Texas Individual and Family Health Insurance Explained

We're going to take the very complicated world of individual or family health insurance and boil it down.

From 10's of 1000's of enrollments, we'll show you the steps we take daily to help people find the best fit (both benefits and cost!).

Since 2014, it's a whole different world in Texas and many people we come across are overpaying.

First, our credentials:

We'll break it down from more general to very specific along these lines:

- Individual and family insurance since 2014 with Obamacare

- When can I enroll in Texas individual family coverage

- What's the difference between on or off exchange

- How does the subsidy or tax credit work with Texas individual family plans

- Understanding the new Texas individual and family doctor networks

- How to really compare Individual and Family health plan benefits

- What Texas carriers are the best for individual and family coverage

- Are there alternatives if I don't qualify for a subsidy or missed open enrollment

- How to quote and enroll in Texas individual and family plans

Let's get to it!

Individual and family insurance since 2014 with Obamacare

Let's start with the 40,000 foot view of the market in Texas.

First, we'll clear up some terms.

Obamacare, ACA (Affordable Care Act), and Exchange all mean the same thing. Pick whatever term that doesn't cause you anger (politically) because the rules apply equally now across ALL individual and family plans including in Texas.

The 2014 law completely transformed the health market...some good...some bad.

Here are the big changes that apply across the board:

- You cannot be declined or have rates increased based on health (except for smoking)

- There's no waiting period for pre-existing conditions

- There are defined times you can enroll now (open enrollment or special enrollment periods)

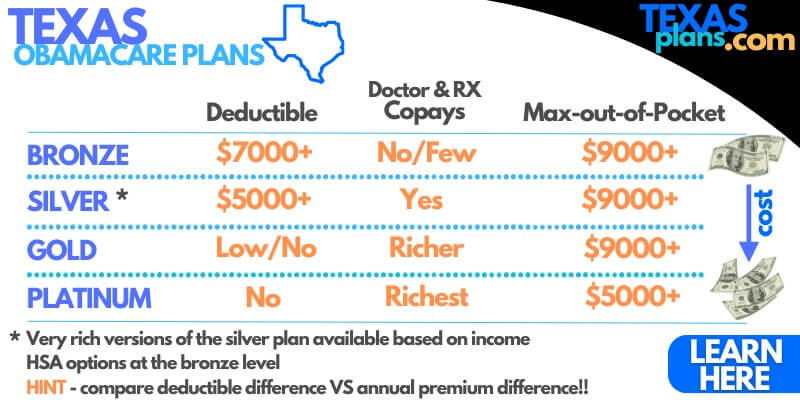

- Benefits are standardized along 4 basic levels: bronze, silver, gold, and platinum

- There's no annual or lifetime benefit levels

- What's covered is now standardized and much broader: mental health, maternity, etc.

- There can be subsidies that reduce your monthly premium and even richer versions of the silver plan based on income

That last one is really the star of the show these days.

With all the additions to health plans came a pretty big bump in the cost of plans after 2014.

The subsidy aims to offset this but only if we qualify based on income! More on that below.

Our quote system automatically calculates the subsidy or tax credit below.

So...let's start with the when's of the new market!

When can I enroll in Texas individual family coverage

Since people can't be declined based on health and there's no waiting period, the ACA law set rules for when you can apply.

Meaning...you can't go uninsured, tear an ACL, and run out and get health insurance to cover the surgery.

The basic rules:

- Open enrollment - Nov 1st - Jan 15th of each year; you can enroll or change plans regardless of health

- Special enrollment periods - qualifiers that let you enroll outside open enrollment

A big review of when you can enroll in Texas individual family plans but the most common:

- Loss of coverage (involuntary) - job coverage, from a move, aging off coverage, losing Medicaid

- Move to or within Texas that affects your health insurance options (meaning...not down the street!)

- Big household changes - marriages, divorces, births, deaths, adoptions

- Income levels within a certain level - see our 150% trigger article!

Those make up 90% of the enrollments we do daily but it's a short list with many other ones.

