I Lost My Job and Need Texas Obamacare

This feels like the majority of enrollments we help people with these days outside of open enrollment (when everything goes crazy).

Loss of a job usually means loss of a employer coverage.

Sure, you might have a Cobra continuation option but at full price and the rates can be brutal.

Especially if just lost your main source of income!

Luckily, we have an option that fits both bills (loss of coverage and loss of income).

We'll look at how to get the most out of the situation but first, our credentials:

This is what we'll cover:

- Losing your job and Texas health insurance as a special enrollment trigger

- Taking advantage of the Texas subsidy after losing your job

- How to compare the Texas Obamacare plans after losing your job

- Comparing Cobra and Texas Obamacare

- How to quote and enroll in coverage after job loss

Let's get started!

Losing your job and Texas health insurance as a special enrollment trigger

First, understand that we're using Obamacare as short-hand for all individual/family plans in Texas.

Whether we go on or off-exchange (direct with the carrier), it's the same rules, networks, rates, and benefits!

There's one big difference we'll talk about in the next section but the first piece to clarify is this:

Can I enroll in Texas Obamacare if I lost my job?

Two ways to address this.

A loss of employer coverage (from termination or quitting) is a qualified special enrollment trigger (see when can I enroll in Obamacare).

We need to enroll within 60 days of the last day of employer coverage and prior to the 1st of the month we want the plan to start.

So...if we lost coverage May 31st (usually goes through end of the month in which our employment ended), we have through July to enroll.

Let's say we enroll July 15th. Our effective date will be August!

Always the first of the month following enrollment. No way to go backwards but technically, you may also have a Cobra option that can go all the way back to June 1st in the situation above:

The downside is that you'll have to back pay the premiums and it always goes back to the 1st of the month after we lost employer coverage.

We can help with this whole strategizing at help@texasplans.com or 800-320-6269 at no cost to you.

So, loss of employer coverage is a qualified event that allows us to enroll anytime during the year.

One note...if you start Cobra, you have to exhaust it OR wait till open enrollment (Nov 1st - Jan 15th) unless you have another special enrollment trigger.

Reach out if your situation is complicated. Lots of moving pieces here and our assistance is free.

What if your prior employer didn't offer health benefits? This is trickier.

The income change would have to be sizable and just in the right range to allow us to enroll. Let us know your situation.

Most people are looking to replace employer coverage so let's go based on that for now. Here's the big difference with individual/family that might be a good thing for you.

Taking advantage of the Texas subsidy after losing your job

The real reason to enroll on-exchange in Texas these days revolves around the subsidy:

If our income is in the right range, we can qualify for big subsidies which bring down the cost of individual/family health insurance.

We see premiums down to zero!

The tricky part after losing a job is...What income??

Technically, it's our annual estimate for this full year, the AGI on the 1040 tax form; next April's filing.

We help people with this all day long especially for people losing a job. Here's why.

Let's say you made $8K monthly in the situation above (loss coverage May 15th).

Well, technically you made $36K for just under half the year but your income has dropped to zero unless you're getting unemployment (which is counted towards income).

Do we go with $36K annually or is it zero for current month?

Roughly 50% of people who self-enroll mess this up and end up missing out on subsidies and more (richer silver plans).

Really touch base with us. Zero cost for our assistance at help@texasplans.com or 800-320-6269.

We can look at both ways to see what provides you with the best rates in line with what the original ACA law intended (to help people based on ability to pay).

Below a certain level, they will offer Medicaid but that doesn't work for everyone (impacted and limited doctors) plus we have to qualify based on other requirements (usually pregnant or incapacitated).

Answered incorrectly and you may see ZERO subsidies and very high rates. We see people miss out all day long when they're running quotes from this:

We can help you navigate this.

Check out the Income chart for Texas Obamacare or how to the get most out of Texas health plan subsidies.

Okay...then what plans if we're losing our job?

