Compare Work Health Insurance Versus Texas Obamacare

Many workers are making this calculation these days.

Does it make sense to drop insurance from an employer and get Obamacare?

There are many pieces to look at with this decision but we've helped 1000's of people lower their monthly premium as a result of the move.

But we have to be careful as we'll explain below.

Especially when it comes to doctor networks and avoiding having to give the whole subsidy back!

More on that below but first, our credentials:

This is what we'll cover:

- Can I drop employer coverage and get Obamacare in Texas?

- What are the benefits of changing to Obamacare from employer coverage?

- The income threshold to get a Texas subsidy

- Comparing work insurance networks and Texas Obamacare

- Comparing work benefits and Texas Obamacare

- How to quote and enroll in Obamacare while canceling work insurance

Let's get started!

Can I drop employer coverage and get Obamacare in Texas?

The short answer is yes.

Loss of coverage is a qualifying event that allows you to enroll in Texas Obamacare the 1st of the month following enrollment.

It's a special enrollment trigger! Even outside of open enrollment (Nov 1st - Jan 15th).

Obamacare is also a qualified exemption from group insurance so it doesn't mess up the participation requirements that employer plans have.

In fact, many employers are looking at whether it's cheaper for their employees to cancel the group plan and let employees get Obamacare.

We have a whole review on this from the employer's point of view here.

There are generally three items to consider as an employee when making such a move:

- Cost difference between work plan and Obamacare (the real reason to change)

- Doctor network differences between employer plans and Obamacare

- Benefit differences between group coverage and Obamacare

We'll go through all these below starting with the real draw for most people to even entertain this move.

One note...Obamacare, ACA, and on-exchange are all the same thing! Same networks, rates, and benefits.

Don't get tripped up on the terminology or politics of it. There can be huge savings if we get this right, which is the point of this article.

Let's start with cost!

What are the benefits of changing to Obamacare from employer coverage?

This is really a question of cost. To the employee!

Since 2014, the main draw of Obamacare plans has been the subsidy that's available based on income.

This directly reduces the cost of your monthly coverage!

Basically, the Federal government is paying part of your premium and it can be significant depending on income, age, and size of household.

We have a big guide on how to get the most subsidy with more detail.

When you run your quote below, the system will automatically show your expected subsidy based on two items:

- Best estimate for this year's income; AGI on the 1040 tax form next April's filing

- Household size is everyone that files together on a 1040 tax form even if not enrolling

We spend most of our days now helping people correctly size up this income question since it causes so many to lose out on subsidies.

It's complicated! Especially for self-employed (more here) or those with income in flux.

It used to be that individual/family plans were cheaper than employer plans, all things being equal.

That's no longer the case but the subsidy can bring the costs way down! We see premiums of zero in some cases!

Now typically, an employer is making a contribution towards an employee's choice of coverage so it then becomes:

Which is more...the employer's contribution OR the subsidy through Obamacare?

What's important is your NET premium monthly that comes out of your pocket for equivalent coverage.

You can run that quote here but let us help you at zero cost:

Then there's the question of dependents, which can make things more complicated.

Let's touch base on an important caveat that might prevent the change.

The income threshold to get a Texas subsidy

The original crafters of the ACA law didn't want everyone jumping off their employer plan to get Obamacare!

So they built in a rule around "affordable coverage".

Translation:

If an employer's plan is "affordable" to the employee, then they will NOT qualify for a subsidy.

What's affordable these days?

If the employee's share of the premium is less than 8.39% of the HOUSEHOLD income, it is deemed affordable and there's no tax credit available.

Let's take an example please.

- Let's say a single person makes $2000/month

- 8.39% of $2000 is $167.8

- If their share of the monthly premium is $167.8 or less, no subsidy

If that employee has to contribute $200, they can get a subsidy on the individual family market!

Remember, for households of more than 1, they look at the household income versus the family premium share.

This is usually pretty easy to beat since dependents can really cost quite a bit on employer plans (less help from the employer usually).

One note...if the employee (self) coverage is affordable based on their share but dependents are not, the dependents can get a subsidy!

Just email us your situation with gross income, zip code, dates of birth, and cost of employer plan.

We'll see if we meet the test. There's no cost for our assistance.

So...let's say we qualify for a subsidy based on the quote and our employer coverage is not deemed "affordable", then what?

Let's start with doctor networks.

Comparing work insurance networks and Texas Obamacare

Depending on the carrier, this may be one of the bigger differences to compare first.

Employer networks are different from individual family plans through Obamacare (even off-exchange).

Generally, employer networks are bigger and they may still have PPO options. We looked at how to get PPOs through Texas Obamacare but that only works if you have your own business and someone on payroll.

