Obamacare (ACA) are designed for very different needs.

Generally, short term is there to fill a temporary and defined gap in coverage.

- Waiting for a new job plan to start

- Waiting for an exchange plan to start

- Waiting for Medicare to start

- Waiting for open enrollment

See a pattern there?

It works well there to cover gaps when we don't have other options.

Some people actually use short term for longer-term coverage so let's look at the core differences.

Short term plans in Texas:

- Can be declined based on health

- Fixed periods of time up to 360 days generally

- Can start as early as midnight following enrollment

- Does not have the required benefits of ACA plans (maternity, mental health, etc.)

- More choices for major medical or catastrophic type benefits (high deductibles, max's, etc.)

This is more similar to what we had before 2014 with Texas health benefits.

The rules feel about the same as well.

Then, there's Obamacare plans:

- Cannot be declined based on health but need to enroll at certain times

- Can renew year after year or cancel month to month

- Earliest effective date is 1st of the month after enrollment

- Comprehensive list of required benefits that are standardized

- 4 basic levels of coverage which must meet certain benchmarks

So...short term is more catastrophic in nature while Obamacare is more comprehensive but tends to be more expensive as a result if we're not eligible for tax credits (subsidies).

Let's break down these differences in more detail.

Comparing the plan benefits between short term and Obamacare in Texas

We'll start with Texas Obamacare plans since they're standardized.

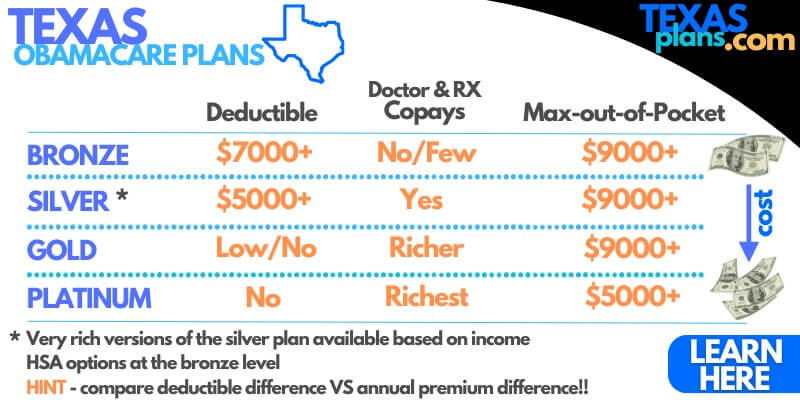

Here's the basic layout of the 4 levels:

The main difference is that Obamacare plans are required to cover a long list of different benefits including:

- Mental health

- Maternity

- Out-patient prescription

- Preventative

- Physician costs

- Surgical and hospital costs

There's no annual or lifetime cap on these benefits!

That's a big difference as most short-term plans will allow a choice in annual or lifetime benefit caps.

Here's the benchmark plan chart for Obamacare:

Bronze and silver are the most popular by far with the silver making up most of the market. Learn how to compare the Obamacare metallic plans.

As for short term, United Health is the dominant carrier in Texas and they offer a range of different plans with increasing benefits.

We have a whole review on Texas short term plans but a quick look here.

United has four different short term options in the Texas market with increasing benefits:

- Hospital and Surgical - catastrophic care for facility-based needs

- Tri-Term Value - adds in other benefits (office, etc.) after deductible is met; RX card

- Copay Select Max - adds in copays for office and RX; coinsurance up to max after deductible

- Plan 80 Max - you pay up to deductible then plan takes over for covered benefits

The goal of short term for longer-term needs is usually about the cover the bigger bill or major medical coverage.

Most people opt for the first two options.

What about the doctors we're able to see on both?

Comparing the networks between short term and Obamacare

In some respects, the networks will likely be pretty similar now.

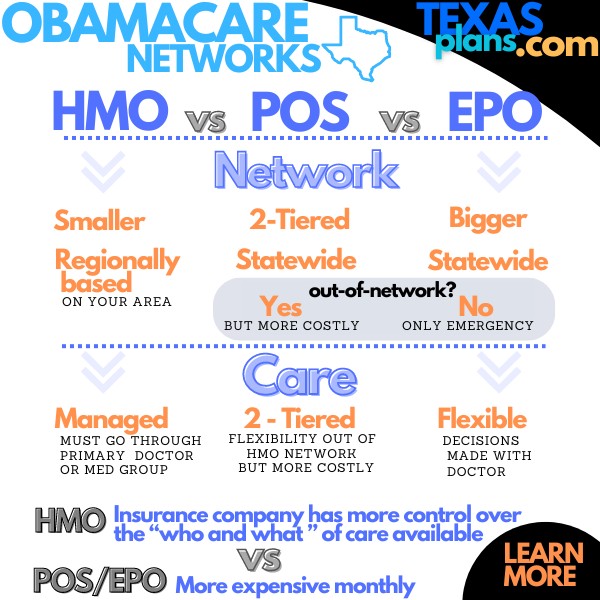

Most of the Obamacare plans have moved to the HMO model now with only a few EPOs still out there (Ambetter and Oscar).

We have a big review of the Obamacare networks explained but BCBS, United, Aetna, and others have all embraced the HMO model simply because it can help keep costs under some control.

United's short term health plans also have an HMO setup.

So...if your doctors are in both networks, that's an easier decision.

If you want more flexibility or control over care, the EPOs are only available on the Obamacare market but they're also more costly generally compared to HMOs at the same benefit level.

It's a trade-off. You can check your doctors or hospital right through the quote tools below!

These days, they're not too far apart since 2014 when HMOs have slowly taken over the individual family market.

The big question then comes up. What about rates?

Comparing the rates between short term and Obamacare

This isn't exactly apples and apples since they cover very different things now with the standardized requirements of Obamacare.

For example, if you get a short-term plan with a very high max out of pocket (let's say $25K) versus Obamacare's at $9K, sure...it's going to be cheaper.

If we're not eligible for a subsidy, the short-term plans can indeed be cheaper but just understand that this comes with more exposure on the backend if health goes sideways.

The short-term plans work pretty well for bigger ticket items like hospital, accidents, surgeries, etc.

Chronic health issues...maybe not as much but we may also have an open enrollment coming up or a special enrollment trigger that allows us to get on the exchange regardless of health.

Run your quote to make sure there's enough savings on the short term to even justify going that direction.

Again, this assumes we're able to enroll right now on Obamacare anyway and have the choice!

Speaking of rates.

How to quote or enroll in either short term or Obamacare

We make this free, fast, and easy here:

Or here:

Remember to enter your income info in the Obamacare quote as that may be a big deciding factor.

There's zero cost for our assistance so reach out with any questions!

The decision between short term and Texas obamcare generally comes down to the following:

- Can we enroll in Obamacare right now (open enrollment or special enrollment trigger)?

- How long do we need the coverage till?

- What's the cost difference between the bronze plan and the lower two short term options?

We're happy to help compare this for you!