Check with us for your specific situation and we'll scour the full list!

If we can't enroll due to either triggers, we can get short term plans till one comes around. More on that below.

Let's tackle one more common misconception.

What's the difference between on or off exchange

By law, on and off exchange must have the same:

- Networks

- Benefits

- Rates

So, what's the difference?

You can only get the subsidy and richer versions of the silver plans ON-exchange.

This can be a huge difference as we see costs come down $1000's per year and sometimes down to zero!

Don't leave this money on the table. It's why roughly 99% of our enrollment is on-exchange these days as the income can run pretty high and still trigger a subsidy.

Some Texans are under the impression (usually from their doctors) that on-exchange is different than off-exchange in terms of networks. Not the case as we'll discuss below in that section.

There's no real reason to enroll off-exchange these days. Now, let's look at the real reason to go on-exchange.

How does the subsidy or tax credit work with Texas individual family plans

People...this is it.

Based on income, we can get subsidies that reduce the monthly premium invoice that comes from the carrier.

It can apply to all the plans equally and we see premiums down to zero sometimes.

So many people make mistakes when self-enrolling that cause them to lose out on real money.

This is where we spend most of our day helping people at no cost!

- Income is best estimate for AGI on the 1040 tax form; next April's filing

- Household is everyone that files together on that 1040 even if not enrolling

Here's the income chart as a reference (the online quote is better though below):

If the income info isn't entered correctly, it can cause Medicaid enrollment and/or missing out on subsidies.

Let us help you through this at no cost to you!

We have a big review on how to get the most Texas health plan subsidy or How to understand the income chart for the subsidy.

The subsidy tends to go up as we get older since its goal is to cap your exposure at a certain percentage of the AGI.

If you're self-employed, check out the guide for self-employed and Texas Obamacare as income can get tricky.

Next question that usually comes up...doctors.

Understanding the new Texas individual and family doctor networks

Once we figure out the subsidy piece, we usually get this question...

"Which plans will work with my doctor?"

A few notes there.

First, the individual and family networks are smaller than employer plans and we no longer have PPOs available.

Big article on how individuals or families might be able to get Texas PPO plans but generally, it's HMO and EPO on the individual market.

As rates have exploded, the carriers have turned to HMOs to try and contain the increases.

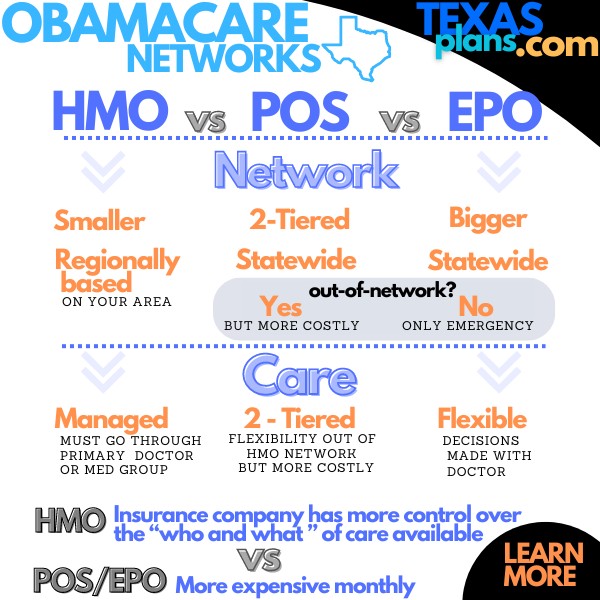

On the market, we have mainly HMOs, a few EPOs, and one POS:

We have a big review on how to compare Texas Obamacare networks but we make this much easier.

In the quote tool below, you can enter YOUR doctors and the system will automatically show you which plans will work with them!

This saves so much time and as agents with decades of experience, we remember having to call all the doctor offices and asking what plans they worked with.

Much better system.