How to compare the Texas Obamacare plans after losing your job

This depends on finances (probably not great after losing a job) and health care needs.

We have a big guide to comparing the Texas Obamacare plans but let's look at it through the lens of just losing a job.

If we're thinking just short term till we get a new job, a higher deductible (bronze or silver) might make more sense.

Keep costs down and just cover the big bills.

One note...if we're eligible for the silver 87 or 94 based on income, those are really hard to beat!

More on the Texas enhanced silver plans.

If you have bigger healthcare issues, you can go up the scale and any subsidy will apply accordingly.

We look at how to compare the metallic plans but really, it's a comparison of premium difference versus deductible/max-out-of-pocket.

Again, if short term, that changes the equation and it's probably best to run through your situation with us.

We can also get short term health insurance if we don't qualify for a subsidy.

Comparing Cobra and Texas Obamacare

There are some differences to understand beyond just cost (with the subsidy).

Here are the major differences:

- Cobra coverage tends to be more expensive, especially if you're eligible for a subsidy

- Cobra networks tend to be bigger and may have PPOs (not available on Obamacare markets)

Really, it's a comparison of cost versus network flexibility and choice.

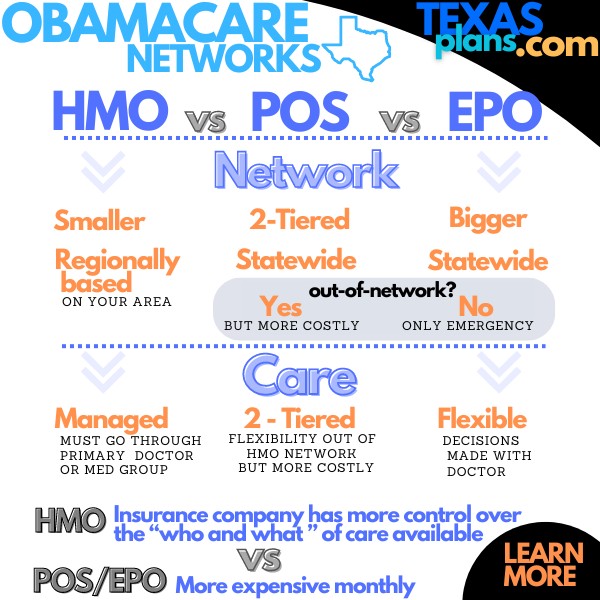

Most of the individual/family Texas plans are HMO now. A few EPOs (see how to compare Texas Obamacare networks).

If you really want a Texas individual family PPO, Cobra may be the only choice but it might mean quite a bit more out of pocket in premium.

With Obamacare, you also get to pick a new carrier, plan, and network to match your current needs which probably needs to focus on costs since you've lost your job.

You can always cancel either month to month. No long term contract either way.

We just need to submit the cancellation prior to the end of the month you want it to end:

Otherwise, most of the plans whether through an employer, Cobra (which is just continuation of the employer plan that you pay for), or Obamacare are required to cover the same stuff these days.

This is especially true for small business plans (up to 100 employees) which have the same basic metallic plan levels.

Large companies might have different structures but we can usually match them up against Obamacare plans.

So...let's see if you qualify for these subsidies we keep talking about.

How to quote and enrolled in coverage after job loss

Run your Texas individual/family plan to compare with loss employer plans here:

A few notes:

- Income is best estimate for this year's income (AGI on the 1040 tax form; next April's filing including expected unemployment)

- Household is everyone that files together on that 1040 tax form, even if not enrolling

Again, this is the hardest part so we're happy to help at no cost to you. We've helped 10's of 1000's people run through this calculation so we've seen it all.

Email us at help@texasplans.com or call 800-320-6269.

We'll make sure you're not just missing out on big subsidies and/or the richer silver plans at a time when you need them most (just lost a job!).

You can always cancel month to month if you get other employer coverage and coverage.

We'll help with the whole process and save you time and frustration!