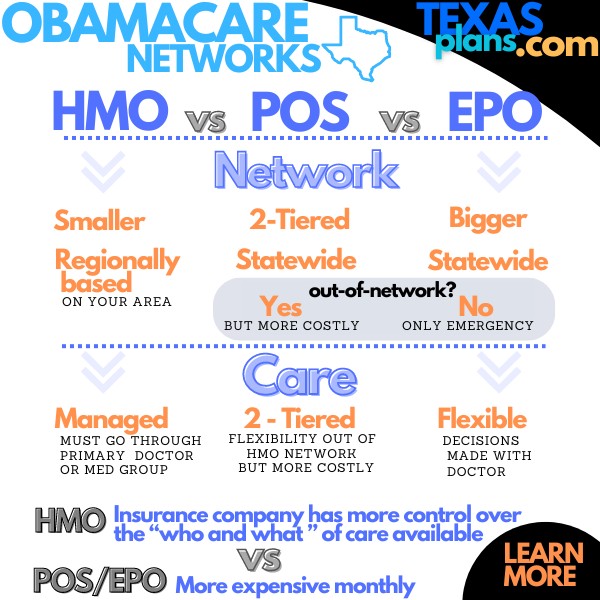

Otherwise, most of the Texas Obamacare network is HMO with a few EPOs sprinkled in.

If you already have an HMO, the transition will be pretty easy. If your employer plan is a PPO, that might be an adjustment.

The EPOs work like a PPO but with no benefit out of network other than a true emergency.

We make this process easy however. When you run your quote below, you can enter your doctors and/or hospitals of choice in the quote system and it will show you what plans work with them!

We have a whole guide to Texas Obamacare networks.

On the Obamacare, we have most of the

dominant

Texas carriers:

- BCBS of Texas

- United Health

- Aetna

- Cigna

- Ambetter

and more!

So...if our doctors are okay in the new network or we're flexible, then what?

Comparing work benefits and Texas Obamacare

This has gotten much easier since 2014!

Basically, individual/family plans have come up to where group plans were in terms of key protections:

- No waiting period for pre-existing conditions

- Can't be declined based on health

- Required list of benefits including maternity, mental health, preventative, and more

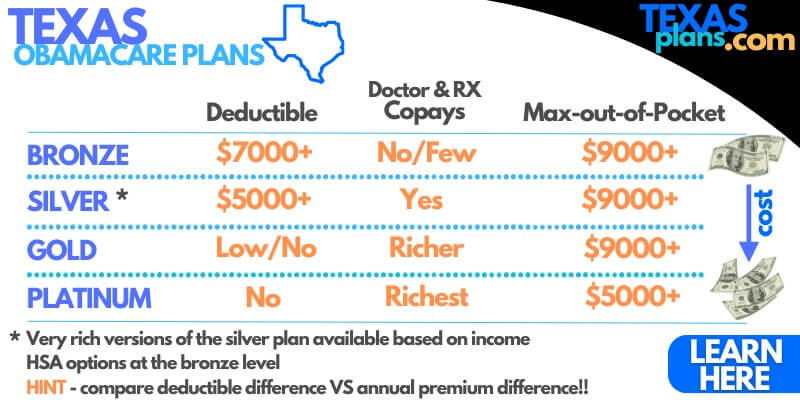

More importantly, the small business and individual/family markets now have the same standardized benefit levels:

This makes it so much easier to compare since a given level can't deviate from the benchmark by more than +/- 2%!

If you have a Gold plan through your work, you can pick a gold plan through Obamacare and they'll be pretty comparable in what they cover and by how much.

More importantly, you're not locked into what the job offered!

Meaning...they might have had a silver plan and you want a bronze (cheaper, major medical) or gold plan (richer benefits) based on your health care needs and cost.

It's a chance to change up options.

One note...if you've met a lot towards your out-of-pocket max or deductible on the job plan, it might make sense to make the switch at open enrollment for a Jan 1st effective date when this all resets.

Just a heads up! We can help you compare the cost savings versus any amount already made.

Let's get to the best part (hopefully) of the whole change. What's the cost?

How to quote and enroll in Obamacare while canceling work insurance

You can run your Obamacare fast, free, and easy here:

- Best income estimate for AGI on the 1040 tax form for THIS year

- Household is everyone on that 1040 even if not enrolling

If you want to piece together coverage, we're happy to help. Just contact us and we'll get to work at zero cost to you.

Don't cancel your employer coverage till you get confirmation back of approval on the Obamacare plan.

We can help with the entire process to make it much easier (and faster).