Basically, between HMOs and EPOs, it's a comparison of:

- Flexibility and control of health care decisions (HMO is more "managed")

- Monthly premium (HMOs are cheaper)

EPOs work like PPOs but there's no benefit outside the network other than a true emergency.

We've been on both PPOs and EPOs and they're pretty comparable but reach out with any questions.

We've nailed down the subsidy and the doctors. What about plans on the individual and family Texas market?

How to really compare Individual and Family health plan benefits

First, the benefits are standardized so a gold plan can't break from the benchmark plan by more than +/- 2%.

This makes it much easier to compare and really, we're picking a "level" (like silver, etc.) rather than a plan.

Here's the rough sketch:

- If you're eligible for the silver 87 or 94, go no further!

- Compare annual deductible difference versus annual premium difference

- Silver is by far the most popular plan with a good blend of cost and benefits

We have a big guide on how to compare the Obamacare metallic benefits but let's cut to the chase with our Top 3 Tips!

If you're eligible (don't miss out by a few $100 in income estimate...check with us!), there's no reason to go any further.

They'll pay for themselves versus bronze with pretty simple health care needs.

Compare annual deductible and premium differences

So, how do we compare the different levels?

A good approach is to look at the difference in deductible and compare that to annual premium difference.

Meaning...if we're saving a lot in premium, it makes jumping up in benefits less attractive!

One note...the bronze, silver, and gold plans all have very high max out of pockets (how plan treats the big bill).

When you do this, the silver usually stands out as a good blend.

It offers copays for office visits and RX and the premium savings might make the gold less attractive.

We can size this up pretty quickly for you!

For people that just want major medical coverage or catastrophic health plans, the bronze has two options:

- Standard bronze 60

- HSA qualified bronze plan (HDHP)

We have a big review on Texas individual family HSAs since they tend to win out IF you're going to fund the account for tax deduction.

Here's the benchmark plan chart:

Again, happy to help here. It gets confusing!

What about carriers?

What Texas carriers are the best for individual and family coverage

We have many carriers that participate in the individual family market in Texas with some heavy hitters.

Generally, the most popular are:

- BCBS of Texas - roughly half the market

- United health - new addition with nationwide stature

- Oscar and Ambetter - resting on their EPO network options

Lots of smaller carriers that focus on certain areas but you're in good hands with the above and really, BCBS of Texas is hard to beat (big review on BCBS and a comparison of BCBS versus United).

The carrier question generally gets answered when we check our doctors!

Really, the carrier with the biggest network and better pricing is probably the one to beat and that figures into why the above are so popular.

Enter your doctors in the quote tool below so we can rule that out and hopefully make the carrier question easier. See our big comparison of Texas individual family carriers.

What if we're not getting a subsidy or can't enroll (missed open enrollment)?

Texas is lucky (in many ways really).

Are there alternatives if I don't qualify for a subsidy or missed open enrollment

There are two options but really it's one.

We're lucky in Texas to still have Short term health plans available through United Health (a trusted carrier nationwide).

Check out our big review on Texas short term health plans but a few notes:

- Can start midnight following enrollment if approved

- More major medical in nature with different levels of coverage

- No subsidies but premiums tend to be lower than unsubsidized plans since benefits are more limited

Really, this usually works when someone can't enroll (no special enrollment trigger) OR can't afford unsubsidized plans and just want major medical.

Keep in mind that what's covered is much more limited than the ACA or Obamacare plans as a result!

With a robust short term option, the health sharing plans really don't make sense in Texas. They're not insurance and hospitals are starting to push back when people show them the cards since payment has been an issue.

We feel much more comfortable with United's short term in this situation.

Alright...that's a wrap. Pricing please!

How to quote and enroll in Texas individual and family plans

People are busy so we make this free, fast, and easy to use here:

- Income is best estimate for this year's AGI on the 1040 tax form; next April's filing

- Household is everyone on that 1040 even if not enrolling

This is where people usually make mistakes so run through it with us. There's zero cost for our assistance.

This addresses 80% of the questions we commonly get. Let us help with the other 20% now and going forward!